- German Industrial Production: Monday, 7:00. Industrial Production in the eurozone’s largest economy fell to 0.9% in November. The downtrend is expected to continue, with a forecast of 0.1% for December.

- Sentix Investor Confidence: Monday, 9:30. Investor Confidence came in at 1.3 in January, ending a nasty streak of 10 successive declines. Another gain is expected for February, with a forecast of 4.1.

- German Final CPI: Wednesday, 7:00. Inflation has struggled but improved in December with a solid gain of 0.5%. The upward trend is expected to continue, with a street consensus of 0.8%.

- French Industrial Production: Wednesday, 7:45. Industrial Production sagged In November, with a reading of -0.8%. Analysts are expecting a strong rebound in December, with an estimate of 0.4%.

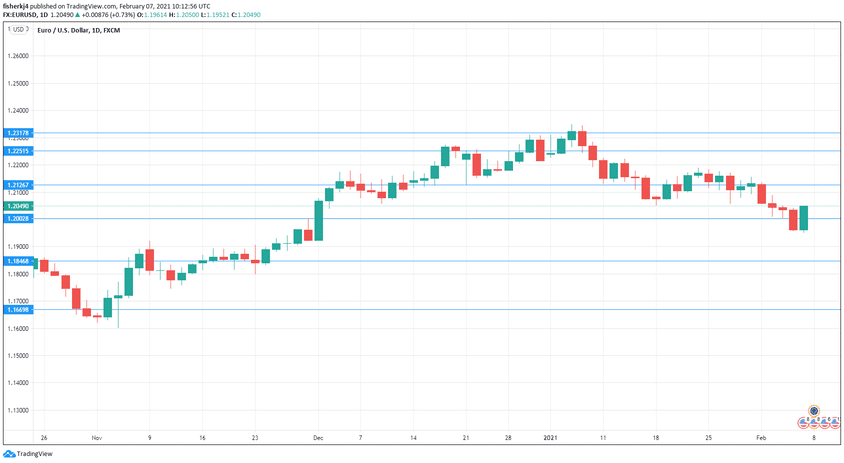

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2317.

1.2250 has held in resistance since April 2018.

1.2126 is next.

1.2002 (mentioned last week) is protecting the symbolic 1.20 line.

1.1846 is an important monthly support line.

1.1667 is the final support level for now.

.

I remain neutral on EUR/USD

The eurozone economy remains weak, and the Covid lockdowns are making economic conditions even worse. The Biden stimulus program is gathering steam, which could weigh on the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!