- German ifo Business Climate: Tuesday, 7:00. Business confidence remains relatively strong in the eurozone’s largest economy. The indicator rose to 92.1 in December and is expected to give up some ground in January, with an estimate of 91.5.

- German GfK Consumer Climate: Wednesday, 7:00. Consumer confidence continues to weaken. The indicator dropped to-7.3 in December, down from -6.7 beforehand. The downward trend is expected to continue in January, with an estimate of -7.8.

- German Prelim CPI: Thursday, All Day. Germany’s CPI rebounded in December to 0.5%, up from -0.8% a month earlier. The first-estimate for January stands at 0.4%.

- French Flash GDP: Friday, 6:30. France’s economy soared by 18.2% in Q3, but is expected to reverse directions in Q4, with an estimate of -4.1%.

- German Unemployment Change: Friday, 8:55. Germany’s labor market has looked strong in H2 of 2020, reeling off six straight declines However unemployment is expected to go up in December, with an estimate of 10,000.

- Monetary Data: Friday, 9:00. M3 Money Supply is projected to remain at 11.0% in December. Private Loans is projected to edge up to 3.2%, after posting three straight gains of 3.1%.

.

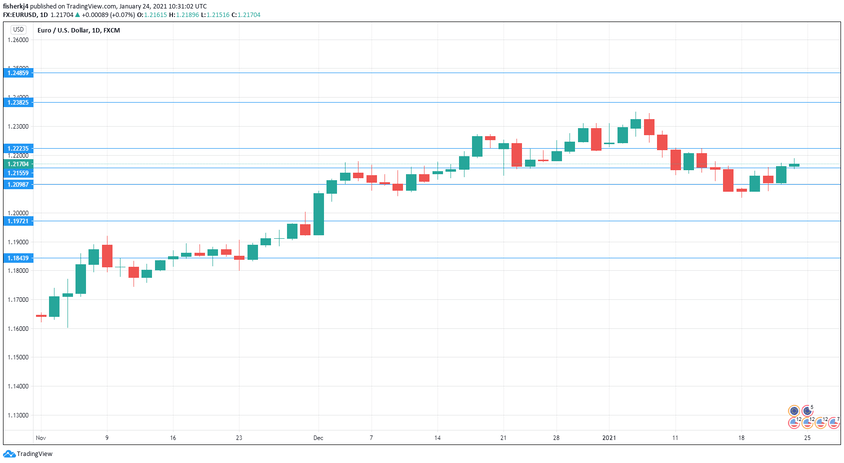

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2484.

1.2328 is next.

1.2224 has held in resistance since April 2018.

1.2156 is an immediate support level.

1.2099 is protecting the 1.21 line.

1.1972 (mentioned last week) has provided support since early December.

1.1844 is the final support line for now.

.

I am bearish on EUR/USD

The US dollar short squeeze appears to have run out of steam, so the euro is in a good position to make gains this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!