EUR/USD eventually turned down on a dovish Draghi, weak data, and global trade fears among other developments. What’s next? The pre-holidays features a mix of data from all over the world. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Mario Draghi sent the euro down by saying that the balance of risks is moving to the downside. In addition, the ongoing Brexit saga also took its toll on the common currency. In the US, data was quite upbeat, with retail sales coming out above expectations. All in all, euro/dollar was pressured, but never fell out of range.

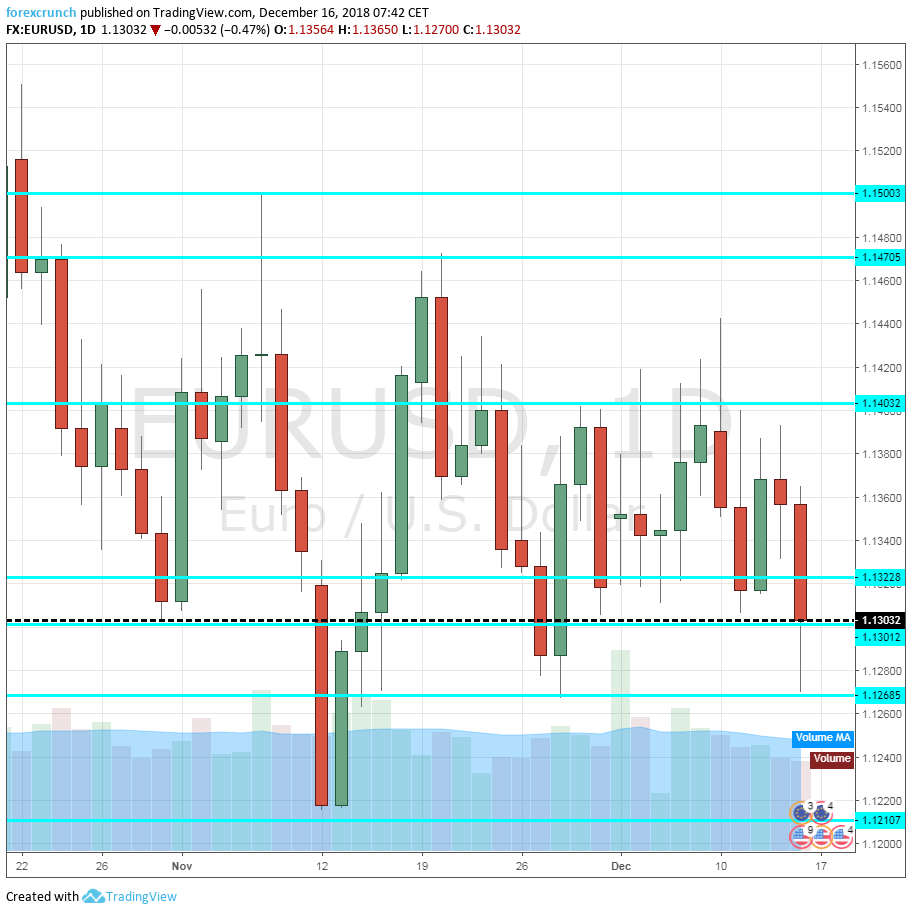

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Final CPI: Monday, 10:00. According to the initial figures for November, the headline Consumer Price Index stood at 2%, exactly the ECB’s target. Core inflation still lags behind, with only 1% y/y. The final read will likely confirm the first one.

- Trade Balance: Monday, 10:00. The euro zone’s trade balance surplus is squeezing alongside Germany’s falls in exports. The surplus reached 13.4 billion euros in September and a small rise to 14.2 billion is expected.

- Bundesbank Monthly Report: Monday, 11:00. Several forecasters have downgraded their assessments for the German economy, especially after it had contracted in Q3. The monthly report by the central bank, the Bundesbank, will likely reflect this trend.

- German Ifo Business Climate: Tuesday, 9:00. IFO is Germany’s No. 1 Think Tank. The Business Climate score for November stood at 102, off the highs. Another slide, this time to 101.8, is on the cards for December.

- German PPI: Wednesday, 7:00. Producer Prices feed into consumer ones. The locomotive of the euro area saw the PPI rising by 0.3% last month. A drop of 0.1% is expected now.

- Belgian NBB Business Climate: Wednesday, 14:00. This broad survey was barely positive in November, coming out at +0.4. A drop back to negative territory, to -0.9 points, is on the cards. Negative numbers represent worsening conditions.

- Current Account: Thursday, 9:00. Similar to the narrower trade balance, the current account is in positive territory thanks to German exports. And also here, the surplus is forecast to broaden from 17 to 18.4 billion.

- German GfK Consumer Climate: Friday, 7:00. The 2,000-strong survey has been showing a gradual decline in recent months. Yet another slide is on the cards: from 10.4 to 10.3 points.

- French Consumer Spending: Friday, 7:45. The second-largest economy saw a leap in spending back in October: 0.8%. A correction is due now, with a slide of 0.1%.

- Consumer Confidence: Friday, 15:00. The official consumer confidence measure by Eurostat was negative, at -4 points, back in November. The same figure is expected now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar failed in its recovery attempts early in the week and found itself sliding, hitting 1.1270, mentioned last week.

Technical lines from top to bottom:

1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1500 is a very round level and also capped the pair’s advance in early November. 1.1475 was a high point in mid-November. 1.1415 capped EUR/USD in early December.

1.1325 was a low point in mid-November. 1.1300 is a round number that held the pair in mid-August and late October |double-bottom) and also held the pair down in June 2017. 1.1270 served as support late in November and is now a double bottom.

1.1215 is the low point it reached in November. Lower, we are back to levels last seen in 2017. 1.1110 was a low point back in June. 1.1025 was a stubborn cap back in May 2017.

I remain bearish on EUR/USD

The monetary policy divergence between the US and Europe is stark. After the ECB came out with a dovish end to QE, the Fed is set to raise rates and cotninue doing so.

Our latest podcast is titled What to expect from the Fed, trade, and the Brexit saga

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!