EUR/USD had a choppy week amid market mood swings. What’s next? Apart from Trump’s tariffs and Brexit, the PMI data stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The European Central Bank left its policy unchanged and President Mario Draghi surprised with an upbeat tone. The ECB did not downgrade inflation forecasts. Together with a long-awaited rate hike from Turkey, the euro advanced. Mostly optimistic headlines about Brexit carried the euro higher alongside the pound. A deal seems more realistic now, as Chief EU Negotiator Michel Barnier says. The German ZEW figure came out better than expected. US inflation missed expectations but retail sales were OK and consumer sentiment surprised to the upside.

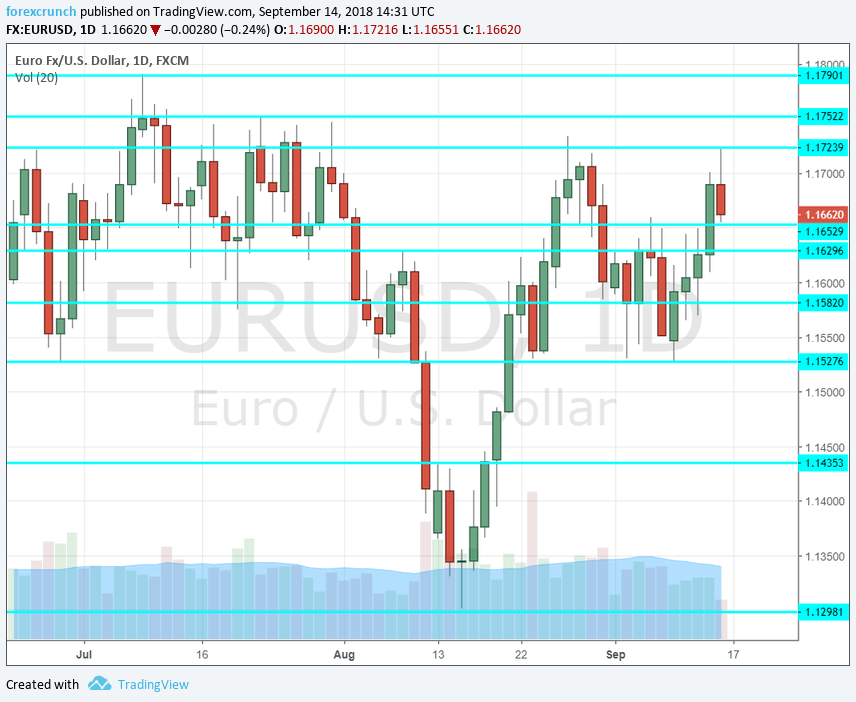

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Final CPI: Monday, 9:00. The preliminary estimate for inflation for August came out at 2% on the headline and 1% on the core, missing expectations by 0.1% on both measures. The final read is expected to confirm the preliminary figures, but surprises are possible.

- German PPI: Wednesday, 6:00. The Producer Price Index disappointed in July by rising by only 0.2% m/m, below expectations and indicating slower inflation down the road. August’s numbers will likely be similar.

- Current Account: Wednesday, 8:00. The euro-zone has a broad current account surplus, standing at 23.5 billion in June. German exports push the trade balance and also this gauge to its highs. We will now get information for July which is expected to show a surplus of 22.4 billion euros.

- Consumer Confidence: Thursday, 14:00. The official Eurostat consumer sentiment gauge had already exited negative territory but retreated and dropped again to -2 last time. The negative figure represents a bit of pessimism among Euro-zone consumers. This is a broad survey of 2,300 consumers and it is forecast to remain unchanged now.

- Flash PMI’s: Friday morning: 7:00 for France, 7:30 for Germany, and 8:00 for the euro-zone. France saw moderate growth in August with a score of 53.5 in the manufacturing sector according to Markit. We will now get the preliminary score for September which carries expectations for 53.5. France’s services sector did better with 55.4 points in August. A repeat of the same number is expected. Germany, the continent’s largest economy, had a score of 55.9 in the manufacturing sector, above the average and 55.8 is protected now. Services stood at 55 points and a minor increase to 55.1 is predicted. The euro-zone saw 54.4 and 54.5 in manufacturing and services respectively. Both are expected to be repeated.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar moved up and then down, retreating from the 1.1650 level mentioned last week before surging to higher ground.

Technical lines from top to bottom:

1.1850 was the peak on June 14th, before Draghi sent the euro down. 1.1795 was a swing high back in July.

1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions and it capped the pair in mid-September. 1.1650 was a swing low in late August and is very closely followed by 1.1630 which held the price down in mid-August.

1.1580 worked as support in late August. 1.1530 supported the pair twice in August, making it an important line. 1.1435 held the EUR/USD down when it was trading around the yearly lows.

1.1300 is a round number that held the pair in mid-August and also held the pair down in June 2017.

I remain bearish on EUR/USD

While the ECB was relatively relaxed, the Fed is on course to raise rates and to enter tight monetary policy. Monetary policy divergence and a potential comeback of trade wars could push the pair down.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!