EUR/USD went higher but struggled to hold onto the gains as the dust settled from the US Mid-Term Elections. What’s next? GDP numbers and other figures stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The US Mid-Term Elections resulted in a split Congress, as expected. The US Dollar lost a bit of ground on the Democrats’ win of the House but recovered quite quickly. The Fed left rates unchanged and left the door wide open to a rate hike in December. The Eurogroup meetings yielded a bit of optimism regarding the clash between Italy and the European Commission regarding the Italian budget. However, the issue is far from being resolved. A Brexit deal seems close and this provided a bit of support to the common currency.

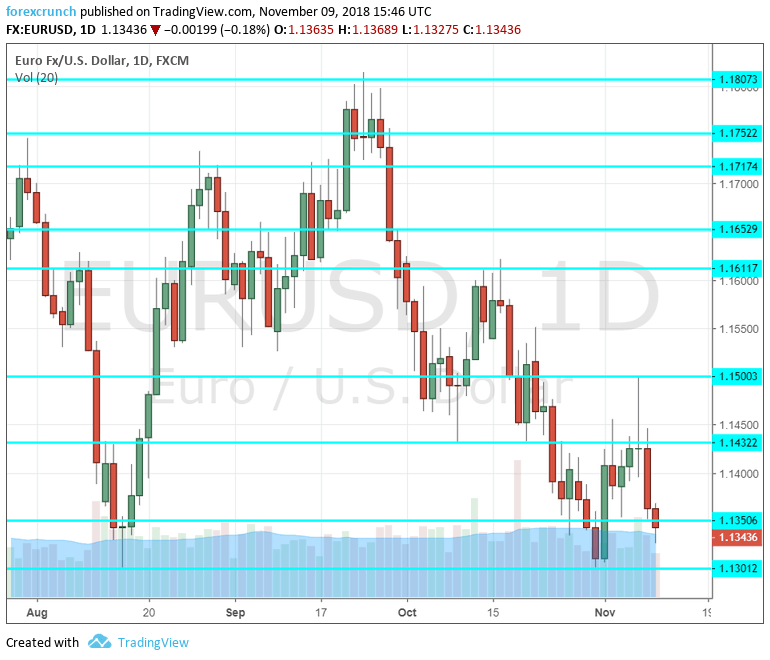

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Final CPI: Tuesday, 7:00. The euro zone’s largest country saw its Consumer Price Index rising by 0.2% m/m in October, according to the preliminary release. The final report will likely confirm the initial read. The data feeds into the final euro-zone figure.

- French Private Payrolls: Tuesday, 7:45. The second-largest economy in the euro area saw a minor increase in payrolls back in Q2: 0.1% according to the final read for the quarter. We will now receive the preliminary estimate for the third quarter. Another increase is likely: 0.3% is expected.

- German ZEW Economic Sentiment: Tuesday, 10:00. The survey of around 300 analysts and institutional investors remained in negative territory in October, as it has been throughout most of the year. The score of -24.7 reflected growing pessimism. -24.2 is on the cards now. A similar figure is likely now. The all-European number was at -19.4 and -17.3 is predicted now.

- German GDP: Wednesday, 7:00. We have already learned that the euro-zone economy slowed down in Q3: 0.2% according to the first release. However, the publication did not include Germany, the largest country. The locomotive of Europe grew by 0.5% in Q2 and a slowdown is likely in Expectations stand on an outright contraction of 0.3%. Q3. A significant deviation will impact the update for the euro-zone GDP due at 10:00.

- French Final CPI: Wednesday, 7:45. According to the initial read, France’s CPI rose by 0.1% m/m in October. The final read for is projected to confirm the preliminary number.

- GDP: Wednesday, 10:00. The first read for Q3 GDP was quite disappointing: a growth rate of only 0.2%, half the pace seen earlier in the year. This Flash read will likely confirm it. However, it is important to note that any surprise in Germany’s figures will reshape expectations for the euro-zone figure.

- Industrial Production: Wednesday, 10:00. The number for the currency bloc comes after the main countries published their own figures. Nevertheless, surprises are quite common here. After a few disappointing months, industrial output rose by 1% in August. We may see a weaker figure in September. A drop of 0.4% is on the cards.

- Trade Balance: Thursday, 10:00. The euro-zone enjoys a broad trade surplus thanks to German exports. However, this surplus was wider earlier in the year and stood at 16.6 billion in August. A wider surplus is likely for September: 16.7 billion euros.

- German WPI: Friday, 7: 00.Prices at the wholesale level eventually reach consumers. After an increase of 0.4% in September, a more moderate rise of 0.2% is projected for October.

- Final CPI: Friday, 10:00. The initial inflation figures for October stood at 2.1% on the headline and 1.1% on the core, above 0.9% seen in September, providing some relief for the European Central Bank. The final publication is expected to confirm the initial numbers.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week on the back foot but found support at 1.1365 (mentioned last week). It then moved higher.

Technical lines from top to bottom:

1.1815 was the high point in September. 1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions and it capped the pair in mid-September. 1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1500 is a very round level and also capped the pair’s advance in early November. 1.1430 separated ranges during October.

1.1365 temporarily cushioned the drop in EUR/USD on its way down. 1.1300 is a round number that held the pair in mid-August and late October |double-bottom) and also held the pair down in June 2017.

Lower, we are back to levels last seen in 2017. 1.1220 and 1.1100 are notable.

I remain bearish on EUR/USD

The US elections are behind us and it’s back to normal for EUR/USD: the Italian crisis is not resolved, the euro-zone is slowing down and the Fed remains hawkish.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!