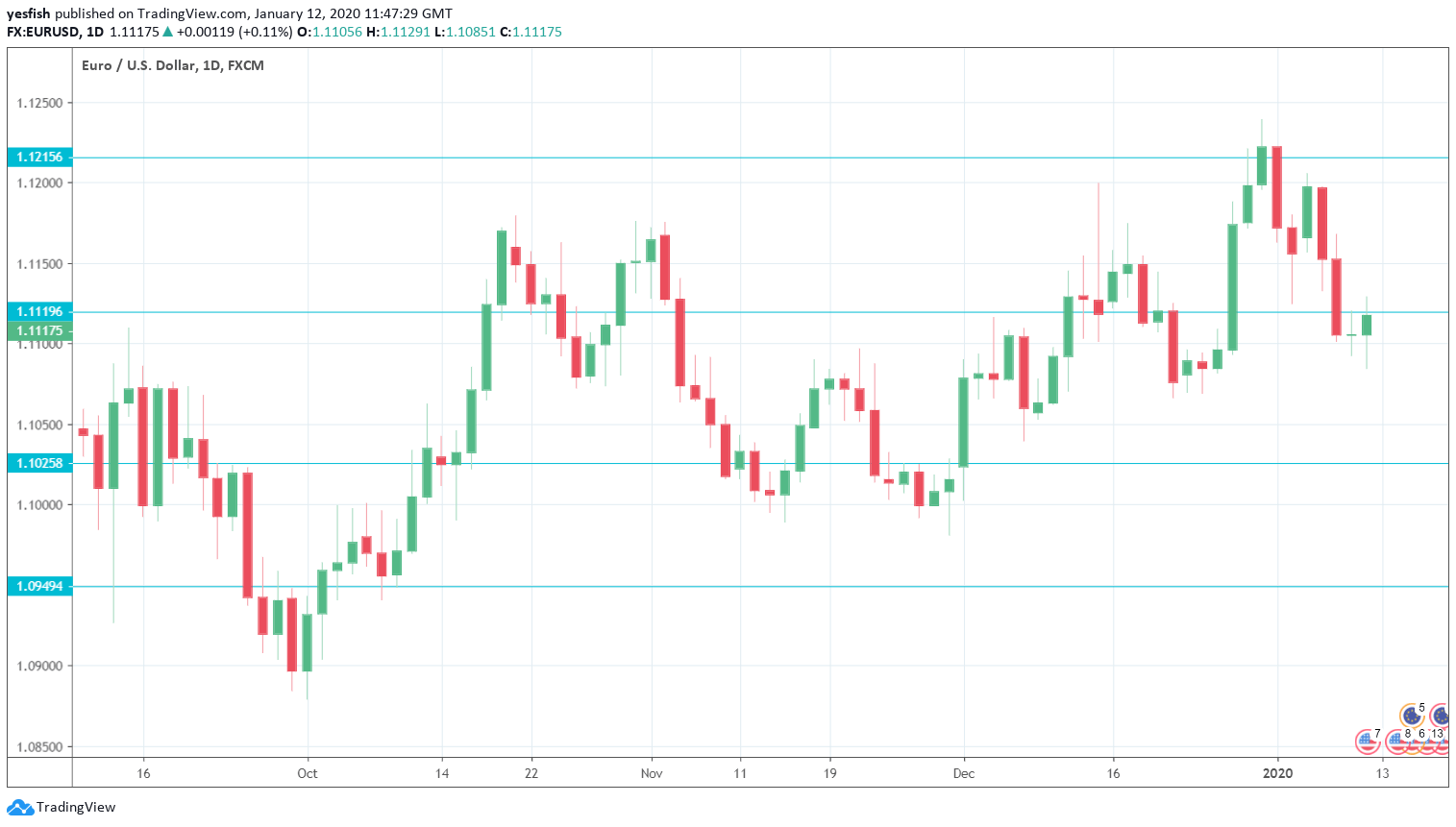

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French Final CPI: Wednesday, 7:45. Inflation in the eurozone’s second-largest economy remains weak. In November, CPI edged up to 0.1%, up from zero a month earlier. A stronger reading is expected in December, with an estimate of 0.4%.

- Industrial Production: Wednesday, 10:00. This indicator declined 0.5% in October, matching the estimate. This points to weakness in the eurozone manufacturing sector. Analysts expect better news in November, with a forecast of 0.3%.

- German Final CPI: Thursday: 7:00. German consumer inflation fell sharply in November, with a decline of 0.8%. The initial reading for December inflation rebounded to 0.5%, and the final reading should confirm this figure.

- ECB Monetary Policy Meeting Accounts: Thursday, 12:30. The ECB minutes provide details of the ECB’s policy meeting in December. This marked Christine Lagarde’s debut as ECB President, so any hints on the future direction of policy could move the euro.

- Inflation Data: Friday, 10:00. In December, eurozone consumer inflation improved for a second straight month. CPI rose to 1.3%, up from 1.0% in November. The final reading is expected to confirm this figure.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1515, which was a high point in January 2019.

1.1390 has held firm in resistance since June.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 remains relevant. Currently, it is an immediate resistance line.

1.1025 (mentioned last week) is protecting the symbolic 1.10 level. 1.0925 is next.

1.0829 has held in support since April 2017. It is the final support level for now.

I am neutral on EUR/USD

EUR/USD posted gains of 1.9% in December, but has declined 1.0% so far in January. The eurozone economy is struggling, with ongoing weakness in the manufacturing sector and low inflation levels. This will make it difficult for the euro to gain ground against the U.S. dollar.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!