- Service PMIs: Monday, 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. The services sector is expected to continue to indicate a contraction in September, with readings below the neutral 50-level. German and eurozone second estimates are projected to confirm the initial readings, at 49.1 and 47.6, respectively.

- Sentix Investor Confidence: Monday, 8:30. Investors remain pessimistic, as the confidence indicator has been mired in negative territory. Still, the indicator has been steadily moving closer to zero, and improved to -8.0 in September, up from -13.4 points. The forecast for October stands at -9.2 points.

- Retail Sales: Monday, 9:00. Retail sales are the primary gauge of consumer spending. In July, retail sales disappointed with a reading of -1.3%, well below the estimate of 1.3%. Analysts expect a rebound in August, with a forecast of 2.4%.

- German Factory Orders: Tuesday, 6:00. After recording double-digit declines and gains in recent months, the July reading came in at 2.8%. The August estimate stands at 3.0%.

- German Industrial Production: Wednesday, 6:00. Industrial Production slowed to 1.2% in July, down from 8.9%. A gain of 1.5% is projected for August.

- ECB Monetary Policy Meetings Accounts: Thursday, 11:30. The ECB will release the minutes of its September policy meeting. Investors will be dialed in, looking to see if policymakers discussed the need for additional flexibility.

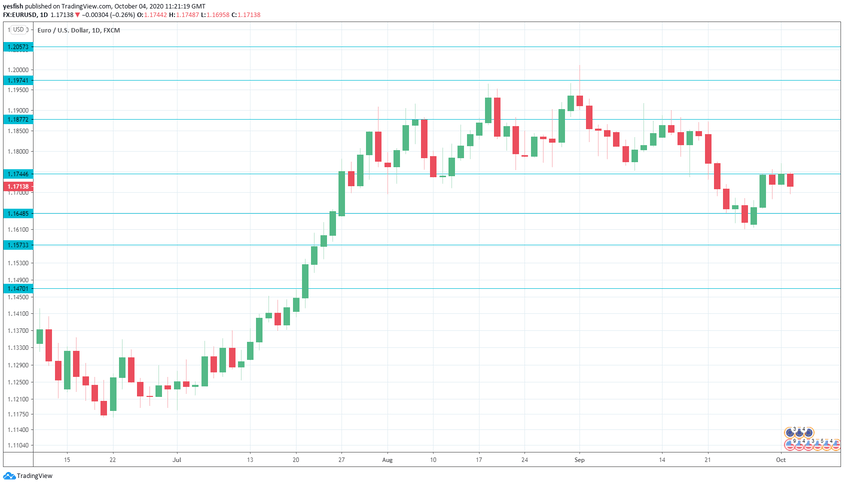

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2057, which was an important resistance line last week.

1.1974 is protecting the symbolic 1.20 level.

1.1877 is next.

1.1744 has weakened in resistance.

1.1648 is the first support level.

1.1573 (mentioned last week) follows.

1.1470 has held in support since July.

1.1328 is the final support level for now.

.

I am bearish on EUR/USD

The ECB is under pressure to add more stimulus, which would put downward pressure on the euro. With the eurozone economy continuing to struggle, the euro is not particularly attractive to investors.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!