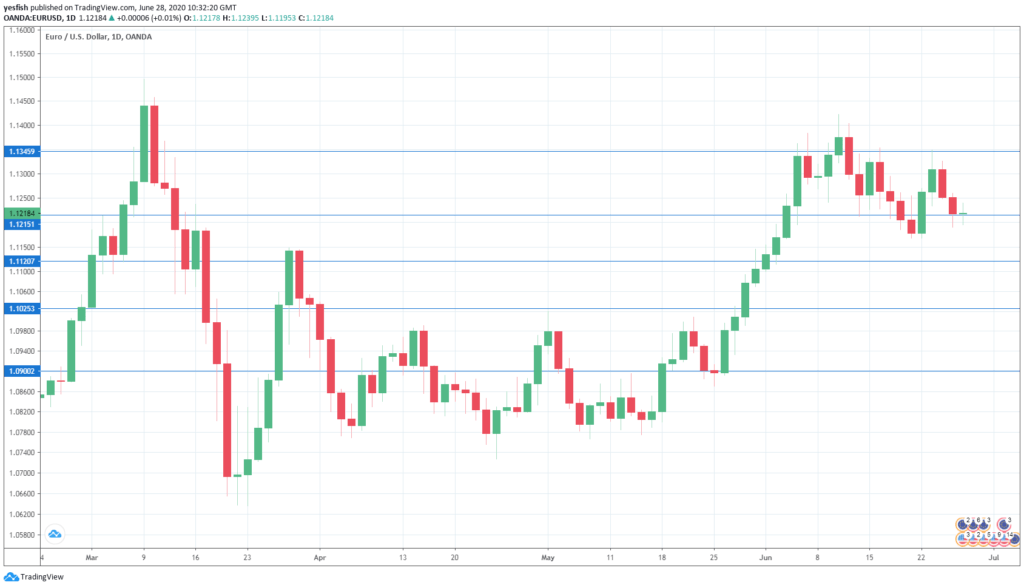

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Flash CPI: Monday, 7:00. The euro area’s fourth-largest economy has declined for two consecutive months, with a revised read of -0.9 percent in May. The forecast for June stands at an identical -0.9 percent. Spain’s input also feeds into the euro-zone number.

- German Preliminary CPI: Monday, All Day. Inflation levels remain low across the eurozone. German inflation declined by 0.1% in May. However, analysts expect a rebound in June, with an estimate of 0.3%.

- French Consumer Spending: Tuesday, 6:45. French consumer spending has been in free-fall. The reading of -20.2% in April followed a decline of 17.9% a month earlier. Analysts expect a sharp rebound in May, with an estimate of 30.0 percent.

- Eurozone Inflation: Tuesday, 9:00. Consumer inflation started the year at 1.4%, but this shriveled to just 0.1% in May. The June estimate stands at -0.1 percent. The core figure has been much stronger, with back-to-back readings of 0.9 percent. Little change is projected for June, with a forecast of 0.8 percent.

- German Retail Sales: Wednesday 1st-3rd. Retail sales declined over 5 percent in both March and April, as consumption has fallen due to the severe economic conditions in the wake of Covid-19. Better news is expected in May, with a forecast of 3.5 percent.

- Manufacturing PMIs: Wednesday: 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. Spain and Italy’s manufacturing sector showed improvement in May, but both remain in contraction, with readings of 38.3 and 45.4, respectively. Spain is expected to climb to 45.2 while Italy is forecast to rise to 47.9 points. Initial German and eurozone PMIs for June also improved, with releases of 44.6 and 46.9, respectively. The French initial read of 52.1 was particularly strong, indicative of expansion. The final reads for France, Germany and the eurozone are expected to confirm the initial readings.

- Services PMIs: Friday, 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. The services sector showed improvement in June. Germany and the eurozone rose to the mid-40s, as the rate of contraction lessened. However, Spain and Italy continued to show deep contraction in April, with readings of 27.9 and 28.9, respectively. The final reads for France, Germany and the eurozone are expected to confirm the initial readings. Spain and Italy are expected to show a strong improvement, with estimates of 46.0 and 46.6, respectively.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1515.

1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1215 is fluid, as the pair ended the week just above this level. 1.1119 is next.

1.1025 (mentioned last week) has provided support since late May.

1.0920 is the final support level for now.

.

I am neutral on EUR/USD

The euro continues to show movement in both directions, unable to form a trend. With both the eurozone and U.S. struggling with the Corvid-19 pandemic, the lack of direction could continue this week.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week Safe Trading!