EUR/USD made its way to higher ground in the final week of 2017, closing the year just above 1.20. Will it continue gaining ground in 2018? Inflation data stands out as volume trading picks up once again. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

When nothing happens, euro/dollar rises. It is naturally bid. And this is exactly what happened. And between Christmas and the New Year, hardly anything happens. The US dollar suffered from a sell-off, related to profit-taking and end-of-year adjustments.

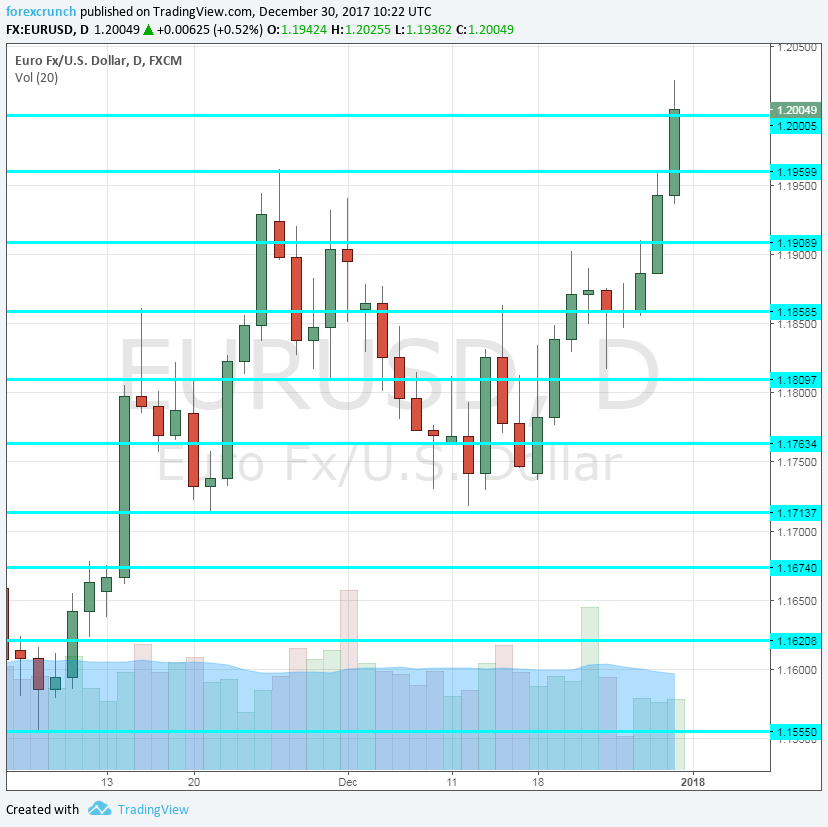

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Tuesday morning: 8:15 for Spain, 8:45 for Italy, final French data at 8:50, final German number at 8:55 and the final euro-zone read at 9:00. Spain, the fourth-largest economy, saw a small rise in November to 56.1 in Markit’s forward-looking survey. Any score above 50 represents expansion. A score of 56.4 is expected now. Italy, the third-largest economy, had an upbeat score of 58.3 points in November. A score of 58.6 is predicted now. According to the preliminary estimate for France, the score was 59.3 points. The initial print for Germany was a sky-high 63.3 points and the euro-zone saw a preliminary estimate of 60.6 for December. The final publication will likely confirm the flash data.

- Spanish Unemployment Change: Wednesday, 8:00. Spain still suffers from high, albeit falling, unemployment problem. It’s early estimate of changes in the number of the jobless, is of interest. In November, Spain saw a smaller-than-expected rise in the number of unemployed: 7.3K. A big drop of 60.3K is projected now.

- German Unemployment Change: Wednesday, 8:55. The continent’s largest economy enjoys a bustling job market and the number of the unemployed is falling quite constantly. A bigger-than-expected fall of 18K was seen in October. A more modest slide of 14K is forecast.

- Services PMIs: Thursday morning: 8:15 for Spain, 8:45 for Italy, final French data at 8:50, final German number at 8:55 and the final euro-zone read at 9:00. Spain’s services sector saw moderate growth in November according to Markit: a score of 54.4 points. A small increase to 54.7 is estimated. Italy had a score of 54.7 that month. A level of 54.8 is expected. In December, the preliminary read for France showed an excellent score of 59.4. Germany lagged behind with 55.8 while the euro-zone had 56.5. These estimates for December will likely be confirmed now.

- German Retail Sales: Friday, 6:00. Germany is known for its exports and not so much for its consumption. This was evident again in October, when the volume of retail sales fell by 1.2%, well below expectations. A bounce is likely for November: 1.1% is on the cards.

- French CPI (preliminary): Friday, 7:45. After we saw the initial releases from Germany and Spain, France releases its own measure, hours before the all-European number. Prices rose by 0.1% in November. An increase of 0.3% is projected.

- Retail PMI: Friday, 9:10. Markit’s last report for the continent comes via the retail sector. It had a score of 52.4 in November. We will now see the figure for December, which included the all-important Christmas shopping.

- Inflation: Friday, 10:00. The preliminary inflation report for December provides an overview of all of 2017 and will have an impact on the ECB’s decision later in the month. In November, headline CPI stood at 1.5%, which was similar to previous months and not too far from the ECB’s target of “2% or a bit below”. The disappointment came from core CPI, was remained stuck at 0.9%. Without a rise in core inflation, headline CPI may retreat as well. The expectations now stand at 1.4% for headline CPI and 1% for core CPI.

- PPI: Friday, 10:00. Somewhat overshadowed by the CPI release, the report for producer prices for November will provide additional color for inflation in the pipeline. A rise of 0.4% was seen in October and 0.3% is on the cards now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a slow start to the week, but it eventually made a move to the upside, challenging resistance at 1.1910 (mentioned last week).

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

1.1820 worked as a cushion to the pair in late November and works as weak support. 1.1760 served as a cushion in November and also played a role beforehand.

1.1710 was the high of August 2015 and also worked as support in November. 1.1670 was a swing low in October. and hasn’t worked too well.

The 2016 high of 1.1620 slowed down the pair also in October. 1.1555 was the low point in November and works as a cushion. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I remain bullish on EUR/USD

The euro-zone economies look good and the good news in the US is already priced in. In a quiet week, the regular flows of imports and exports favor a higher EUR/USD.

Our latest podcast is titled What does 2018 have in store for financial markets?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!