EUR/USD lost a lot of ground on the ongoing Italian crisis but bounced back quite impressively as the greenback retreated in the wake of November. Volatility woke up as well. Will this continue? The upcoming week features GDP figures and quite a few other indicators. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Euro was under pressure from several fronts. German Chancellor Angela Merkel announced she will step down from the leadership of her party following the defeat in regional elections in Hesse. Italy reported stagnation in its GDP report for Q3. The disappointing outcome complicates the clash with the European Commission over its 2019 budget. Italy wants a more spending in order to stimulate the economy while the EC wants lower spending to lower the debt-to-GDP ratio. In the US, hopes for a trade deal between the US and China weighed heavily on the US Dollar late in the week. The related turnaround in stocks also diminished demand for the safe-haven US Dollar. However, a deal is far from being certain. The NFP beat expectations with 250K and the acceleration of wage growth to 3.1% is encouraging. Late in the week, reports that the ECB is mulling a new TLTRO program weighed on the euro.

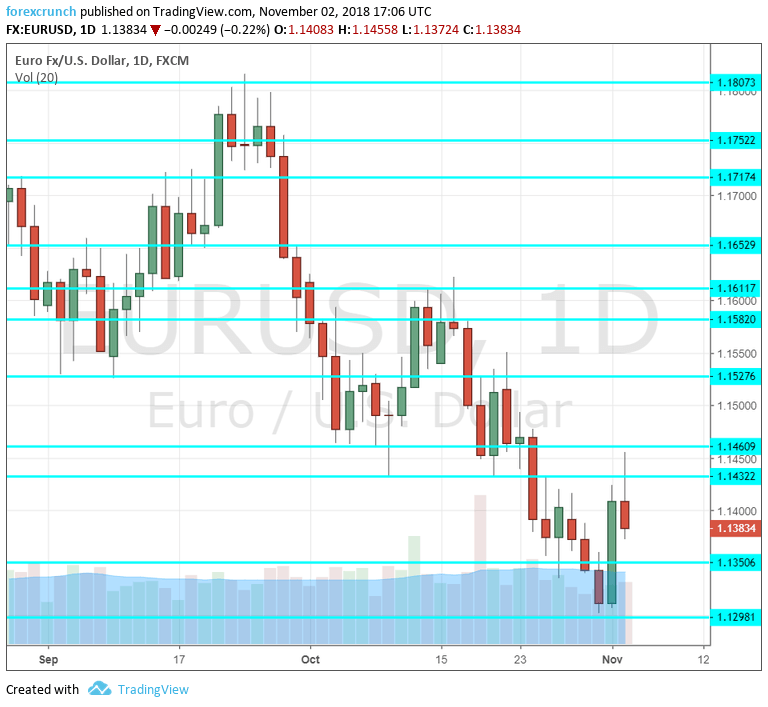

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Unemployment Change: Monday, 8:00. The fourth-largest economy in the euro-zone has seen a material improvement in its job market, but the unemployment rate is still high, above 14%. The fresh monthly snapshot the change in unemployment is of interest. The number of jobless increased by 20.4K in September. Another increase may be seen now as fewer tourists visit the southern European nation.

- Sentix Investor Confidence: Monday, 9:30. This survey of around 2,800 analysts and investors stabilized in October with a score of 11.4 points. We may see it falling in November’s survey. A score of 9.9 is expected.

- German Factory Orders: Tuesday, 7:00. This volatile measure of orders at factories increases by 2% in August, above expectations. A second consecutive month of increases may be seen in the publication for September. A slide of 0.4% is on the cards.

- Services PMI’s:Tuesday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German number at 8:55, and the final euro-zone number at 9:00. Markit’s forward-looking survey for Spain’s services sector stood at 52.5 points back in September, a bit above the 50-point threshold that separates contraction from expansion. A score of 51.9 is projected. Italy, the third-largest economy, had a better score of 53.3 points. A level of 52.1 is forecast.The preliminary read for France for October stood at 55.6 points, for Germany at 53.6 points, and for the whole euro-zone at 53.3. These initial reads will likely be confirmed.

- PPI: Tuesday, 10:00. Prices at factory gates eventually reach consumers. The Producer Price Index increased by 0.3% back in September. The figure for October will likely be similar. A rise of 0.4% is expected.

- German Industrial Production: Wednesday, 7:00. Germany is considered the “locomotive of Europe.” However, its industrial output has seen some hiccups lately. Production dropped by 0.3% in August. The change in September is due now and expectations stand on another drop, this time of 0.1%.

- Retail Sales: Wednesday, 10:00. Consumers squeezed their shopping back in August: a slide of 0.2% was recorded. While the data is released after the major countries will have released their own figures, it tends to surprise. A minor increase of 0.1% is estimated.

- German Trade Balance: Thursday, 7:00. German exports keep the euro-zone trade balance positive for a long time. The German surplus stood at 18.3 billion euros in August. The figure for September will likely be better: 21.2 billion euros.

- French Trade Balance: Thursday, 7:45. Contrary to Germany, France suffers from a trade deficit, which reached 5.6 billion back in August. A deficit of 6.1 billion is projected now.

- ECB Economic Bulletin: Thursday, 8:00. Two weeks after the European Central Bank made its rate decision, it publishes the economic data it had when making that decision. The statistics and analysis provide insights into the economy, inflation, and future monetary moves.

- French Industrial Production: Friday, 7:45. French industrial output rose in August, contrary to Germany. The modest increase of 0.3% is a step forward for the second-largest economy in the euro-zone. We will now receive figures for September. A drop of 0.3% is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was pressured to the downside and eventually challenged the 1.1300 level (mentioned last week). It then bounced from the level, creating a double bottom and shooting higher.

Technical lines from top to bottom:

1.1815 was the high point in September. 1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions and it capped the pair in mid-September. 1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1570 was the low point as September came to an end 1.1530 supported the pair twice in August, making it an important line.

1.1460 was the low point in the initial drop in October 2018. 1.1422 was the low point in mid-October.

1.1365 temporarily cushioned the drop in EUR/USD on its way down. 1.1300 is a round number that held the pair in mid-August and late October |double-bottom) and also held the pair down in June 2017.

Lower, we are back to levels last seen in 2017. 1.1220 and 1.1100 are notable.

I remain bearish on EUR/USD

While inflation is stable, weaker economic growth cannot leave the ECB unmoved. On the other hand, the US economy is still looking good. The economic and monetary divergence will likely push the pair further down after the significant correction seen now.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!