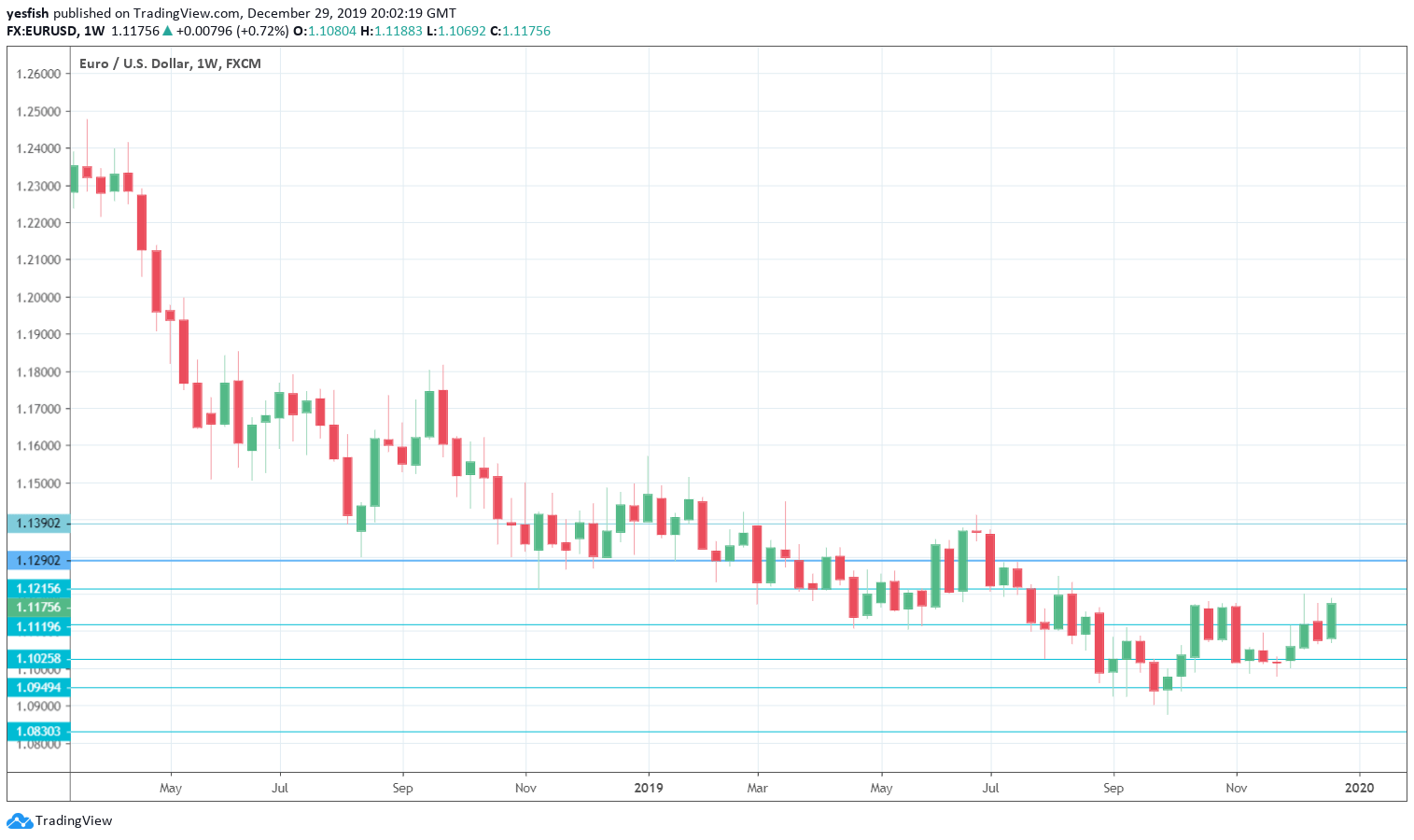

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish CPI: Monday, 8:00. CPI in the eurozone’s fourth-largest economy improved to 0.4% in October, up from 0.2% a month earlier. The upswing is expected to continue in November, with an estimate of 0.9 percent.

- Manufacturing PMIs: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. These final PMI readings are expected to confirm in the initial releases in late December. Spain’s manufacturing sector has been in contraction mode for the past six months, and the trend is expected to continue in December, with an estimate of 46.8 pts. In Italy, the manufacturing sector has been in decline for over a year and the forecast for the upcoming release is 47.6 pts. The German indicator is expected to dip to 43.8 and the eurozone PMI is projected to fall to 45.9 pts. The French PMI is expected to drop to 50.3, compared to 51.7 in November.

- German Preliminary CPI: Friday, All Day. German CPI posted a sharp decline of 0.8% in November. Inflation is expected to rebound, with an estimate of 0.4% for the initial December release.

- German Unemployment Change: Friday, 8:55. German unemployment rolls fell by 16 thousand in October, which was the sharpest decline in nine months. Unemployment rolls are expected to climb by four thousand in November.

- Monetary Data: Friday, 9:00. M3 Money Supply rose to 5.6% in October, up from 5.5% a month earlier. The estimate for November stands at 5.7%. Private Loans climbed to 3.5% in October, up from 3.4% a month earlier. The forecast for the November release is 3.6%.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1515, which was a high point at the end of January.

1.1435 was a low point at the beginning of February.

1.1390 has held firm in resistance since June. This is followed by 1.1345.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 remains relevant. It is under pressure in resistance.

1.1025 (mentioned last week) is protecting the symbolic 1.10 level. 1.0925 is next.

1.0829 has held in support since April 2017. It is the final support level for now.

I am bearish on EUR/USD

The U.S. economy is performing much better than that of the eurozone, which should translate into gains for the greenback. The German locomotive has been sputtering, as German the export and manufacturing sectors have slowed due to weak global demand.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!