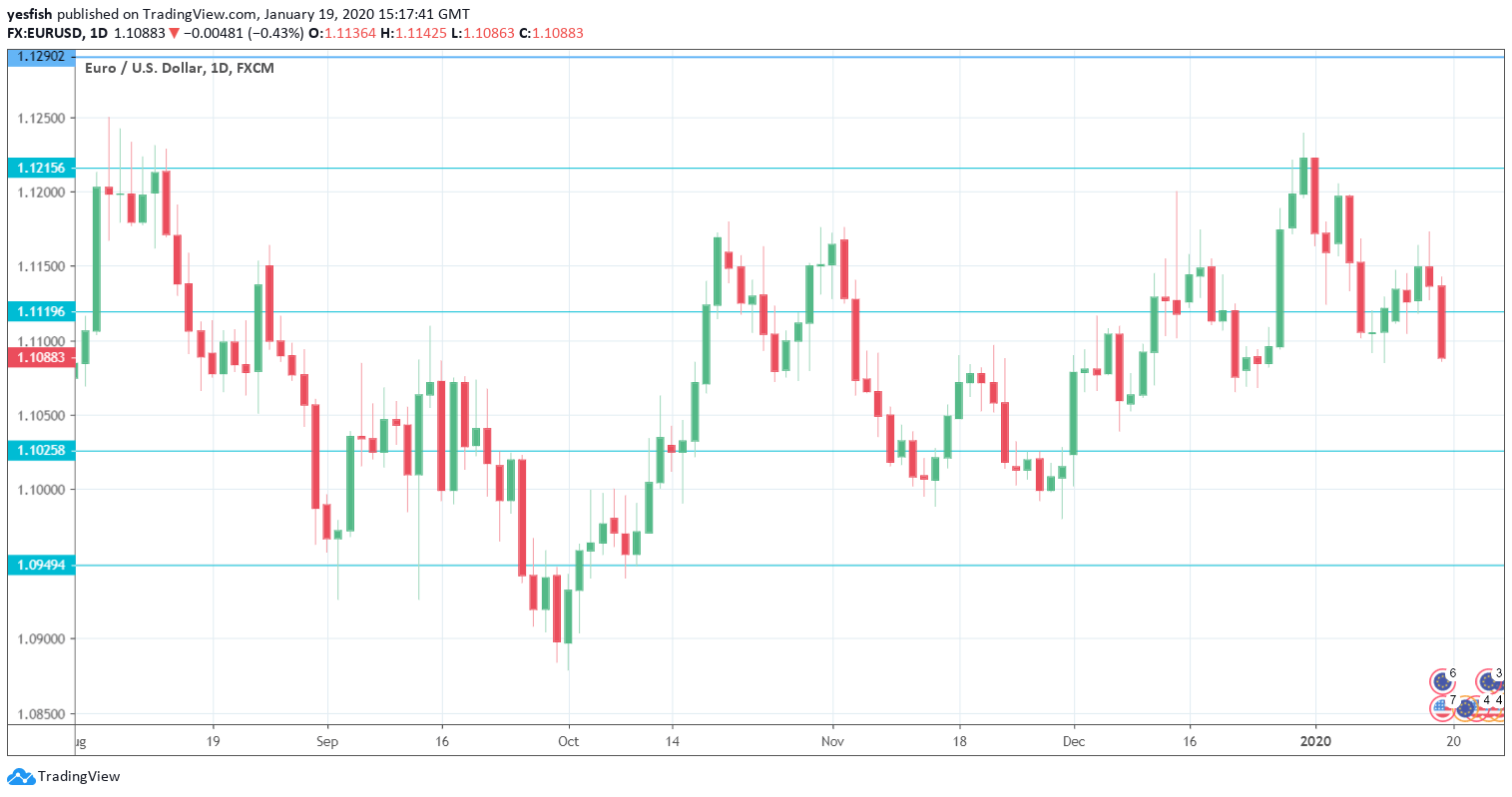

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German ZEW Economic Sentiment: Tuesday, 10:00. After an extended streak of declines, investor confidence jumped in December to 10.7 pts. This figure easily beat the estimate of 1.1 pts. A reading above zero indicates optimism. The upward swing is expected to continue in January, with an estimate of 15.2 pts. The all-European index is projected to rise to 16.3, up from 11.2 in the previous release.

- ECB Rate Decision: Thursday, 12:45. The ECB Minimum Bid Rate has been pegged at 0.00% since March 2016 and no change is anticipated at the upcoming meeting. Analysts will be combing through the rate statement, looking for any hints with regard to future monetary policy.

- Consumer Confidence: Thursday: 15:00. The eurozone consumer remains pessimistic about economic conditions. The index has been steady and is expected to come in at -8 for a second straight month.

- PMIs: Thursday: 7:00. Monday, 8:15 for France, 8:30 for Germany, eurozone number at 9:00. These are the initial releases for services and manufacturing PMIs. The services PMIs continue to point to expansion in Germany, France and the eurozone. The manufacturing sector is in worse shape, as the German and eurozone manufacturing PMIs pointed to contraction (44.6 and 46.9, respectively). French manufacturing PMI was almost unchanged, at 50.5 pts.

EUR/USD Technical analysis

EUR/USD ended the week with losses, falling to a low of 1.1086 in the Friday session. This was the pair’s lowest level since December 26th.

Technical lines from top to bottom:

1.1390 has held firm in resistance since June.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 remains relevant. Currently, it is an immediate resistance line.

1.1025 (mentioned last week) is protecting the symbolic 1.10 level. 1.0925 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

.

I am bearish on EUR/USD

EUR/USD has posted losses for three straight weeks. The U.S economy is in much better shape than that of the eurozone, so we could see the euro drop toward the 1.10 level, which has psychological significance.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!