Intensive coalition talks failed over the weekend. The business-friendly FDP did not want to talk business anymore and abandoned the negotiation table. A report that they may support a minority government from the outside sent the euro higher, but they did not prove to be correct.

The German president, Frank-Walter Steinmeier, urged Chancellor Angela Merkel and the other parties to make further efforts to form a coalition. A minority government is unprecedented in modern German history and neither is a fresh round of elections.

However, Merkel will likely go to the polls once again. She dislikes the option of a minority government. New elections may be held around March or April according to German political analysts.

While the current government will stay in office in the next few months, the uncertainty leaves quite a few issues in the air. The next step of Brexit talks and the EU reforms pushed by French President Emmanuel Macron could be delayed.

And while the euro-zone economies and specifically Germany are growing at a rapid clip, things could change due to uncertainty.

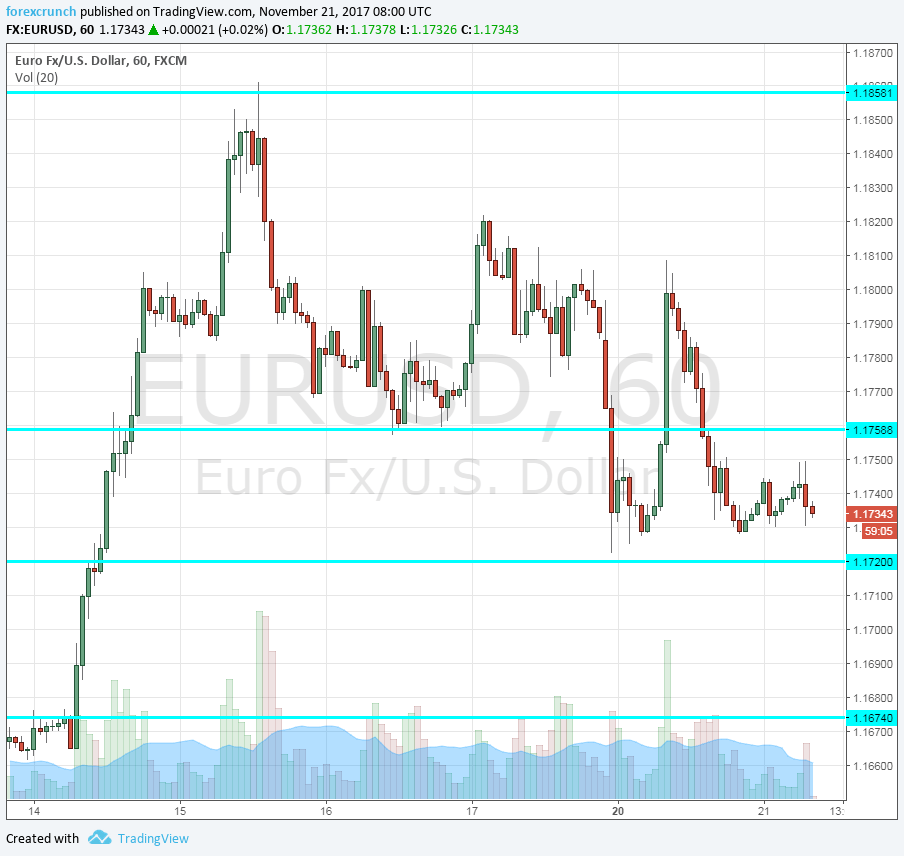

EUR/USD is under pressure, trading around 1.1735 after reaching 1.1730. Yesterday’s low was 1.1722, which could work as another cushion. Further support awaits around 1.1670 and 1.1620.