EUR/USD fell to new 17-month lows but recovered quite quickly. What’s next? The ECB Meeting Minutes and PMI’s stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Italy did not budge on the European Commission’s rejection of its budget. The showdown continues in the upcoming week. In addition, the German economy contracted in Q3, a worrying sign, even if this was expected. On the other hand, a Brexit draft deal is finally here and this supports the risk environment. The ongoing talks between the US and China also help. Late in the week, the US Dollar lost ground on dovish comments from several Fed officials.

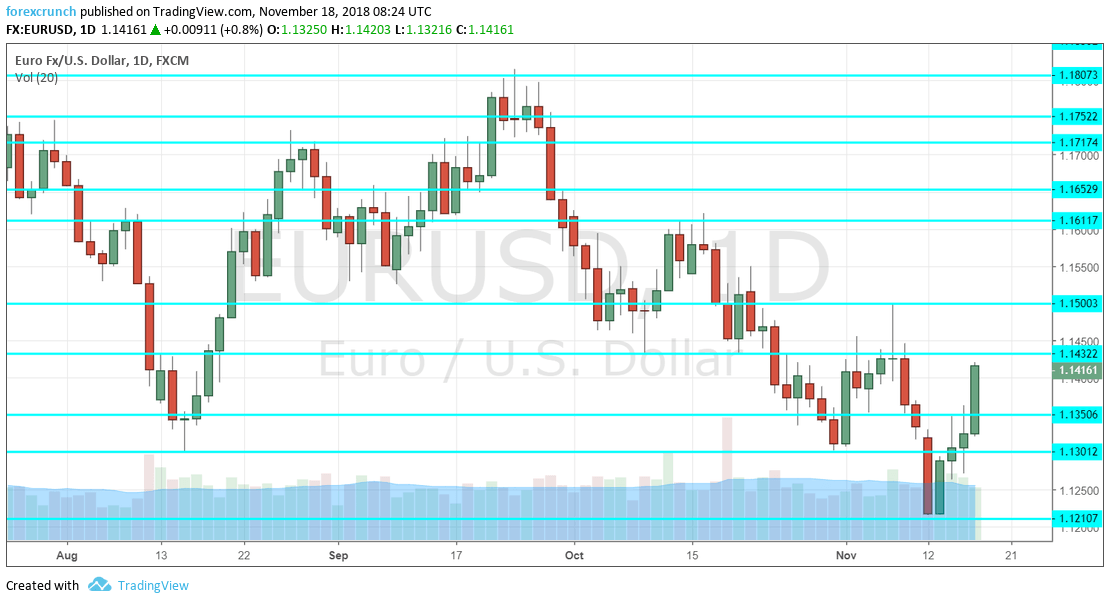

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Eurogroup Meetings: Monday. Finance ministers of the euro-zone convene to discuss the economic situation and Italy is high on the agenda. After the European Commission rejected the budget, Italy stuck to the budget, the deficit, and the growth forecasts. Will Brussels move forward in disciplining the third-largest economy in the currency bloc? Headlines come are due during the day.

- Current Account: Monday, 9:00. The euro-zone enjoys a current account surplus that is mostly due to Germany’s exports. After a positive figure of 23.9 billion euros in August, September’s numbers will likely be similar. 24.2 is projected.

- ECB Financial Stability Review: Monday, 9:00. The European Central Bank releases an assessment of the banks’ stability and also of the economic situation which impacts stability and vice versa twice a year. Comments by the Frankfurt-based institution will on slowing growth be of interest.

- German PPI: Tuesday, 7:00. Germany saw a jump of 0.5% in the Producer Price Index in September. The data for October will likely be more moderate. Prices at factory gates eventually reach consumers. An increase of 0.3% is on the cards.

- ECB Meeting Minutes: Thursday, 12:30. The European Central Bank releases its monetary policy accounts four weeks after the rate decision. Back then, President Mario Draghi remained confident about the inflation situation and about growth. However, growth has significantly slowed down and other economic signs have disappointed. Will we see a more dovish and worried stance by the Frankfurt-based institution? The publication may have a considerable impact as it is released on Thanksgiving and many Americans may be away, causing low market liquidity.

- Consumer Confidence: Thursday, 15:00. The official Eurostat’s survey of around 2,300 consumers remained at the low ground in October: -3 points, reflecting pessimism. The figure for November will likely be similar. A repeat of the same score is expected.

- German GDP: Friday, 7:00. The final release is projected to confirm that the German economy squeezed in Q3: an outright contraction that was reported now. Any move from -0.2% will be of interest. The final figures do not usually deviate from original ones.

- Flash PMI’s: Friday morning: 8:15 for France, 8:30 for Germany, and 9:00 for the whole euro-zone. Markit’s forward-looking survey for France’s manufacturing sector stood at 51.2 points in October, barely above the 50-point threshold that separates expansion from contraction. We will now receive the preliminary numbers for November which is expected to stand at 51.3. The services sector had a better score of 55.3. 54.9 is on the cards. Germany, the continent’s largest economy, saw a score of 52.2 for its substantial manufacturing sector and 52.3 is expected now. The services sector had an improved figure of 54.7 and 54.6 is forecast now. Euro-zone manufacturing PMI stood at 52 points in October with 52 predicted now. Services for the full currency-bloc was at 53.7 and 53.6 on the cards for November.

- Belgian NBB Business Climate: Friday, 14:00. The broad survey of around 6,000 businesses dropped back to the negative ground in October: -1.1 points, reflecting worsening conditions. A drop to -1.8 is expected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was unable to hold onto support at 1.13 (mentioned last week) and fell to a new 2018 low before recovering.

Technical lines from top to bottom:

1.1815 was the high point in September. 1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions and it capped the pair in mid-September. 1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1500 is a very round level and also capped the pair’s advance in early November. 1.1430 separated ranges during October.

1.1365 temporarily cushioned the drop in EUR/USD on its way down. 1.1300 is a round number that held the pair in mid-August and late October |double-bottom) and also held the pair down in June 2017.

1.1215 is the low point it reached in November. Lower, we are back to levels last seen in 2017. 1.1100 and 1.10 are notable.

I am neutral on EUR/USD

The ongoing Italian crisis, Germany’s contraction and the monetary divergence between the Fed’s rate hikes and the ECB’s hesitance all point to the downside. The recent comments could limit the falls, but the trend remains to the downside.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!