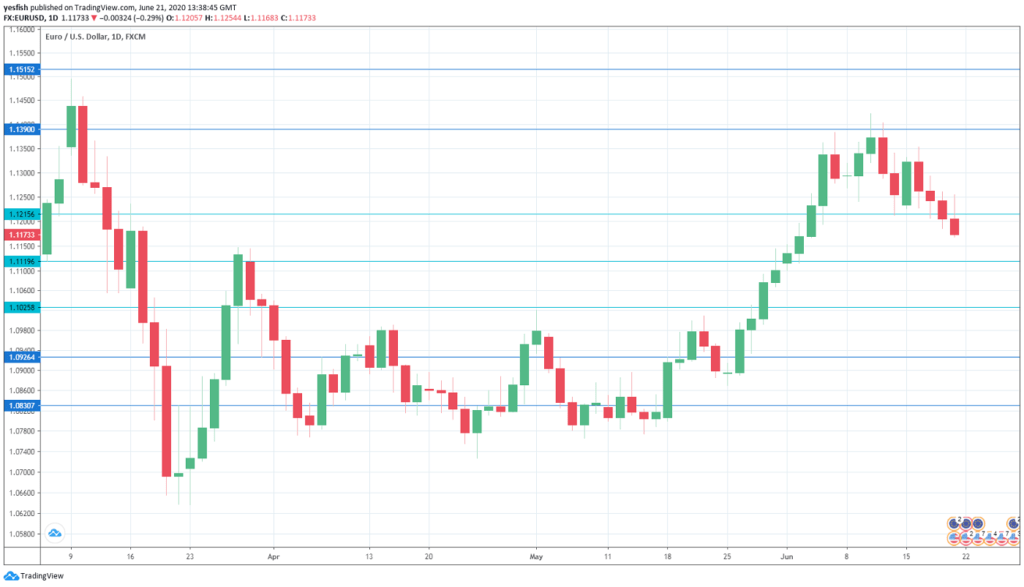

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Consumer Confidence: Monday, 14:00. The official Eurostat’s survey of around 2,300 consumers remains mired in negative territory, which indicates pessimism. In May, the indicator came in at -19 points. Another soft release is expected in June, with a forecast of -15 points.

- Flash PMIs: Tuesday, 7:15 in France, 7:30 in Germany, and 8:00 for the whole eurozone. The services sector remains in contraction but did show some improvement in the May data. The German and eurozone services PMIs were just above the 30-level, while the French indicator improved to 36.6 points. The manufacturing sector also continues to contract, with readings in April well below the 50-level, which separates contraction from expansion. German Manufacturing PMI rose to 36.6, the eurozone indicator came in at 39.4, and French Manufacturing PMI climbed to 40.6 points. The initial readings for June are projected to improve but remain in contraction territory.

- German Ifo Business Climate: Wednesday, 8:00. After falling to 74.3 in April, business confidence rebounded in May, with a reading of 79.5. Still, confidence levels have dropped significantly; back in January, the indicator stood at 96.1 points. The estimate for June stands at 85.0 points.

- German GfK Consumer Climate: Thursday, 6:00. Consumers remain deeply pessimistic in the eurozone’s largest economy. The indicator has posted back-to-back declines, with a release in May of -18.9 points. The forecast for June stands at -11.0 points.

- Eurozone Monetary Data: Friday, 8:00. M3 Money Supply accelerated to an annual growth rate of 8.3% in April, up from 7.5% a month earlier. Private Loans slowed to 3.0% in April y/y, down from 3.4% beforehand. We will now receive data for May. Money Supply is projected to rise to 8.6% while Private Loans are expected to grow by 3.3 percent.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1215 is providing support. 1.1119 is next.

1.1025 (mentioned last week) switched to support in late May.

1.0920 has held in support since late March.

1.0830 is the final support level for now.

.

I am bearish on EUR/USD

Despite severe economic conditions in the eurozone, the euro has held its own against the dollar. Still, the U.S. economy is in better shape than the eurozone, which bodes well for the dollar.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week Safe Trading!