In the US, the highlight was the Federal Reserve policy meeting. As expected, the Fed kept interest rates close to zero. Of more interest to investors was the Fed message that it will not raise rates before 2023, under its new inflation target, which allows inflation to overshoot 2% without triggering a rate hike.

US retail sales slowed significantly in August. The headline reading dropped to 0.6%, down from 1.2%. Core retails sales came in at 0.7%, down sharply from 1.9%. This points to weakness in consumer spending, which is a key driver of economic growth.

- Consumer Confidence: Tuesday, 14:00. The Eurozone consumer remains pessimistic about economic conditions, as consumer confidence has hovered at -15 points for three straight months. Will we see an improvement in the upcoming release?

- German GfK Consumer Climate: Wednesday, 6:00. German consumer confidence dipped to -1.8 in August, down from -0.3 points. The indicator has failed to post a gain since March. The estimate for September stands at -1.0 points.

- PMIs: Wednesday, 7:15 in France, 7:30 in Germany, and 8:00 for the whole eurozone. In August, German and eurozone manufacturing PMIs pointed to very slight expansion, with readings of 52.2 and 51.7, respectively. The French index came in at 49.8, just below the 50-level, which separates contraction from expansion. The Services PMIs for all three countries were in the low 50’s pointing to slight expansion. Little change is expected in the September releases.

- German Ifo Business Climate: Thursday, 8:00. Business confidence has been moving higher and climbed from 90.5 to 92.6 in August. The upswing is expected to continue in September, with a forecast of 93.9 points.

- Monetary Data: Thursday, 8:00. M3 Money Supply accelerated for a seventh successive month, climbing to an annual growth rate of 10.2.% in July, up from 9.2%. Private Loans remained pegged at 3.0% in July y/y. Money Supply is projected to rise to 10.0% while we await the forecast for Private Loans.

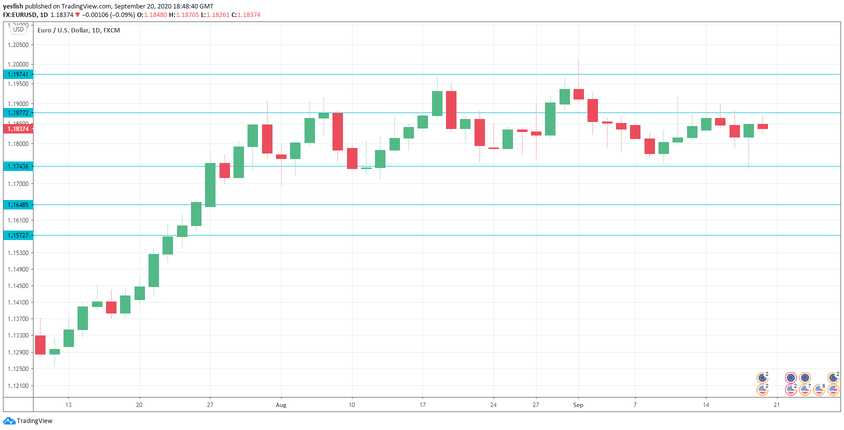

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2174.

This is followed by 1.2107.

1.1974 is protecting the symbolic 1.20 level.

1.1877 is a weak resistance line.

1.1744 is the first support level.

1.1648 has held in support since late July.

1.1573 (mentioned last week) is the final support line for now.

.

I remain neutral on EUR/USD

Investors have not shown any preference for either currency, leaving EUR/USD directionless over the past two weeks. This lack of activity could continue next week as well.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!