- EUR/USD maintains a bearish bias following a 6-day downtrend.

- Vagueness on US Senate’s spending bill and COVID rise in China continue to loom the risk sentiment.

- Investors keep an eye on NFP for further impetus.

Following a six-day downtrend, the EUR/USD forecast remains weak ahead of Friday’s European session. As of the time of writing, the bears rest around 1.1820 as the major pair fell 0.10% for the day.

Recently, the EUR/USD prices have suffered from the double strike of the Delta Covid option and the uncertainty of US stimulus. The negative effects of the fears over US employment data would also affect the Federal Reserve System’s (FRS) escalating rate-cutting and rate-hiking talks and the overly restrictive stance of federal central banks globally.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

According to the latest US data, the virus levels in China have reached a six-month high. Moreover, infections have reached multiday highs in Australia. However, central bankers are optimistic that they will regain their easy money after the pandemic by increasing interest rates.

The US Senators also postponed the vote on the infrastructure spending bill because of issues with COVID-19 and expectations of monetary policy adjustments. As noted by Reuters, “Senate Majority Leader Chuck Schumer has ended discussions on a $1 trillion infrastructure package. It is unclear when the Senate will vote on adoption.”

The moderately offered futures for stocks and shares in Asia-Pacific reflect the gloomy mood. Furthermore, risk appetite supports the US Dollar Index (DXY) and US Treasury bond yields. After peaking 12 days ago, the yield on the US 10-year Treasury rose by 1.8 basis points (bp).

Despite a wave of risk aversion favoring sellers in EUR/USD, the US employment data for July will determine the short-term direction given the disagreement among Fedspeak. If the main labor report meets expectations, the pair might prolong the decline, but a surprise in the negative direction could consolidate recent losses.

Aside from the NFP report, German industrial production and Covid headlines, along with the US stimulus package, should also be closely examined.

COVID fears in the Eurozone

Following an increase of over a month, the most contagious variant of Delta has reportedly decreased in frequency in Europe.

The World Health Organization released a report on Tuesday (Aug 3) showing that the drop in new cases is mainly related to a decline in Spain and the UK cases.

The number of infections in Spain, where a fifth wave threatens summer holidays, declines after reaching a record high in early July.

Several EU countries have also introduced stricter measures for travelers from Spain, Cyprus and the Netherlands due to rising Covid-19 cases. In addition, US officials have advised against traveling to Spain, Greece or Ireland.

–Are you interested to learn more about forex signals? Check our detailed guide-

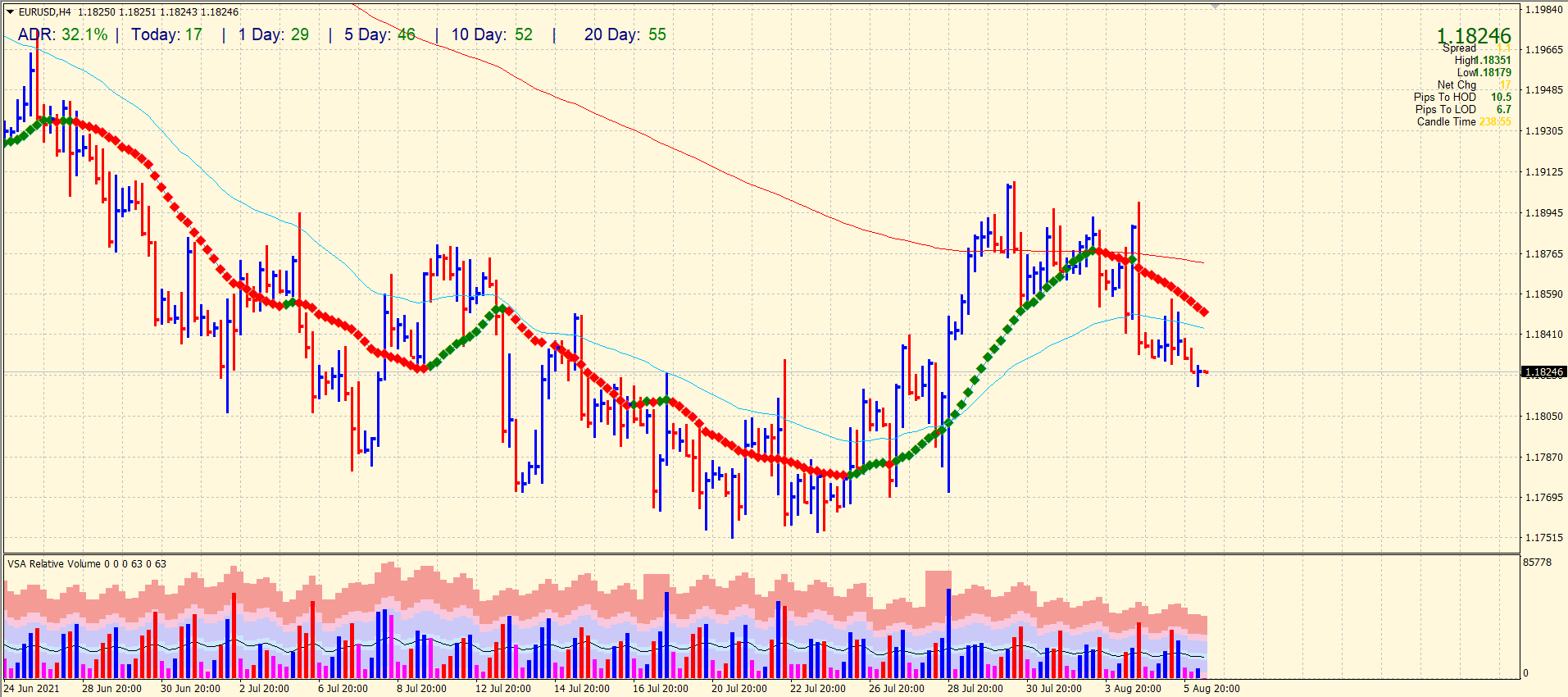

EUR/USD technical forecast: Sellers to dominate

The sellers are dominating the market. The EUR/USD price broke below the 50-period SMA on the 4-hour chart. The volume shows bearish bias, and the price may target the swing lows of July near 1.1750 area. On the upside, 20-period SMA and 50-period SMA continue to cap the gains around 1.1850.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.