- German Retail Sales: Monday, 7:00. In November, Retail Sales slowed to 1.9%, down from 2.6% beforehand. Still, this was a respectable gain. Analysts are bracing for a downturn in December, with an estimate of -2.0%.

- Manufacturing PMIs: Monday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. The German and eurozone manufacturing sectors remain well into expansionary territory. The second-estimate PMIs for Germany and the eurozone are expected to confirm the initial readings, with readings of 57.0 and 54.7, respectively. France, Spain and Italy are slightly above the 50-level, which separates contraction from expansion.

- French CPI: Tuesday, 7:45. Inflation in the eurozone’s second-largest economy posted a second-straight gain of 0.2% in December. However, the forecast for January stands at -0.3%.

- GDP: Tuesday, 10:00. The markets are preparing for a rough end to the year for eurozone growth. The first estimate for Q4 GDP stands at -1.4%, as the resurgence of Covid-19 is hampering the economy.

- Services PMIs: Wednesday, 8:15. Services remain in contraction, with readings below the 50-level. The second-estimate PMIs for Germany and the eurozone are expected to confirm the initial readings, at 46.8 and 45.0, respectively. Italy and Spain are expected to show readings in the mid-40s, with Italy bringing up the rear with an estimate of 39.5.

- Inflation Report: Wednesday, 10:00. Inflation remains weak in the eurozone, but better news is expected for January, The headline reading is expected to improve to 0.4%, while the core reading is expected to climb to 0.7%, which would mark a 6-month high.

- Retail Sales: Thursday, 10:00. Retail Sales sank in November, with a reading of -6.1%, which was a 7-month low. The markets are expecting a rebound in December, with a gain of 1.4%.

- German Factory Orders: Friday, 7:00. Factory Orders slowed to 2.3% in November, down from 2.9% beforehand. A sharp downturn is projected in December, with an estimate of -1.2%.

.

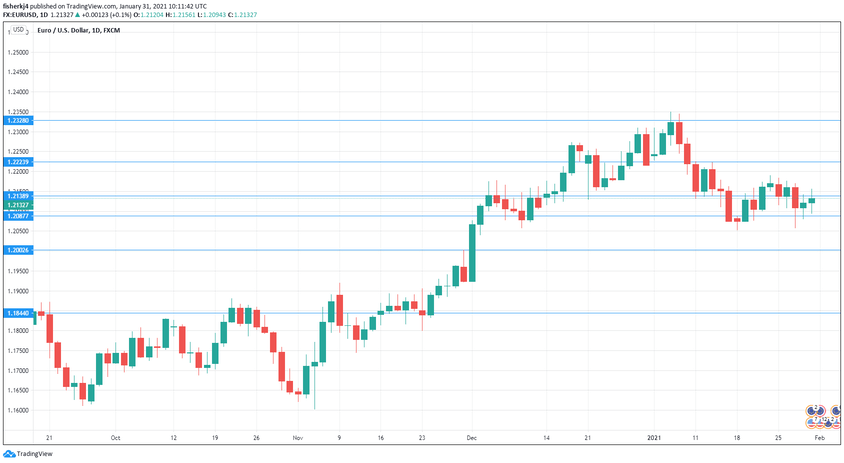

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2428.

1.2328 is next.

1.2223 has held in resistance since April 2018.

1.2087 is the first support level.

1.2002 is protecting the symbolic 1.20 line.

1.1844 (mentioned last week) is the final support line for now.

.

I am neutral on EUR/USD

The eurozone economy continues to struggle with the resurgence of Covid-19. In the US, Biden’s massive stimulus program could weigh on the dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!