- German Prelim CPI: Monday, All Day. Germany’s CPI jumped 0.8% in January, its highest level since April 2019. However, inflation is expected to slow to 0.4% in February, with a forecast of 0.4%.

- Manufacturing PMIs: Monday, 8:50 in France, 8:55 in Germany, and 9:00 for the whole eurozone. The German and eurozone manufacturing sectors remain well into expansionary territory. The second-estimate PMIs for Germany and the eurozone are expected to confirm the initial readings, with readings of 60.6 and 57.7, respectively. France, Spain and Italy are all projected to post readings above the 50-level, which separates contraction from expansion.

- German Retail Sales: Tuesday, 7:00. In December, Retail Sales showed a sharp contraction, with a read of -9.2%. A modest gain is expected in January, with an estimate of 0.9%.

- Inflation Report: Tuesday, 10:00. Inflation pressures have been accumulating in the eurozone. Headline CPI is expected to remain unchanged at 0.9%, while the core reading is projected to show a gain of 1.1%.

- Services PMIs: Wednesday, 8:15. Services remain in contraction, with readings below the 50-level. The second-estimate PMIs for Germany and the eurozone are expected to confirm the initial readings, at 45.9 and 44.7, respectively. Services in Italy, Spain and France also are showing contraction, with readings below the neutral 50-level.

- Retail Sales: Thursday, 10:00. Retail Sales rebounded in December with a reading of 2.0%, which was a 4-month low. The markets are expecting a downturn in January, with a gain of -1.5%.

- German Factory Orders: Friday, 7:00. Factory Orders declined by 1.9% in December, the first decline since April. The indicator is forecast to rebound in January, with an estimate of 0.8%.

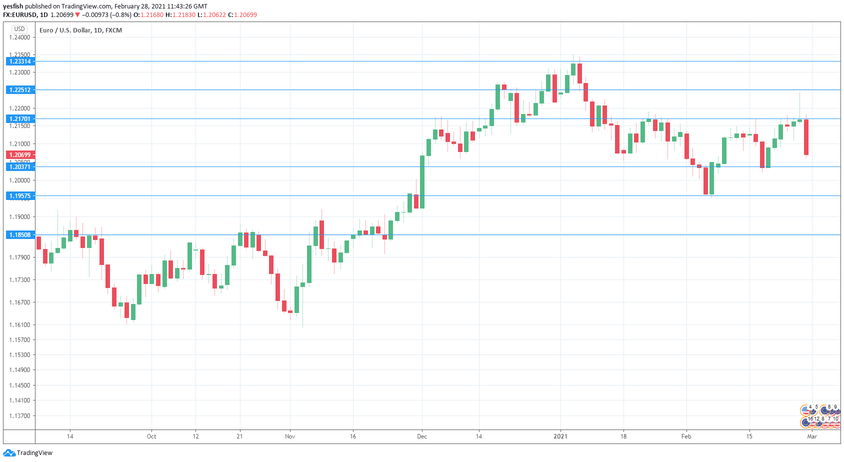

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2331 (mentioned last week).

1.2251 has held in resistance since the first week in January.

1.2170 is an important monthly resistance line.

1.2037 is the first support level. It is a weak line.

1.1957 has held in support since the first week in February.

1.1850 is the final support line for now.

.

I remain neutral on EUR/USD

The US dollar showed strong gains last week, but this could be the tail end of a dollar short squeeze. At the same time, the US economy continues to show stronger numbers than in the eurozone.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!