EUR/USD managed to tick up amid OK data from Europe and weakness in the US dollar. GDP data and Draghi’s testimony stand out in a busier week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

German GDP smashed expectations and rose by 0.8% q/q. This certainly provided support to the euro. Draghi sounded upbeat about the euro-zone economy despite making his usual cautionary comments about inflation. Inflation was confirmed at lower levels, limiting the gains of the euro. Inflation was better than expected in the US, but the issues around passing tax cuts weighed on the greenback.

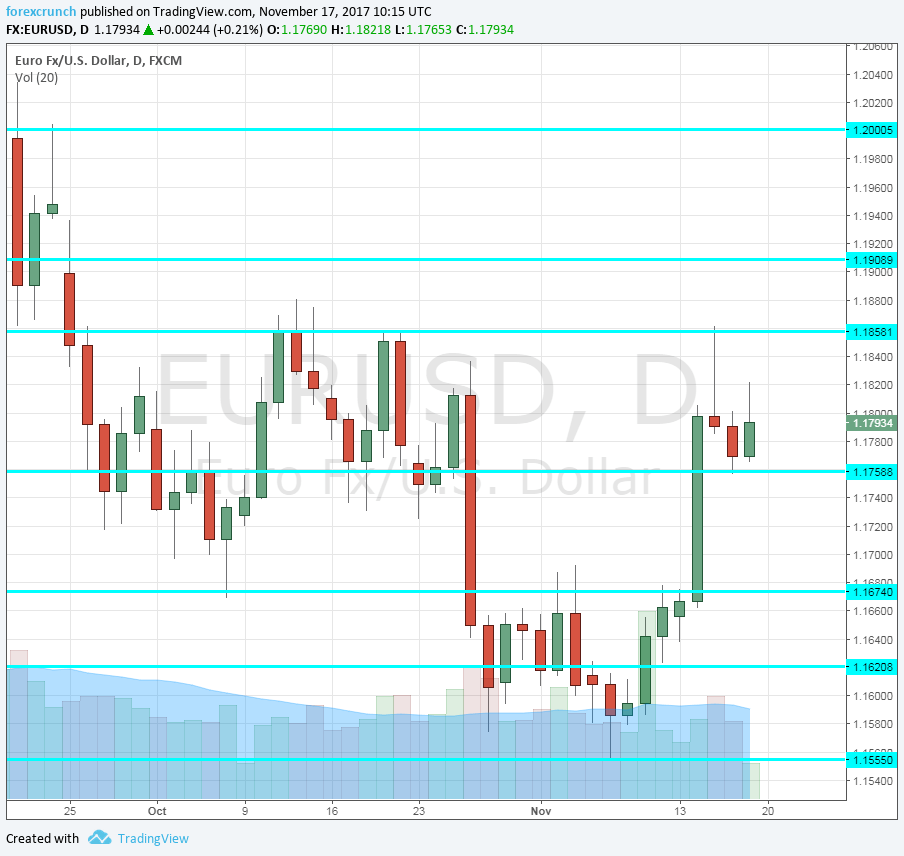

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German PPI: Monday, 7:00. Producer prices rose by 0.3% in September, indicating higher inflation in the pipeline. However, PPI exceeded expectations for quite a few months but CPI is not going anywhere fast.

- Mario Draghi testifies Monday, 14:00. The president of the ECB faces European MPs in Brussels and may lay out an updated view of the euro-zone economies and the inflation situation. The next meeting of the ECB is only in mid-December, so Draghi will not be constrained by a “quiet period”.

- ECB Financial Stability Review: Tuesday, 9:00. Twice a year, the European Central Bank publishes its report on financial stability. The publication had a major role during the darker days of the financial crisis but still remains of importance. Any mention of inflation will be of interest.

- Consumer Confidence: Monday, 15:00. This official survey of 2300 consumers has improved in the past year, but failed to break back to positive ground. The score of -1 seen in October reflects minor pessimism. A similar number is on the cards now.

- German Final GDP: Thursday, 7:00. According to the preliminary release, the German economy grew by 0.8% q/q, a very impressive rate. The number will probably be confirmed now.

- Spanish Unemployment Change: Thursday, 8:00. Spain still suffers from massive unemployment despite an improvement in recent years. This monthly gauge of unemployment rose by 27.9K in September. Another increase is likely for October, as the tourism season winds down and as we could also see an impact of the Catalan crisis.

- Flash PMIs: Thursday morning: 8:00 for France, 8:30 for Germany and 9:00 for the whole euro-zone. In October, the French manufacturing PMI scored 56.1 points, significantly above the 50-point threshold that separates contraction from expansion. The services PMI stood at 57.3 points. Germany, the largest economy, had a score of 60.6 in manufacturing, representing rapid growth. The German services PMI lagged behind with 54.7 points. The whole euro-zone had 58.5 for manufacturing and 55 for services.

- ECB Meeting Minutes: Thursday, 12:30. The European Central Bank made a big announcement at its October meeting, laying out the plan to decrease the bond-buying scheme: 30 billion euros per month beginning in January through September. The dovish tilt came from the fact that they left the door open to more buys after September 2018. We know that this wasn’t a unanimous decision and the minutes will provide further evidence. How much support did the hawkish view get in that meeting? How worried are the various members about inflation?

- Belgian NBB Business Climate: Thursday, 14:00. This wide survey advanced to positive ground, reaching 0.5 points in October. The 6000 strong survey struggled to cross the 0 level and reflect improving conditions.

- German Ifo Business Climate: Friday, 9:00. IFO is GErmany’s No. 1 Think-Tank and it has been showing an upbeat sentiment. The headline business climate score jumped to 116.7 points in October.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was initially capped at the 1.1670 level (mentioned last week) but then made a clear breakout.

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1910 held the pair down back in August. 1.1860 capped the pair in August and in October while working as support in September.

1.1760 served as a cushion in November and also played a role beforehand. 1.1670 was a swing low in October. and hasn’t worked too well. The 2016 high of

1.1620 slowed down the pair also in October. 1.1555 was the low point in November and works as a cushion.

It is followed by the round number of 1.15. 1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I remain bullish on EUR/USD

The excellent German GDP numbers support the euro and Draghi cannot hold the pair down. In the US, the Fed hesitates amid weaker inflation. This sets the ground for further gains for the pair.

Our latest podcast is titled Pound problems and real raises

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!