EUR/USD moved up on the dovish Fed shift and despite weak German data and as the global mood improved but could not hold onto its gains. Can the pair continue higher? A speech by ECB President Draghi stands out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The FOMC Meeting Minutes called for patience, reiterating Chair Powell’s dovish stance. The shift to the dovish side came on top of similar comments from officials. FOMC member Bostic went as far as opening the door to a rate cut should push come to shove. The words sent EUR/USD above 1.1500. German industrial output plunged by 1.9% in November, stoking fears of an outright recession. However, the euro managed to weather the storm. The US and China concluded trade talks on a positive note and made progress. The news came alongside a report that Trump strives to strike a deal to appease markets. Markets indeed rose and this weakened the safe-haven USD. However, the greenback made a comeback at the end of the week, sending the pair below 1.1500.

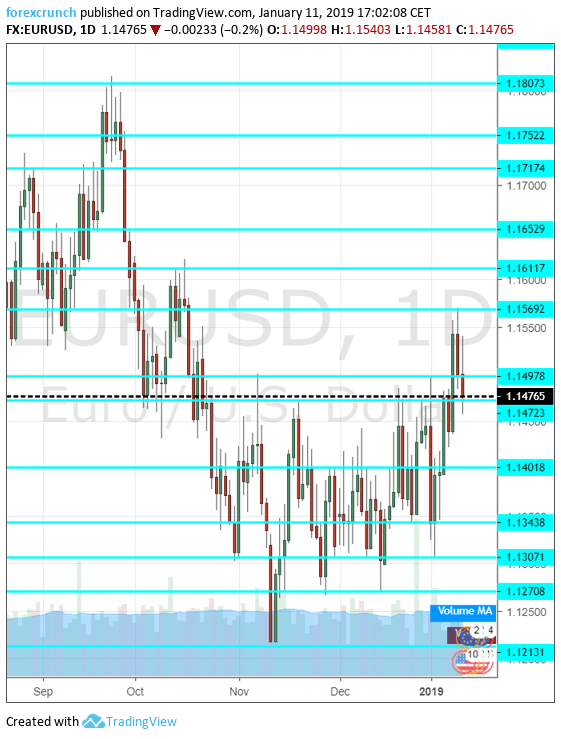

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German WPI: Monday, 7:00. The Wholesale Price Index (WPI) provides insights into inflation in the pipeline. It advanced by 0.3% in November and we will now receive the read for December.

- Industrial Production: Monday, 10:00. Despite its late publication after the German data, the all-European industrial output number tends to surprise. Production rose in October by 0.2% and downfall is likely for November.

- French Final CPI: Tuesday, 7:45. According to the initial report from France, prices remained flat in December. The final data will likely confirm it.

- Trade Balance: Tuesday, 10:00. The euro zone’s trade balance surplus is gradually falling and hit 12.5 billion euros in October. A small increase is likely now: 13.2 billion is projected.

- Mario Draghi talks Tuesday, 15:00. The President of the European Central Bank presents the annual report before the European Parliament in Strasbourg and will have the opportunity to share his views about the economy. Recent signs have been worrying, with growing chances of a recession in Germany and in Italy. On the other hand, unemployment is down and inflation is steady. He may also express his opinions on the global economy.

- German Final CPI: Wednesday, 7:00. The preliminary release of German inflation for the final month of 2018 came out at 0.1% m/m, within expectations. The final read is expected to confirm the initial figure. Any deviation will impact the all-European number due on Thursday.

- Final CPI: Thursday, 10:00. The flash CPI read for December missed expectations on the headline: a deceleration to 1.6% y/y against 1.9% in November and 1.8% expected. Core CPI held its ground with 1% y/y. The final estimate is likely to confirm the figure.

- Current Account: Friday, 9:00. Similar to the narrower trade balance measure, the euro-zone enjoys a broad surplus which is off the highs. The number for October stood at 23 billion euros. A similar figure is likely: 24.1 billion is forecast.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made a move above 1.1500 (mentioned last week).

Technical lines from top to bottom:

1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1570 was the post breakout peak in January. 1.1500 is a very round level and also capped the pair’s advance in early November.

1.1475 was a high point in mid-November. The round number of 1.1400 was a pivotal line in the range.

1.1345 provided support in December and the round level of 1.300 was a swing low around the same time.

1.1270 served as support late in November and is now a double bottom. 1.1215 is the low point it reached in November. Lower, we are back to levels last seen in 2017.

1.1110 was a low point back in June. 1.1025 was a stubborn cap back in May 2017.

I remain bearish on EUR/USD

Even though the Fed is moving to the dovish side, the deteriorating economic situation in the euro-zone is set to take its toll.

Our latest podcast is titled What to expect from the Fed, trade, and the Brexit saga

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!