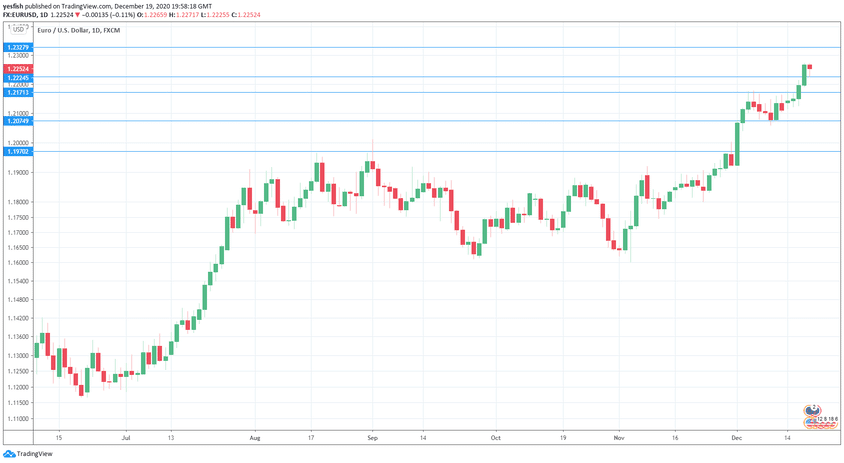

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

US retail sales declined in November, pointing to weak consumer spending. The headline figure came at -1.1%, while core retail sales fell by 0.9%. US PMIs remained well into expansionary territory, with Manufacturing PMI coming in at 56.5 and Services PMI at 55.3. However, the Philly Fed Manufacturing Index slowed to 11.1, down from 26.3 beforehand.

The Federal Reserve maintained its asset purchase program at the current level of $80 billion/mth. In addition, the Fed provided additional guidance which can be viewed as a dovish signal. Unemployment claims were up sharply for a second straight week, rising to 885 thousand.

- Consumer Confidence: Monday, 15:00. If the economic recovery is underway in the eurozone, the consumer hasn’t received the memo. Consumer confidence has been dropping and fell to -18 in November. An identical reading is expected for December.

- German GfK Consumer Climate: Tuesday, 7:00. German consumer climate is also in negative territory and fell to -6.7 in November, its lowest level since June. The downturn is expected to continue, with a forecast of -8.7 in December.

- German Import Prices: Tuesday, 7:00. Import Prices have been steady, with readings of 0.3% for the past two months. We now await the November data.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2555.

1.2478 was last tested in February 2018.

1.2328 is next.

1.2224 has held in resistance since April 2018.

1.2171 switched to support last week as EUR/USD posted sharp gains.

1.2074 is next.

1.1970 (mentioned last week) is the last support line for now.

.

I remain bullish on EUR/USD

The euro has momentum on its side as its trade at multi-year highs. The US Congress is close to reaching a deal on a stimulus package, and the injection of huge funds into the economy would likely weigh on the US dollar. Across the pond, Brexit developments could also impact on the euro – a deal would be bullish for the currency, while failure to reach an agreement could weigh on EUR/USD.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!