How to Make Money with Forex – Is Forex Trading Profitable?

The forex trading industry – which now sees trillions of dollars worth of currencies change hands each and every day – has never been more accessible for the Average Joe. All that is required is an account with an online forex broker – of which there are hundreds.

In this guide, we explore how to make money with forex and whether or not this online trading scene is profitable.

How to Make Money with Forex Quick Steps

If you’re strapped for time and want a quickfire guide on how to make money with forex – check out the walkthrough below.

- Step 1: Choose a forex trading strategy: First, you need to choose a trading strategy that aligns with your financial goals. If you’re a complete beginner, it might be worth sticking with a swing trading strategy that focuses on major forex pairs.

- Step 2: Open a forex trading account: Next, you’ll need to open a trading account with a top-rated forex broker. eToro is a good option here. Not only is the platform perfect for beginners, but it offers dozens of pairs at super-low trading fees.

- Step 3: Deposit Funds: In order to make money in forex, you need to deposit funds into your trading account. eToro accepts various payment methods – including debit/credit cards, e-wallets, and a bank transfer.

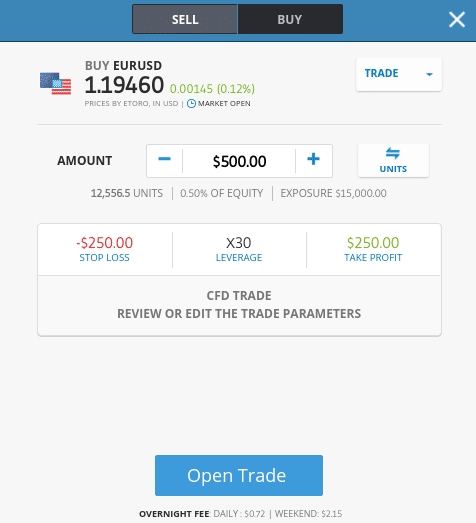

- Step 4: Trade forex: Now that you have funds in your brokerage account, you can place your first forex trade. Search for the currency pair you want to trade and choose from a buy or sell order – depending on whether you think the exchange rate will rise or fall.

When placing a forex order, it’s important to think about risk management too. We talk about how stop-loss and take-profit orders can mitigate the risks of trading forex later in this guide.

Is Forex Profitable? Understanding the Basics of Forex

In order to make money with forex, you need to first have a firm understanding of how this trading sector works. With this in mind, the sections below will explain the basics of forex.

Forex is Trading in Pairs

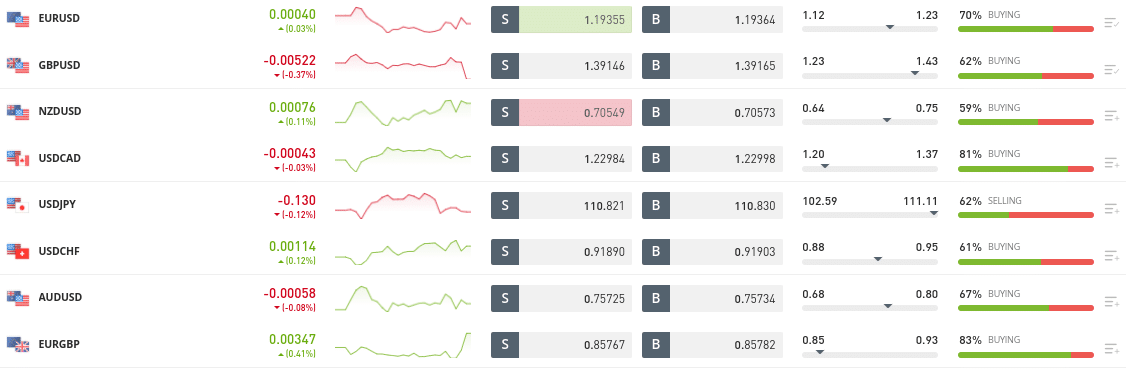

First and foremost, when you trade forex you are speculating on the future value of currency pairs. For example, let’s suppose you were trading EUR/USD – which is the most traded pair in the forex market. This would mean that you are trading the exchange rate between the euro against the US dollar.

- If the exchange rate was 1.1909 – a buy order would indicate that you think this will rise in the near future.

- A sell order would indicate that you think the pair will decline in value.

Maybe you’re wondering how to profit from forex. If you speculate correctly you will close the forex trade with a profit. Sticking with the same example of EUR/USD, the euro is the base currency as it is situated on the left-hand side. The US dollar is therefore the quote currency. This means that for every 1 euro, the market is prepared to pay 1.1909 US dollars.

