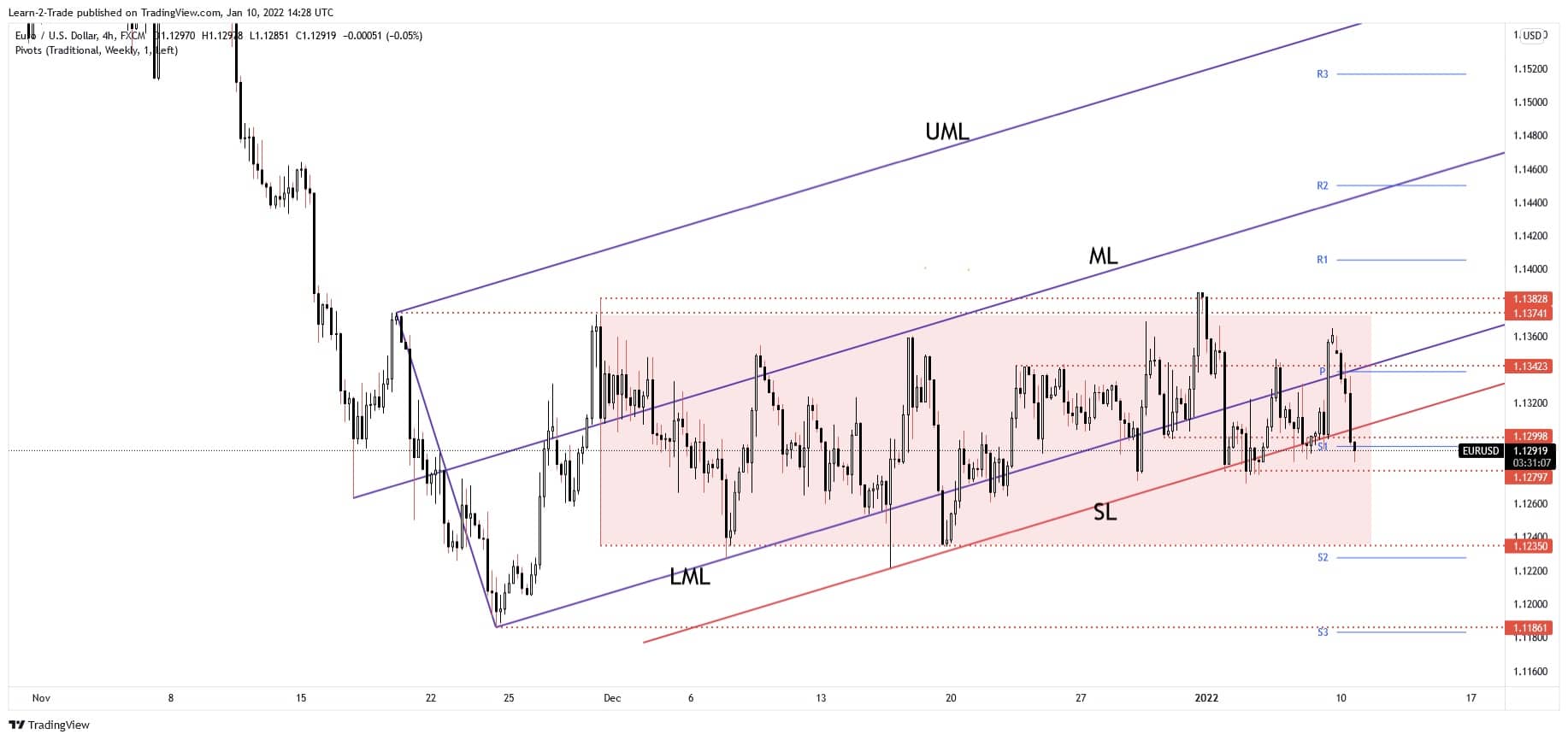

- The EUR/USD pair dropped but only a valid breakdown below the outside sliding line (SL) and a new lower low could announce a larger drop.

- Another false breakdown below the SL may announce a new upside momentum.

- The bias remains bearish after its failure to approach and reach the range’s resistance.

Our EUR/USD forecast sees the pair plunging today as the Dollar Index rallied. Technically, the current sell-off invalidated once again a potential upside reversal and could open the door for a larger drop. The currency pair may extend its downside movement only if the DXY approaches and reaches fresh new highs.

The EUR/USD pair erased Friday’s gain as the DXY failed to stabilize under the 95.75 support. Now, the index challenges a major dynamic resistance, a new false breakout or a strong bearish pattern may announce a new temporary drop.

3 Free Forex Every Week – Full Technical Analysis

As you already know, the US Dollar depreciated on Friday after the NFP was reported at 199K in December below 426K expected and compared to revised 249K in November.

Also on Friday, the Unemployment Rate was reported at 3.9% below 4.1% forecasts, while the Average Hourly Earnings registered a 0.6% growth versus 0.4% estimates.

Today, the eurozone Unemployment Rate was reported at 7.2% as expected below 7.3% in the previous reporting period. In addition, the Sentix Investor Confidence and the Italian Monthly Unemployment Rate reported better than expected figures.

On the other hand, the US Final Wholesale Inventories registered a 1.4% growth in November compared to 1.2% expected and 1.2% in the previous reporting period.

If you want to get involved with automated forex trading to profit from the information in our forecasts, then check out our guide.

EUR/USD Forecast: Price Technical Analysis – Range Formation

The EUR/USD pair dropped as much as 1.1285 today where it has found temporary support. Now, it has managed to rebound as the DXY started to lose altitude. In the short term, it could come back to test and retest the immediate resistance levels before dropping deeper.

As you can see on the H4 chart, the EUR/USD is still trapped inside of the range pattern between 1.1374 and 1.1235 levels.

Its failure to reach and retest the 1.1374 signaled exhausted buyers and a potential drop. Still, it remains to see if the price will have enough bearish energy to be able to confirm its breakdown below the ascending pitchfork’s outside sliding line (SL). Another false breakdown could announce a new bullish momentum.

Personally, I believe that only a new lower low, a bearish closure below 1.1279 could really announce a strong downside movement.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.