- The EUR/USD pair could come back down if it stabilizes under the weekly pivot point.

- A new lower low could activate a larger drop.

- The bearish scenario could be invalidated by a valid breakout above 1.0593.

The EUR/USD price plunged after the US inflation data was released. It has dropped as low as 1.0501, where it found strong demand. Now, the pair is trading at 1.0560 at the time of writing. The pair rebounded as the Dollar Index dropped in the last hour.

–Are you interested in learning more about STP brokers? Check our detailed guide-

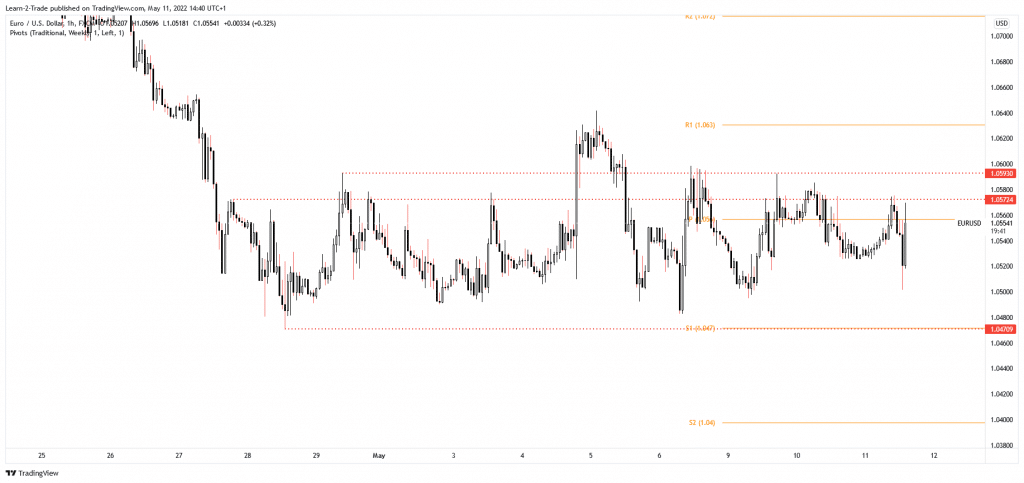

Technically, the price continues to move sideways between 1.0470 and 1.0593. Escaping from this range could bring new opportunities. However, the volatility is high in the short term, and the EUR/USD pair registered sharp movements in both directions.

Fundamentally, the US Consumer Price Index registered a 0.3% growth in April versus 0.2% expected and compared to 1.2% growth in March, while the Core CPI surged by 0.6% in the last month versus 0.4% estimates and after registering a 0.3% growth in March.

The inflationary pressure remains high. The FED could be forced to take strong action in the next monetary policy meeting. The US will release the PPI, Core PPI, and Unemployment Claims tomorrow. The economic figures could bring strong moves in the short term.

EUR/USD price technical analysis: Range remains intact

As you can see on the 4-hour chart, the EUR/USD pair failed to resume its sell-off, and now it challenges the weekly pivot point of 1.0550 while the 1.0572 stands as a static resistance.

–Are you interested in learning more about making money with forex? Check our detailed guide-

As long as it stays under this level, the price could still come back down and resume its sell-off as the bias remains bearish. Conversely, stabilizing below the pivot point may signal a new sell-off. This scenario could take shape if the Dollar Index resumes its growth.

The EUR/USD pair could invalidate more declines only after making a valid breakout above the 1.0572 and the 1.0593 upside obstacles.

It could extend its sideways movement in the short term, so we’ll have to wait for fresh trading opportunities. A new lower low could activate a larger downside movement if the rate drops and closes below 1.0501.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money