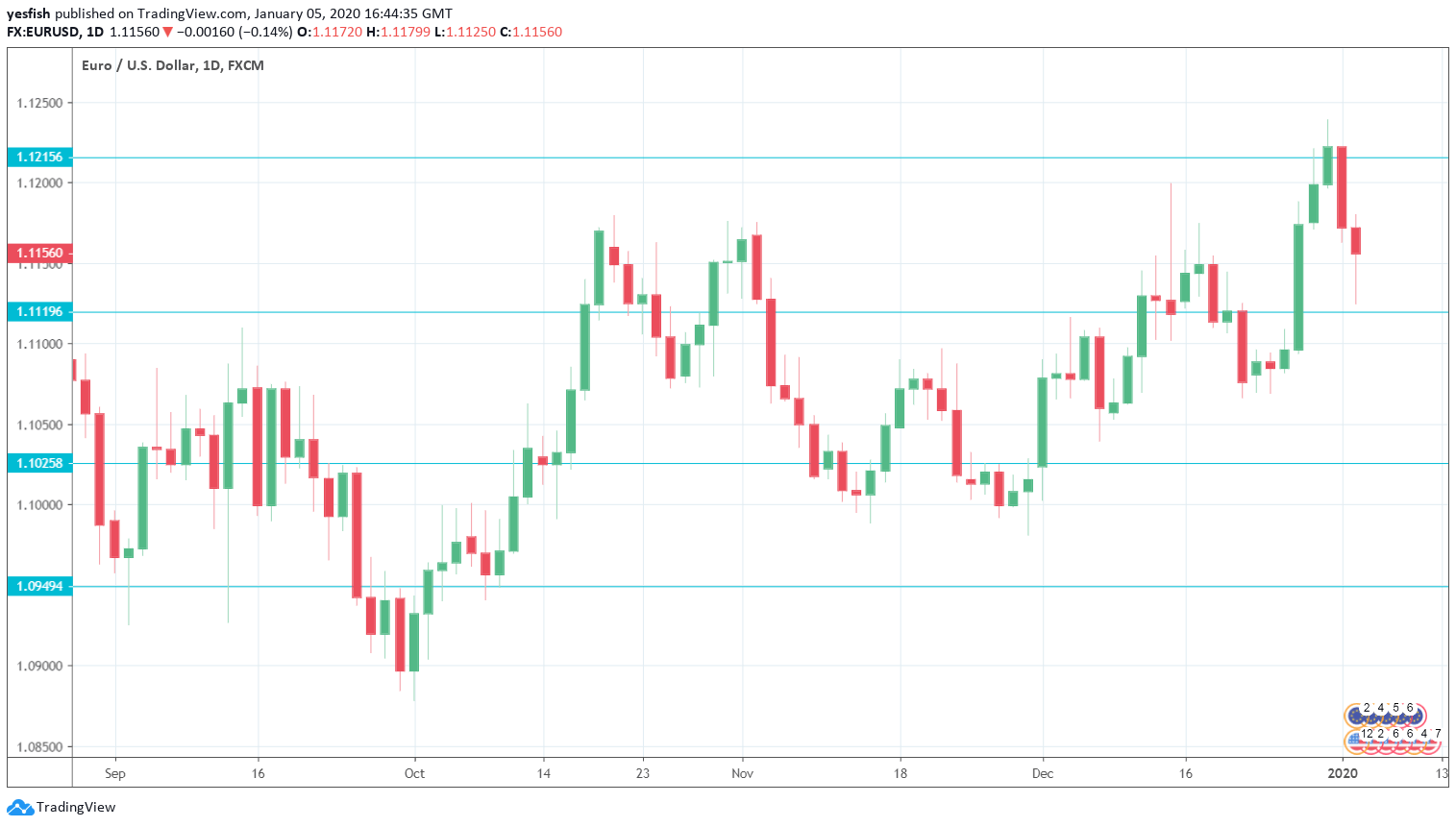

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Retail Sales: Monday: 7:00. Retail sales fell 1.9% in October, much worse than the estimate of -0.2%. A strong rebound is expected in November, with a forecast of +1.1%.

- Services PMIs: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Services PMIs continue to outshine the manufacturing PMIs, with readings slightly above the 50-level, pointing to weak expansion. The PMI readings are expected to confirm the initial readings from November.

- Sentix Investor Confidence: Monday, 9:30. After a string of declines, the indicator came in at 0.7 in December. The January forecast stands at 3.0, which would indicate an improvement in investor confidence.

- CPI Flash Estimate: Tuesday, 10:00. Inflation came in at 1.0% in November. The markets are expecting better news in December, with a forecast of 1.3%.

- Retail Sales: Tuesday: 10:00. Eurozone retail sales fell by 0.6% in October, its weakest reading in 2019. The indicator is expected to rebound in November, with an estimate of 0.6%.

- German Factory Orders: Wednesday, 7:00. Factory orders fell by 0.4% in October, the third decline in four months. The markets are expecting better news in November, with an estimate of 0.2%.

- German Industrial Production: Thursday, 7:00. The German manufacturing sector continues to struggle, as industrial production fell 1.7% in October. The indicator is expected to rebound in November, with an estimate of 0.9%.

- ECB Monetary Policy Meeting Accounts: Thursday, 12:30. The minutes will provide details of the monetary policy meeting held in December, the first to be chaired by ECB President Christine Lagarde.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1515, which was a high point at the end of January.

1.1435 was a low point at the beginning of February.

1.1390 has held firm in resistance since June. This is followed by 1.1345.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 is providing support. It could face pressure early in the week.

1.1025 (mentioned last week) is protecting the symbolic 1.10 level. 1.0925 is next.

1.0829 has held in support since April 2017. It is the final support level for now.

I am neutral on EUR/USD

The U.S. dollar has been under pressure, and the euro took advantage, posting gains of 1.9% in December. Risk appetite has been strong recently, which has pushed the dollar lower. However, the airstrike which killed a top Iranian general on Friday could shake up the markets and cause investors to snap up the safe-haven greenback.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!