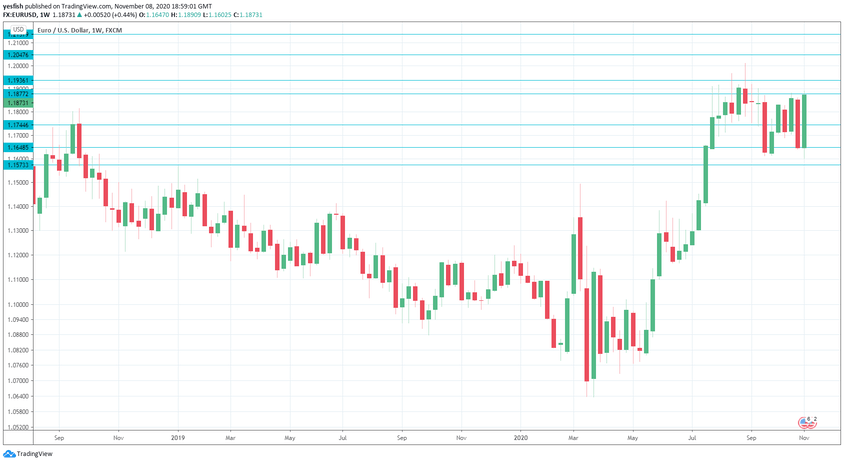

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Trade Balance: Monday, 7:00. Germany’s trade surplus took an unexpected drop in August, falling from EUR 18.0 billion to 15.7 billion. The surplus is expected to rebound to EUR 17.2 billion in September.

- Sentix Investor Confidence: Monday, 9:30. Investors remain pessimistic about economic conditions in the eurozone, and the indicator has been mired in negative territory since February. Analysts are braced for a sharp downturn in November, with a forecast of -15.0 points.

- German ZEW Economic Sentiment: Tuesday, 10:00. The mood in Germany is gloomy, as the indicator fell sharply in October, from 77.4 to 56.1. The downswing is expected to continue, with a forecast of 45.0 points.

- German Final CPI: Thursday, 7:00. German CPI has posted three straight declines, pointing to weak economic activity in Germany. A weak gain of 0.1% is expected in October.

- Industrial Production: Thursday, 10:00. Industrial production has been steadily falling in recent months and dropped to just 0.7% in August. The forecast for September stands at 0.9%.

- GDP: Friday, 10:00. After a dismal Q2, when the eurozone contracted by 12.1%, a strong rebound is expected in Q3, with a forecast of 12.7%. If the actual reading is within expectations, the euro could receive a boost.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2136.

1.2046 is an important monthly line of resistance.

1.1936 is next.

1.1877 is an immediate resistance line.

1.1744 is providing support.

1.1648 is next.

1.1573 (mentioned last week) has provided support since July.

.

I am neutral on EUR/USD

The euro had an excellent week, but this was a result of US broad weakness rather than strength in the euro. The currency’s volatility could continue, but it’s unclear which direction it will take this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!