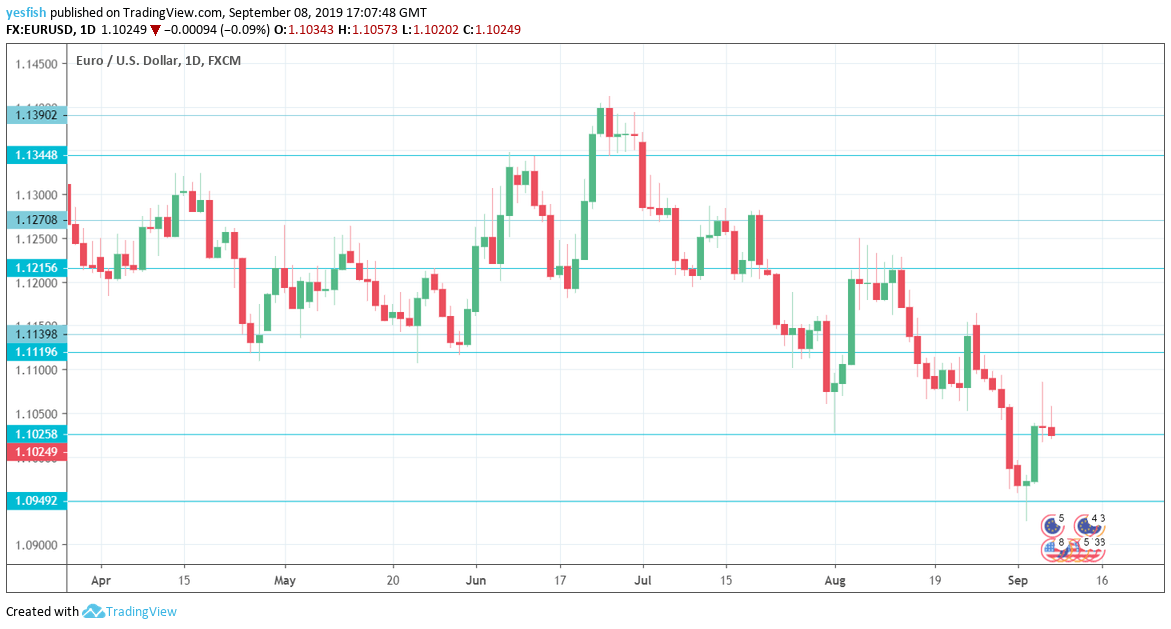

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Trade Balance: Monday, 6:00. Germany continues to post a monthly trade surplus. In June, the surplus slipped to EUR 18.1 billion, down from 18.7 billion a month earlier. The forecast stands at 18.1 billion.

- Sentix Investor Confidence: Monday, 8:30. Investor confidence has been in negative territory for three straight months, as the eurozone economy struggles. The indicator fell sharply in August, falling to -13.7, down from -5.8 points. The estimate in September stands at -13.0.

- French Industrial Production: Tuesday, 6:45. French industrial production slipped by 2.3% in June, much weaker than the estimate of a 2.1% gain. The forecast for July is 0.5%.

- German Final CPI: Thursday, 6:00. German inflation improved to 0.5% in July, but inflation remains well below the ECB inflation of around 2.0%. The markets are braced for a decline of 0.2% in August.

- Eurozone Industrial Production: Thursday, 9:00. The eurozone manufacturing sector continues to struggle, with four declines in the past five months. Another decline is expected in July, with a forecast of 0.1%.

- ECB Rate Decision: Thursday, 11:45. The ECB is expected to hold rates at a flat zero, so investors will be combing through the rate statement. If policymakers sound dovish about economic conditions, the euro could lose ground.

- Trade Balance: Friday, 9:00. The eurozone’s trade surplus narrowed in June to EUR 17.9 billion, down sharply from the May release of 20.2 billion. The downward trend is expected to continue, with an estimate of 17.5 billion.

EUR/USD Technical analysis

Technical lines from top to bottom:

With EUR/USD posting sharp losses, we start at lower levels:

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1345 is next. 1.1290 has held in resistance since the first week of July.

Close by, 1.1270 was a double-bottom in December 2018.

1.1215 is the next resistance line.

1.1119 (mentioned last week) is next.

1.1025 remained relevant last week and is under pressure.

1.0950 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I remain bearish on EUR/USD

The eurozone continues to struggle, as weak global conditions and the U.S-China trade war have taken a heavy toll on the manufacturing sector. Meanwhile, the Brexit crisis is only getting deeper, as a withdrawal deal with London remains elusive.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!