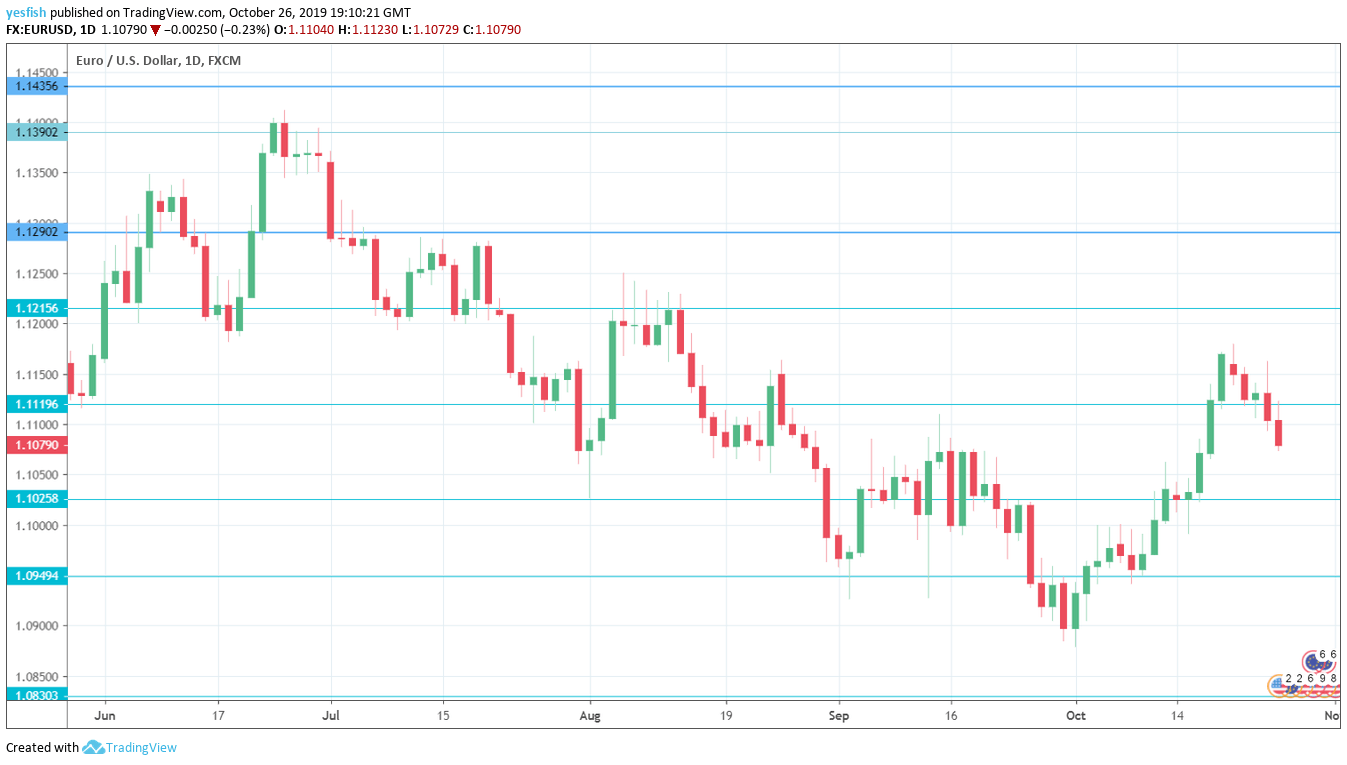

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Monetary Data: Monday, 9:00. M3 Money Supply improved to an annual growth rate of 5.7% in August, up from 5.2% a month earlier. The August estimate stands at 5.7%. Private Loans ticked higher to 3.4% in July on an annualized basis. Another gain of 3.4% is expected in August.

- French Flash GDP: Wednesday, 6:30. GDP in the eurozone’s second-largest economy dipped to 0.2%, its lowest in a year. Another estimate of 0.2% is projected for the third quarter.

- German Preliminary CPI: Wednesday, All Day. German inflation remains subdued and has not posted gains in three months. Consumer inflation came in at 0.0% in September and no change is forecast for the October release.

- French Consumer Spending: Friday, 6:45. French consumer spending has been weak, with only one gain in the past three months. The September estimate stands at a flat 0.0%.

- German Retail Sales: Thursday, 7:00. This key consumer spending indicator rebounded in August with a gain of 0.5%, matching the estimate. The forecast for September stands at 0.3%.

- French Preliminary CPI: Thursday, 7:45. French consumer inflation declined by 0.3% in September, its lowest level since January. Investors are expecting a gain of 0.1% in October.

- Spanish Flash GDP: Thursday, 8:00. Spain’s economy slowed in Q2, with a gain of 0.5%. This was the lowest gain since 2014. The downward trend is expected to continue, with an estimate of 0.4% for Q3.

- Eurozone Inflation: Friday, 6:45. Eurozone CPI is expected to show a gain of 0.7% for the initial reading in October. This would be a slight drop from the final September reading of 0.8%.

EUR/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier. 1.1345 is next.

1.1290 has held in resistance since the first week of July. 1.1215 is next.

1.1119 (mentioned last week) has switched to a resistance role following losses by EUR/USD last week.

1.1025 is the first support level. 1.0950 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I remain bearish on EUR/USD

The euro had a good month of October, climbing 1.6%. Still much of these gains can be attributed to dollar weakness rather than an attractive euro. The eurozone economy remains weak, and Germany has also caught the eurozone contagion with a slump in exports and deep contraction in manufacturing. The euro lost ground last week, and the downward trend could continue.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!