- Current Account: Monday, 9:00. The current account surplus jumped to EUR 36.7 billion in December, its highest level since January 2018. The forecast for January stands at 34.5 billion.

- PMIs: Wednesday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. The March data is expected to show little change from the February numbers. Manufacturing continues to show strong expansion, led by Germany, which impressed with a reading of 60.8. Services has been lagging behind, with Germany, the eurozone and France registering readings below the 50-level, which separates expansion from contraction.

- German GfK Consumer Climate: Thursday, 7:00. Consumer confidence remains mired in negative territory, as consumers are pessimistic about economic conditions. The index came in at -15 in January and no change is expected in February.

- Monetary Data: Thursday, 9:00. M3 Money Supply rose to 12.5% in January, up from 12.3%. No change is expected in the upcoming release. Private Loans edged lower to 3.0%, down from 3.1%. An upturn is expected in February, with an estimate of 3.2%.

- German ifo Business Climate: Friday, 10:00. Business confidence improved in the second half of 2020 and remains strong early in 2021. The index rose from 90.1 to 92.4 in February and is projected to reach 93.1 in March.

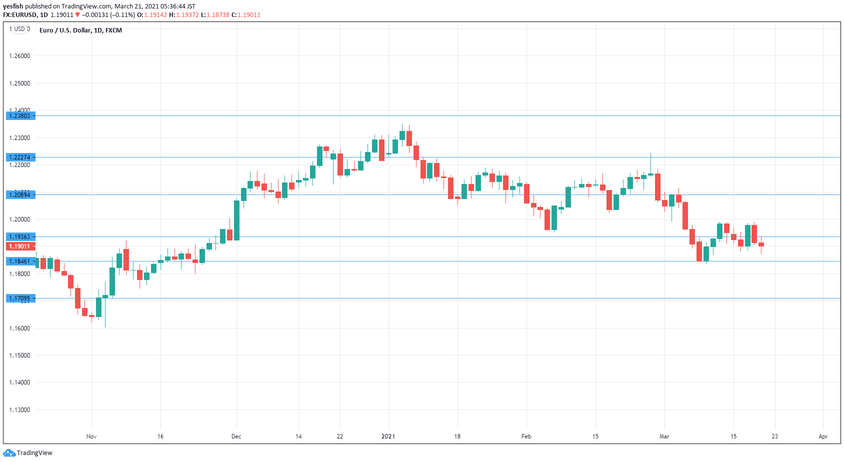

EUR/USD Technical analysis

.