EUR/USD traded in a lower range but did not go anywhere too far as a multitude of factors kept it from making significant breakouts. What’s next? The ECB’s rate decision stands out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Euro enjoyed some optimism on Brexit and got carried away by the Pound. However, the moves were not one-sided and the pair’s range was relatively limited. Concerns about emerging markets somewhat faded away while US tariffs on China reached the forefront. Euro-zone PMI’s were mixed while German factory orders disappointed. US data were mixed as well. The market mood, mostly influenced by tariffs and Brexit, moved the EUR/USD more than anything else.

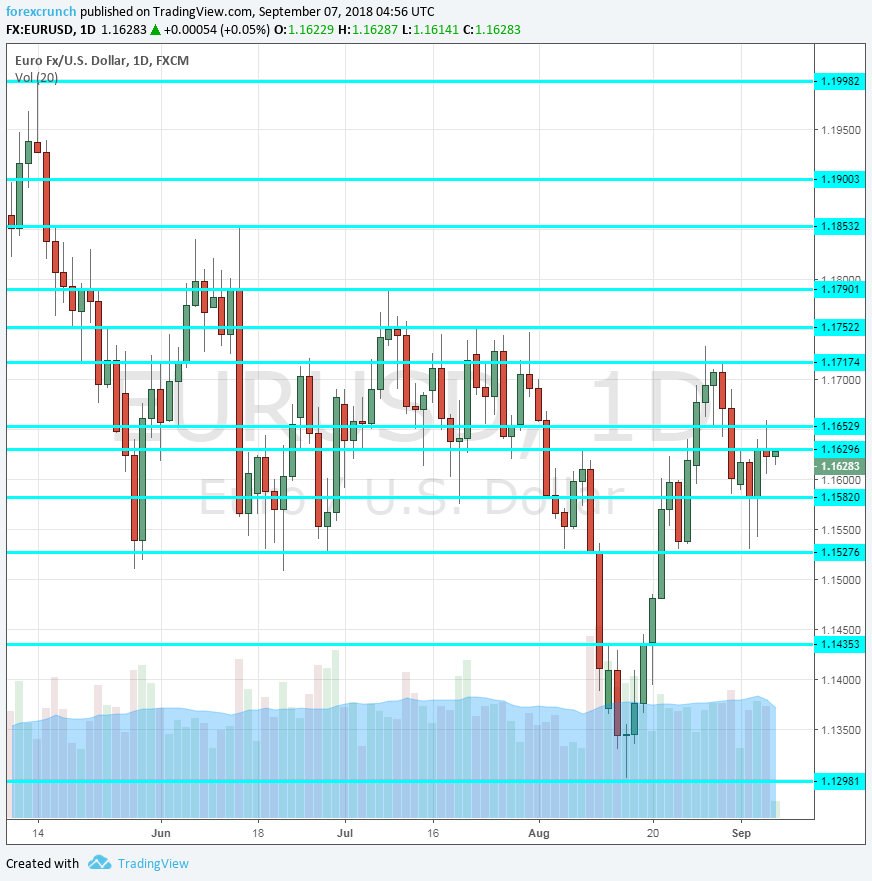

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Sentix Investor Confidence: Monday, 8:30. This survey of 2,800 analysts and investors surprised to the upside in the past two months, reaching 14.7 points in August. A similar figure is likely for September.

- German ZEW Economic Sentiment: Tuesday, 9:00. The influential business sentiment survey in the continent’s largest economy recovered in August but remained in negative territory: -13.7 points. Growing optimism about growth in Germany could push it higher. It is also important to note the Current Conditions component and the all-European figure which was also negative in August: -11.1 points.

- Employment Change: Wednesday, 9:00. This quarterly figure lags the more up-to-date jobless rate figures, but still provides a borad view on the labor market in the old continent. An increase of 0.4% was seen in Q1 2018 and a slightly slower pace is likely in Q2.

- Industrial Production: Wednesday, 9:00. Industrial output for the whole euro-zone is published after the main countries will have published their own data. Nevertheless, the overall number tends to provide surprises. A drop of 0.7% was seen in June and another slide cannot be ruled out for July.

- German Final CPI: Thursday, 6:00. The preliminary estimate for August stood at a monthly increase of 0.1%. The final measure will likely confirm it. Any change in the German number will impact the all-European final figure due in the following week.

- French Final CPI: Thursday, 6:45. The second-largest economy in Europe saw an increase of 0.5% m/m in August according to the initial read. Also here, it will likely be confirmed.

- Euro-zone rate decision: Thursday, the decision at 11:45, press conference by President Mario Draghi at 12:30. The European Central Bank reduces its bond-buying scheme at the end of the month to €15 billion from €30 billion so far. It intends to end purchases at the end of the year. Draghi and co. are unlikely to make any announcements. However, the recent drop in inflation and trade concerns may push them to paint a more dovish picture. In addition to the tone of the presser, the ECB releases new staff forecasts in this meeting. Any upgrade or downgrade of inflation and growth forecasts may be indicative of the next moves by the central bank. No big changes are on the cards. If Draghi says that downside risks have increased, it could be more meaningful.

- Trade Balance: Friday, 9:00. The euro-zone enjoys a wide trade surplus, mostly driven by Germany’s exports. However, this surplus narrowed in recent months, standing at 16.7 billion euros in June. A small rise may be seen now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar hit the 1.1530 low (mentioned last week), setting a double bottom. From there, it recovered quite nicely.

Technical lines from top to bottom:

1.1850 was the peak on June 14th, before Draghi sent the euro down. 1.1795 was a swing high back in July.

1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1650 was a swing low in late August and is very closely followed by 1.1630 which held the price down in mid-August.

1.1580 worked as support in late August. 1.1530 supported the pair twice in August, making it an important line. 1.1435 held the EUR/USD down when it was trading around the yearly lows.

1.1300 is a round number that held the pair in mid-August and also held the pair down in June 2017.

I remain bearish on EUR/USD

Monetary policy divergence will likely keep the pressure on the pair. The Fed is set to raise rates and the ECB will have the opportunity to remind us of its dovishness, weighing on the euro. Trump’s trade wars are supporting the USD.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!