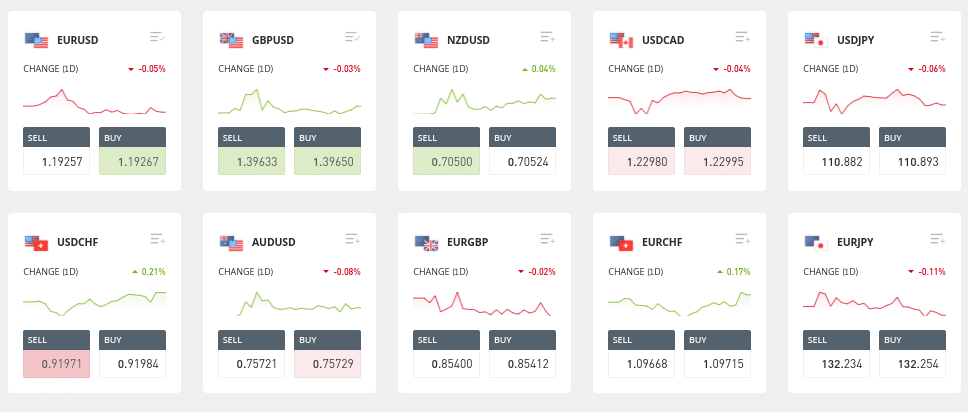

There are dozens of pairs available to trade online, albeit, the ones you have access to will depend on your chosen forex broker. With that said, pairs are typically split into three categories – majors, minors, and exotics.

- Majors: This pair type will always contain the US dollar and another strong currency. This might include the likes of the British pound (GBP/USD), Canadian dollar (USD/CAD), or the Japanese yen (USD/JPY). Crucially, major pairs benefit from most trading action – so they offer large levels of liquidity and tight spreads. This is why majors are best suited for beginners.

- Minors: Otherwise called cross pairs, minors consist of two strong currencies but never the US dollar. Minor pairs still benefit from large levels of liquidity but not to the same extent as majors. Some of the most traded minor pairs include EUR/GBP, EUR/CHF, and GBP/JPY.

- Exotics: This pair type includes one strong currency like the US dollar or euro. It will also contain a less liquid currency – often from an emerging market. The latter might include the Turkish lira, Mexican peso, or the Russian ruble. If you are a beginner, it’s best to avoid exotic pairs are they can be extremely volatile and spreads are much wider than majors or minors.

We have mentioned spreads a few times throughout this guide on how to make money in forex trading. For those unaware of this term, the spread is simply the difference between the bid (buy) and ask (sell) price of the pair you are trading. This gap in pricing is how forex trading platforms make money.

Buy and Sell Orders

Now that you understand that forex is traded in pairs, the next task is to learn about buy and sell orders. As we briefly mentioned earlier, this tells your chosen forex broker whether you think the exchange rate of the pair will rise or fall.

To recap:

- A buy order needs to be placed if you think the exchange rate will rise

- A sell order needs to be placed if you think the exchange rate will fall

In order to close your forex trade, you need to place an opposing order. For example. if you opened the trade with a sell order, you will close it with a buy order.

Stakes and Leverage

When large banks and financial institutions trade forex – they typically do so in currency lots. In most cases, a currency lot equates to 100,000 units. For example, 1 lot of EUR/USD would amount to $100,000, while GBP/USD would equal £100,000.

As you can see, the lot is denominated by quote currency – which is on the right-hand side of the pair. Fortunately – and in line with the growth of retail forex traders, there is no longer a requirement to trading currencies in lots.

On the contrary, the best forex brokers allow you to trade mini, micro, or nana lots. For all intents and purposes, this simply means that you can perform foreign currency trading with low stakes – which makes the industry ideal for those on a budget.

If you’re wondering how to make money trading forex – check out the simplistic example below:

- Let’s suppose you are trading USD/CAD – which is currently priced at 1.2298

- You think the exchange rate of the pair will rise, so you place a buy order

- You decide to stake $100 on this trade

- A few hours have passed and USD/CAD is trading at 2% higher – so you decide to close the position to lock in your gains

- On a stake of $100 – your 2% profit amounts to $2

As the exchange rate of a currency pair moves up and down by such a small amount – at least in the case of majors and minors. this can make it difficult to make a lot of money in this trading scene. As the example highlights, even making 2% on a trade will only return you $2 on a stake of $100.

If you only have access to a limited amount of trading capital, the good news is that forex brokers typically offer something called leverage. In its most basic form, this allows you to trade currencies with more money than you have in your brokerage account.

The amount of leverage you have access to will depend on several key factors, such as:

- The pair you are trading – Major forex pairs attract higher levels of leverage than minors or exotics.

- Retail client or professional – Professional traders will be offered much higher leverage than retail clients.

- Your country of residence – Many nations restrict the amount of leverage that their citizens can obtain when trading forex. For example, in the UK, Australia, and Europe, leverage is capped to 1:30 on majors and 1:20 on other pair types. In the US, leverage is capped to 1:50 on majors.

