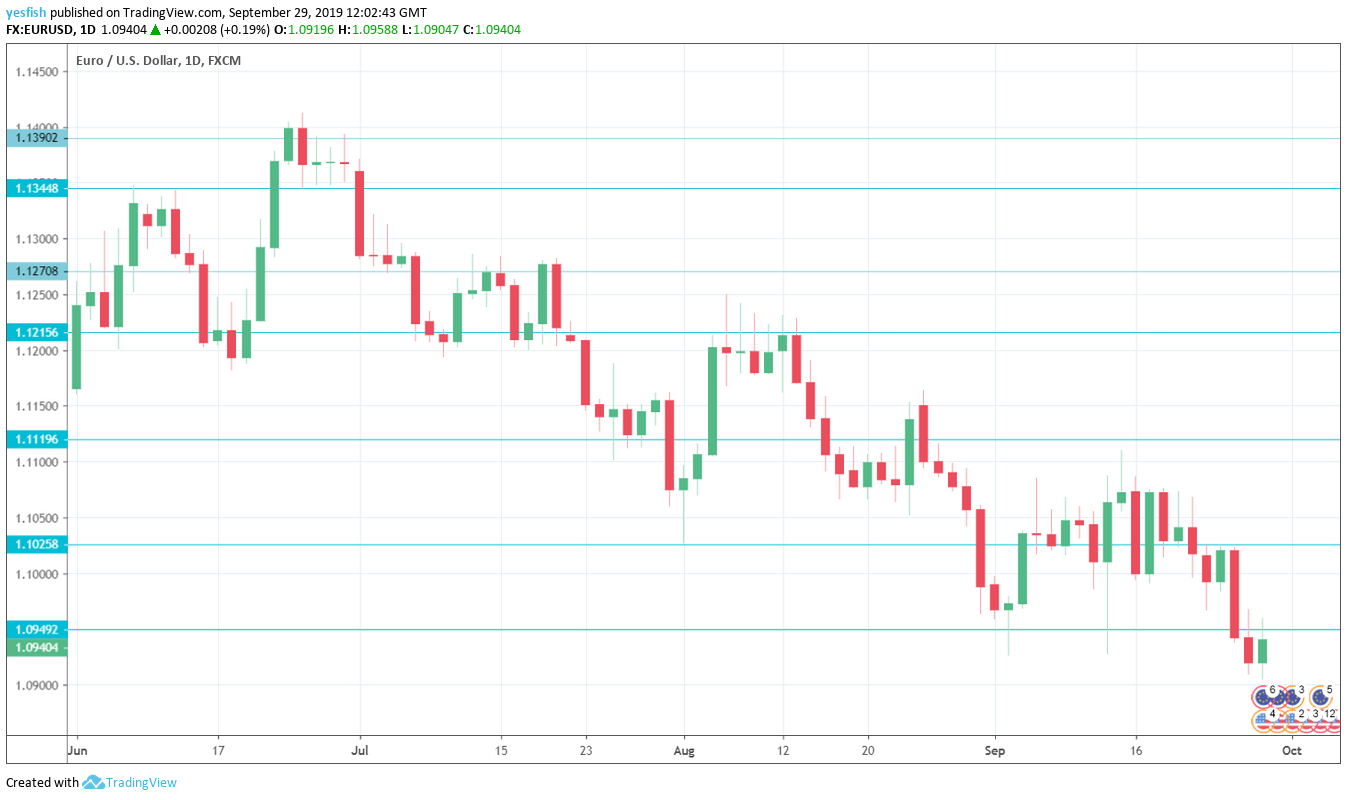

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Germany Preliminary CPI: Monday, All Day. As the largest economy in the eurozone, German inflation data is closely watched. The August release showed a decline of 0.1%, marking the first decline in seven months. Will we see an improvement in September?

- Manufacturing PMIs: Monday: 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. Markit’s forward-looking purchasing managers’ index for Spain’s manufacturing sector has been in contraction mode for the past four months, and the trend is expected to continue in September, with an estimate of 48.2. Italy, the third-largest economy, has been in contraction since September 2018, and the September estimate stands at 48.7. The estimate for the French indicator is 50.3, which indicates stagnation. Germany’s manufacturing sector continues to struggle, and the PMI is expected to drop to 41.4 in September, down sharply from the August reading of 43.5.

- Eurozone Inflation Data: Tuesday, 9:00. Little change is expected in the initial estimate for October inflation. Core CPI is expected to tick higher to 1.0%, up from 0.9%. The headline reading is forecast to remain steady at 1.0%.

- Services PMIs: Thursday, 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. The services sector has been stronger than manufacturing, with all major eurozone economies expected to post readings above 50, which separates contraction from expansion. Spanish PMI is expected to slow to 53.9 and the Italian release is forecast to tick lower, to 50.4. The French PMI is projected to drop to 51.6, down sharply from 54.4. The German and eurozone releases also expected to weaken in September, with scores of 52.5 and 52.0, respectively.

- Eurozone Retail Sales: Thursday, 9:00.The nervous eurozone consumer is holding tightly to her purse strings, as retail sales have contracted in three of the past four releases. The July reading came in at -0.6%, but investors are hoping for a rebound in August, with an estimate of 0.3%.

EUR/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.1390. This is followed by 1.1345.

1.1290 has held in resistance since the first week of July.

Close by, 1.1270 was a double-bottom in December 2018.

1.1215 is the next resistance line.

1.1119 (mentioned last week) is next.

1.1025 remained relevant last week and is a weak resistance line.

1.0950 is providing support.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I remain bearish on EUR/USD

The eurozone continues to struggle and the sober economic picture appears to have caught up with the euro, which has lost ground. Weak global conditions and the U.S-China trade war have taken a heavy toll on the manufacturing sector in Germany and the rest of the bloc. If the U.K. leaves Brexit without a deal, the EU economy will also be affected and this could hurt sentiment towards the euro.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!