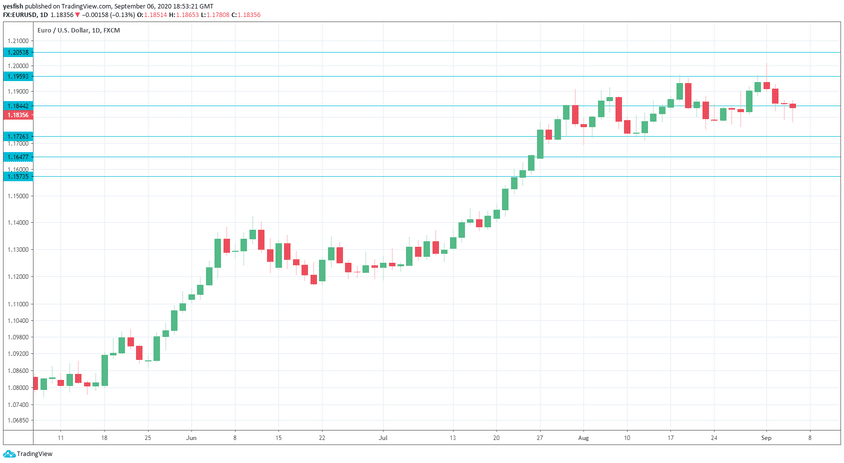

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

In the US, last week’s numbers were solid. Manufacturing PMI improved to 56.0. up from 54.2. The Services PMI also pointed to expansion, but slowed to 56.9, down from 58.1 beforehand. Unemployment claims dropped below the 1-million mark with a reading of 886 thousand. Nonfarm payrolls slowed to 1.371 million, but was very close to the estimate of 1.374 million. The unemployment rate fell sharply to 8.4%, down from 10.2%. This marked the first single-digit reading since April, prior to the Corvid-19 pandemic. There was more good news from wage growth, which rose from 02% to 0.4%.

- German Industrial Production: Monday, 6:00. Industrial output has rebounded nicely since April, when the Covid-19 pandemic sent manufacturing sharply lower. In June, the indicator posted a gain of 8.9% and the July forecast stands at 4.5%.

- Eurozone Sentix Investor Confidence: Monday, 8:30. Investor confidence remains in negative territory, but the trend has been upwards. The indicator improved to -13.4 in August, up from -18.2. The forecast for September is -11.4.

- German Trade Balance: Tuesday, 6:00. Germany’s trade surplus climbed to EUR 14.5 billion in June, up sharply from EUR 7.6 billion. The upswing is expected to continue, with an estimate of EUR 14.9 billion.

- Eurozone GDP: Tuesday, 9:00. GDP for the second quarter is expected at -12.1%, which would confirm the previous two estimates. Unless the actual release is well off the estimate, reaction to this event will be muted.

- French Industrial Production: Thursday, 6:45. Industrial production in the eurozone’s second-largest economy grew by 12.7% in June, above expectations. The estimate for July stands at 5.1%.

- ECB Rate Decision: Thursday, 11:45. ECB policymakers are expected to maintain current monetary policy, as the fragile eurozone economy shows some signs of recovery from the devastating Covid-19 pandemic. The main headaches for the ECB are the strong euro and the threat of deflation, so the rate statement could address these issues.

- German Final CPI: Friday, 6:00. Inflation dropped by 0.1% in August and this initial reading is expected to be confirmed. A reading in negative territory will reiterate that the eurozone could be facing a deflation problem due to weak economic activity.

- All times are GMT

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2174.

This is followed by 1.2053.

1.1958 is protecting the symbolic 1.20 level.

1.1844 is an immediate resistance line.

1.1727 is the first support level.

1.1648 has held in support since late July.

1.1573 (mentioned last week) is the final support line for now.

.

I am bearish on EUR/USD

The US dollar is showing signs of improvement, as the US economy has shown some promising numbers, such as in recent employment releases. With the eurozone continuing to struggle, the euro could be under pressure.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!