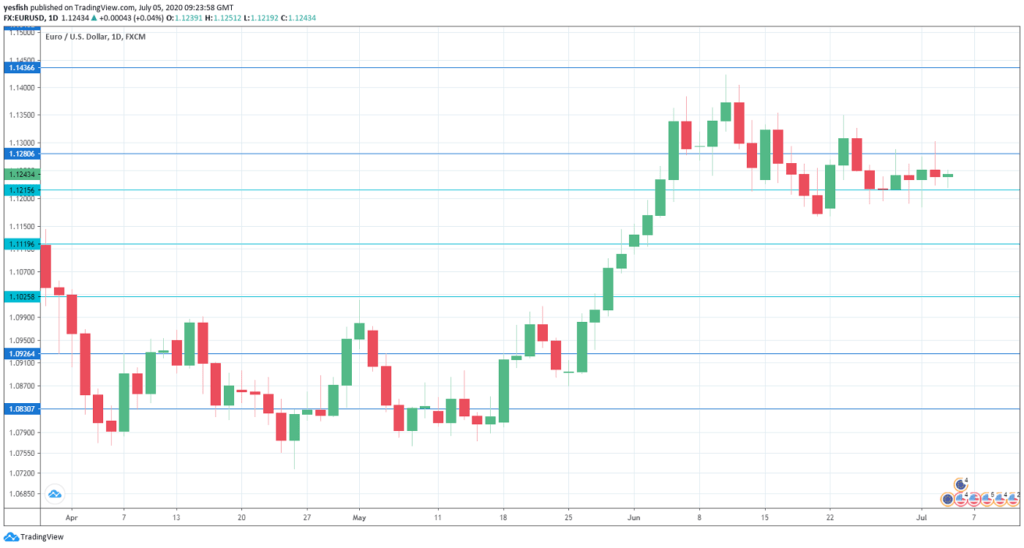

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Factory Orders: Monday, 6:00. Factory orders plunged in April, with a decline of 25.8%. This follows a drop of 15.6%. Better news is expected in May, with a forecast of 15.1 percent.

- Sentix Investor Confidence: Monday, 8:30. Investor confidence has been in deep-freeze in recent months. The indicator improved to -24.8 points in June, up from -41.8 beforehand. The forecast for July stands at -10.8 points.

- Retail Sales: Monday, 9:00. Retail sales fell 11.7% in April, after a drop of 11.2% in March. However, analysts expect a strong rebound in May, with an estimate of 15.0 percent.

- German Industrial Production: Tuesday, 6:00. The manufacturing sector has been hit hard by the coronavirus. Industrial production plunged 17.9% in April, after a drop of 9.2% beforehand. May is expected to bring better news, with an estimate of 10.1 percent.

- French Industrial Production: Friday, 6:45. The second-largest economy in the eurozone has also seen a sharp contraction in manufacturing. The indicator fell 20.1% in April, but is projected to rebound in May, with a forecast of 15.2 percent.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1515.

1.1435 was a low point at the beginning of February.

1.1280 is next.

1.1215 is an immediate support level. 1.1119 is next.

1.1025 (mentioned last week) has provided support since late May.

1.0920 is the final support level for now.

.

I remain neutral on EUR/USD

The euro continues to show limited movement. The eurozone continues to exhibit weak economic conditions, but the euro has been able to hold its own against the dollar and this trend could continue this week.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week Safe Trading!