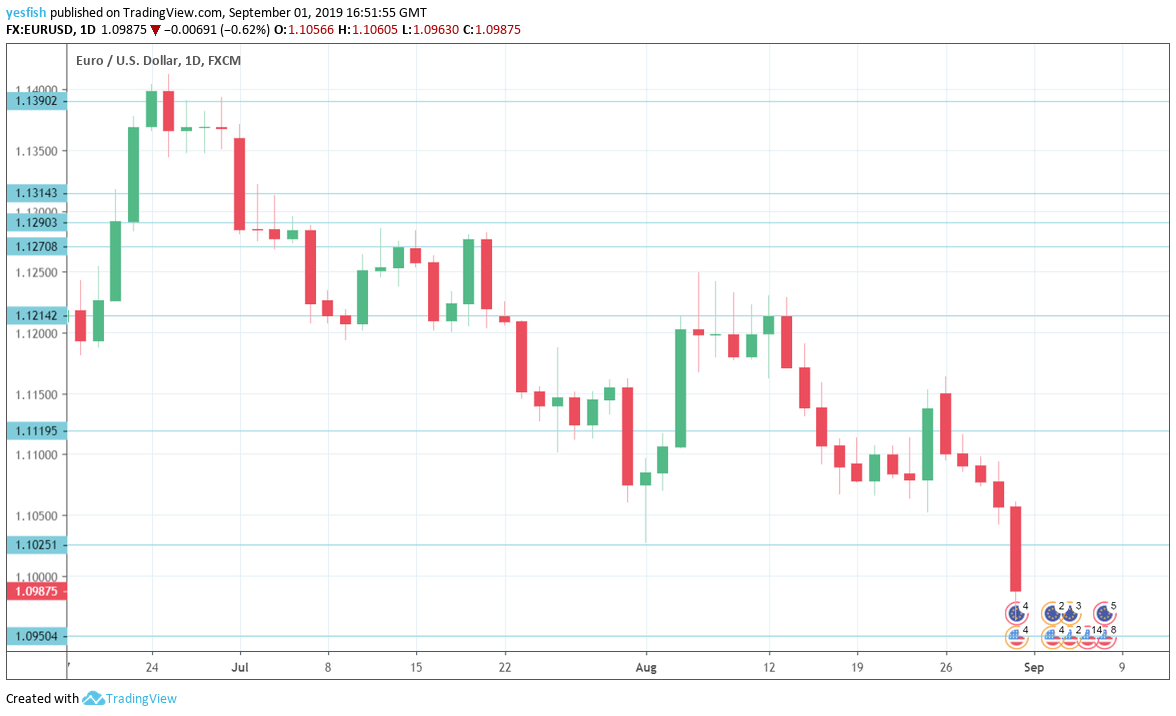

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

In the U.S., it is becoming increasingly clear that second-quarter growth will be significantly weaker than Q1, and there is a strong likelihood that the Fed will introduce further rate cuts in 2019. Second-estimate GDP for Q2, came in at 2.0%, matching the estimate. This was a slight downward revision from initial estimate, which came in at 2.1%. Durable goods orders improved to 2.1%, up from 2.0% a month earlier. However, core durable goods orders declined by 0.4%, the first decline in six months. The week wrapped up with UoM consumer confidence, which dropped sharply to 89.8 in July, down from 98.4 in June. This marked the first time that the key confidence indicator has dropped below the 90-level since October 2014.

The U.S-China trade war has escalated, as new tariffs on both sides took effect on September 1. The U.S. imposed new 15% tariffs on $125 billion worth of Chinese goods, while China has retaliated with new tariffs of 5% and 10% on an unspecified value of U.S. goods, including oil imports.

- Manufacturing PMI’s: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Markit’s forward-looking purchasing managers’ index for Spain’s manufacturing sector has been in contraction mode for the past two releases, and the trend is expected to continue in August, with an estimate of 48.6. Italy, the third-largest economy, has been in contraction since September 2018, and the August estimate stands at 48.6. The estimate for the French indicator is 51.0, which indicates stagnation. Germany’s manufacturing sector continues to struggle, and the estimate for August is 43.6.

- Spanish Unemployment Change: Tuesday, 8:00. The fourth-largest economy in the eurozone has shown dramatic improvement in unemployment, aided by the tourist season. Spain has registered five straight declines in jobless numbers, but a gain of August of 35.8 thousand is expected in August.

- PPI: Tuesday, 10:00. Inflation levels remain low in the eurozone and the Producer Price Index has posted four successive declines. Investors are expecting better news in July, with an estimate of 0.3%.

- Services PMI’s: Wednesday, 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Services sector numbers continue to show stronger numbers than those in the manufacturing one. In the initial PMI readings, Spain had a score of 53.0, France stood at 53.3, while Italy came in at 51.1. The German release came in at 54.4 and for the euro-zone also showed slight expansion, with a reading of 53.4. No changes are expected in the final versions.

- Retail Sales: Wednesday, 10:00. Eurozone retail sales sparkled in June, posting a gain of 1.1%. This easily beat the forecast of 0,3%. The markets are braced for a sharp downturn in July, with an estimate of -0.6%.

- German Factory Orders: Thursday, 7:00. The euro zone’s locomotive saw an increase of 2.5% in factory orders back in June. This marked the strongest gain since May 2018. However, the projection for the July release is a decline of 1,5%.

- German Industrial Production: Friday, 7:00. Industrial output declined by 1.5% in June, the second sharp decline in three months. The estimate for July stands at 0.4%.

- French Trade Balance: Friday, 6:45. France suffers from a chronic trade deficit. This deficit stood at 5.919 billion euros in June. The deficit is expected to narrow in July, with a deficit expected of 4.40 billion euros.

- GDP: Friday, 10:00. According to the previous releases, the euro-zone grew by a meager 0.2% q/q in Q2. Weak growth in Germany is weighing on the eurozone economy. We will now get an update which will likely confirm the previous release.

EUR/USD Technical analysis

Technical lines from top to bottom:

With EUR/USD posting sharp losses, we start at lower levels:

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1345 is next. 1.1290 has held in resistance since the first week of July.

Close by, 1.1270 was a double-bottom in December 2018.

1.1215 is the next resistance line.

1.1119 (mentioned last week) has switched to a support role.

1.1025 was a cap back in May 2017.

1.0950 is next.

1.0829 has held in support since April 2017. 1.0690 follows.

1.0569 has held since April 2017. It is the final line for now.

I remain bearish on EUR/USD

The U.S-China trade war has taken a heavy toll on eurozone and German exports, and a new round of tariffs between the U.S .and China won’t help matters. The Brexit crisis shows no signs of progress, which means that a no-deal withdrawal is a strong possibility. Such a scenario could dampen investor sentiment towards the euro.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!