.

- German Final CPI: Tuesday, 7:00. Inflation has struggled in the eurozone’s largest economy, with declines for most of H2 of 2020. However, the forecast for December stands at 0.5%, which would be the strongest gain since June.

- German ZEW Economic Sentiment: Tuesday, 10:00. The 6-month outlook for the German economy improved markedly in December, climbing from 39.0 to 55.0. The estimate for January stands at 55.1 points.

- Inflation Report: Wednesday, 10:00. Headline inflation has reeled off four straight declines, and this trend is projected to continue in December, with an estimate of -0.3%. The core reading is expected to remain at 0.2%.

- ECB Rate Decision: Thursday, 12:45. The ECB minutes last week noted concern with low inflation and the high exchange rate, and policymakers could reiterate these concerns in the rate statement at the upcoming meeting. No change is expected in current monetary policy.

- PMIs: Friday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. Germany’s manufacturing sector continues to show strong expansion, with the December PMI coming in at 58.3. The estimate for January stands at 57.3. The eurozone Manufacturing PMI is expected in at 54.6, down from 55.2 beforehand. France came in at 51.1 and is forecast to dip to 50.3, just above the neutral 50-level. The services sector has been in contraction with Germany and the eurozone estimated at around the 45 level. France is expected to be stronger, with a forecast of 49.1 points.

.

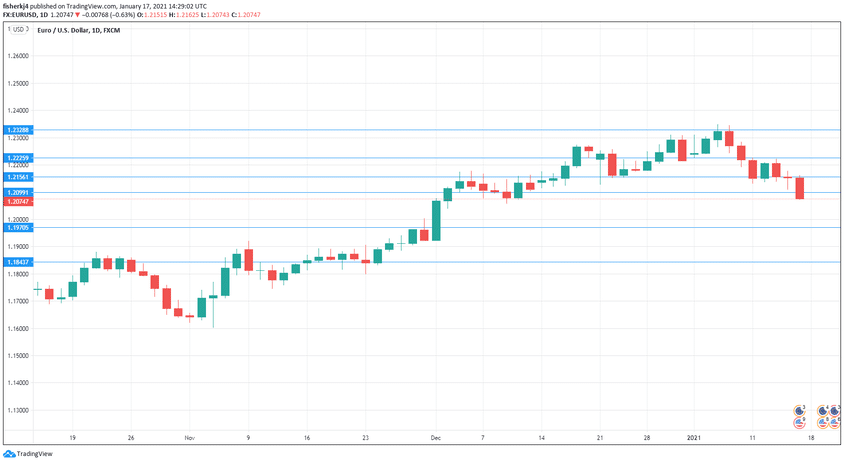

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2328.

1.2224 has held in resistance since April 2018.

1.2156 has switched to a support level after strong gains by EUR/USD last week.

1.2099 is protecting the 1.21 line. It is an immediate support level.

1.1970 (mentioned last week) has provided support since early December.

1.1844 is next.

1.1768 is the final support line for now.

.

I am bearish on EUR/USD

The euro enjoyed strong gains late in the year, as the US dollar turned into a punching bag. However, the greenback has rebounded in the New Year, and this upswing could continue this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!