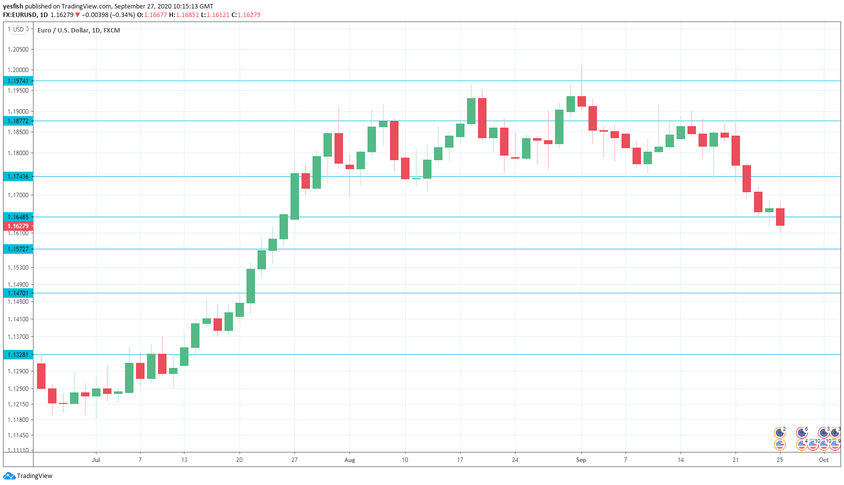

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Prelim CPI: Tuesday, All Day. Inflation remains weak in the eurozone’s number one economy, with CPI registering two straight declines. The estimate for September stands at a flat 0.0%.

- German Retail Sales: Wednesday, 6:00. Retail sales have been struggling, with only gain in the past five months. The July reading came in at -0.9%, but analysts are expecting a gain of 0.4% in August.

- French Prelim CPI: Wednesday, 6:45. Inflation in the eurozone’s second-largest economy remains weak. CPI declined by 0.1% in August and is expected in at -0.4% in September.

- Manufacturing PMIs: Thursday, 7:15 in Spain, 7:45 in Italy, 7:50 in France, 7:55 in Germany and 8:00 for the whole eurozone. German and eurozone PMIs are expected to show expansion, with estimates of 56.6 and 53.7, respectively. The Spanish release is projected to rise to 50.5, up from 49.9 points. This is just above the neutral 50-level, which separates expansion from contraction. The French PMI is expected at 50.9 and Italy at 53.6 points.

- Eurozone Unemployment Rate: Thursday, 9:00. The bloc’s unemployment rate has been steadily increasing and reached 7.9% in August. The upward trend is expected to continue in September, with an estimate of 8.1%.

- Inflation: Friday, 9:00. The specter of deflation remains a headache for ECB policymakers. The headline reading came in at -0.2% in August and is projected at -0.1% in September. Core CPI came in at 0.4% in August and the forecast stands at 0.5% for September.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1974, which is protecting the symbolic 1.20 level.

1.1877 is next.

1.1744 has switched to resistance after sharp losses by EUR/USD last week.

1.1648 is an immediate resistance line.

1.1573 (mentioned last week) is the first line of support.

1.1470 has held in support since July.

1.1328 is the final support level for now.

.

I am bearish on EUR/USD

The US dollar is showing broad strength and the upward trend could continue this week. Covid-19 has shown a resurgence in Europe, and the Brexit bickering could further weigh on the euro.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!