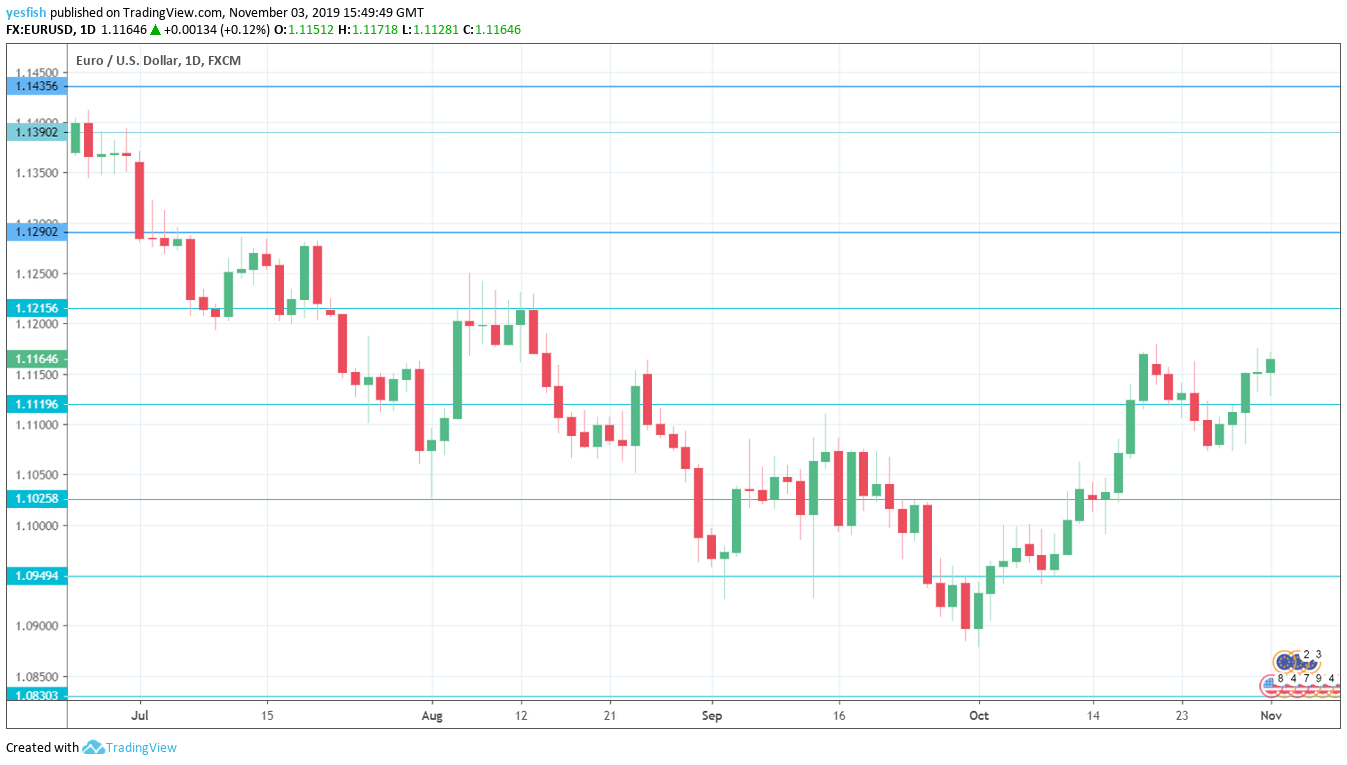

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Markit’s forward-looking purchasing managers’ index for Spain’s manufacturing sector has been in contraction mode for the past four months, and the trend is expected to continue in October, with an estimate of 47.7. In Italy, the manufacturing sector has been in decline for the past 12 months. The German indicator slowed to 47.8 in September, pointing to sharp contraction. The eurozone PMI slipped to 45.7, and the same reading is expected in October. France was the lone bright spot, with a reading of 50.1 points. The forecast stands at 50.5 points.

- Sentix Investor Confidence: Monday, 9:30. Investor confidence took a dive in October, as the indicator came in at -16.8 points. This was the lowest level since 2013. Another weak release is expected in November, with a release of -13.2 points.

- Spanish Unemployment Change: Tuesday, 8:00. Spain’s unemployment rolls increased by 13.9 thousand in September, much better than the estimate of 37.6 thousand. Investors are braced for a sharp increase in unemployment rolls, with an estimate of 60.0K.

- PPI: Tuesday, 10:00. The Producer Price Index has sputtered, with only one gain in the past six months. The August release came in at -0.5%. The forecast for the September release stands at 0.1%.

- German Factory Orders: Wednesday, 7:00. The manufacturing sector is in contraction mode, and factory orders has posted two straight declines. In August, the indicator fell by 0.6%. The markets are expecting a rebound in September, with an estimate of 0.1%.

- Services PMIs: Thursday, 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. The services sector has been stronger than manufacturing, with all major eurozone economies expected to continue readings above 50, which separates contraction from expansion.

- Retail Sales: Thursday, 10:00. Eurozone retail sales rebounded with a gain of 0.3% in August, after a decline a month earlier. The markets are expecting a small gain of 0.1% in September.

- German Industrial Production: Thursday, 7:00. This manufacturing indicator surprised with a gain of 0.3% in August, after posting back-to-back declines. Another decline is projected in September, with a forecast of -0.3%.

- German Trade Balance: Friday, 7:00. Germany’s trade balance slipped to EUR 18.1 billion in August, down sharply from EUR 20.2 billion in July. The trade surplus is expected to rise to EUR 19.3 billion in September.

- French Trade Balance: Friday, 7:45. France posts trade deficits on a continual basis. The deficit widened to EUR -5.02 billion in August, above the estimate of EUR -4.23 billion. The trade deficit is forecast to narrow to EUR 4.90 billion in September.

EUR/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.1515, which was a high point at the end of January.

1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier. 1.1345 is next.

1.1290 has held in resistance since the first week of July. 1.1215 is next.

1.1119 (mentioned last week) remains relevant. Currently, it is a weak resistance line.

1.1025 is the first support level. 1.0950 is next.

1.0829 has held in support since April 2017.

I remain bearish on EUR/USD

The euro enjoyed an excellent month of October, climbing 2.3%. Still much of these gains can be attributed to dollar weakness rather than an attractive euro. The eurozone economy remains weak, and the German manufacturing indicators continue to point to contraction. The U.S. economy remains strong and the Fed has indicated that it will take a pause from the recent rate-cutting.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!