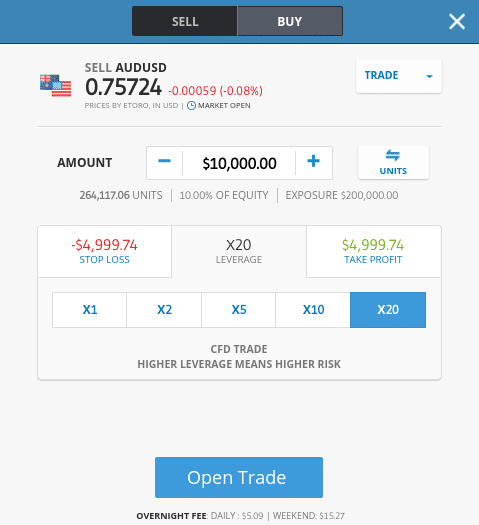

In terms of how high leverage brokers work, you simply need to choose your ratio when you set up your forex trade. For example, if you want to multiple your trade by a factor of 10, select 1:10 (or x10) as your ratio.

If you’re completely new to the world of leverage, check out the example below.

- You are staking $100 on a CAD/USD buy order – meaning you think the exchange rate will rise

- You decide to apply leverage of 1:30 to this position

- You made gains of 2% on this trade – so without leverage, you make a profit of just $2

- However, you applied leverage of 1:30 – so your profit is boosted to $60

As you can see from the above example, if you’re wondering how to make money with forex trading – the likelihood is that you will need to use leverage.

However, leverage can and will boost your losses too. In fact, if you speculate incorrectly by a certain amount, your chosen forex broker will liquidate your position by closing the leveraged trade on your behalf.

For example, if you trade with leverage of 1:30, your position will be liquidated if it goes down by more than 3.33% (1 divided by 30).

Risk Management

Another important aspect to have a firm grasp of when learning how to make money on forex is risk management. This will ensure that you trade forex in a risk-averse manner and thus – restrict the amount of money you lose when a position doesn’t go to plan.

The way to approach this is to create a bankroll management plan. This will limit the amount of capital you risk on each trade and is best viewed as a percentage of your forex account balance. For example, capping your stakes to 1% would mean that a $1,000 balance would permit a maximum trade value of $10.

Additionally, you should also set up stop-loss and take-profit orders on all of the forex trades that you place. A stop-loss order allows you to specify an exit point – should the trade go against you. For example, you might decide to set your stop-loss order at 2%.

This means that you will have the trade closed automatically should the value of your trade go down by 2%. Next, a take-profit order will ensure that your profits are automatically locked in. For example, if you set this at 6%, the broker will close your position if it increases in value by 6%.

How to Make Money With Forex – 5 Top Strategies

Now that we have explained the basics, this section of our guide on how to make money on forex trading will talk about strategies. In a nutshell, those making consistent gains in the forex trading scene do so because they have a strategy and system that works for them.

What works for one trader might not necessarily be the right approach for you, so it’s important to spend some time thinking about your skillset, financial goals, and tolerance for risk.

To help you along the way, below we discuss five strategies that can help you to making money with forex.

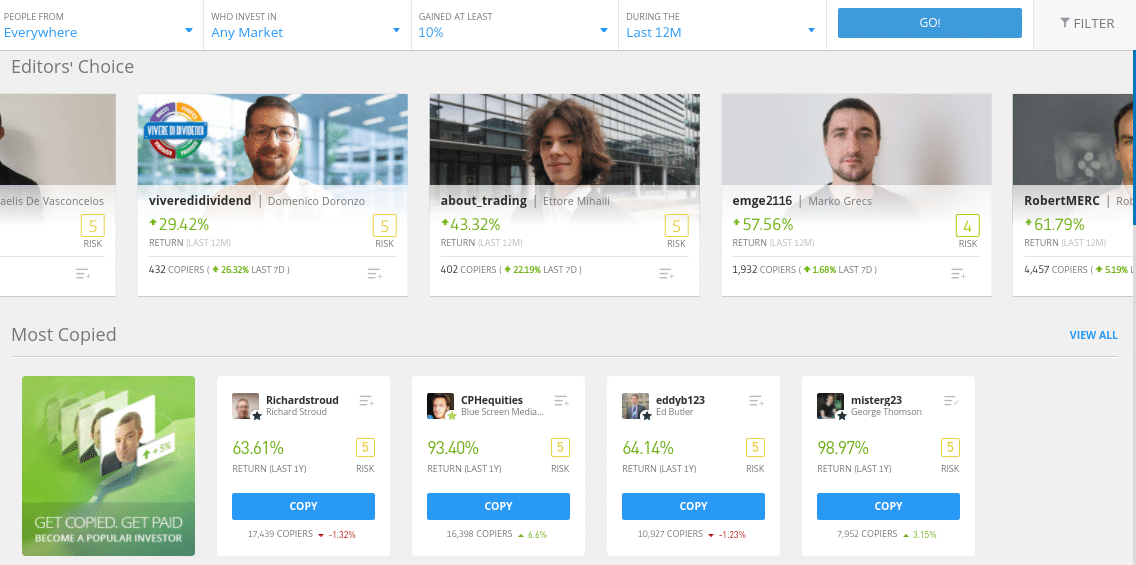

eToro Copy Trading

Make no mistake about – if you are a complete novice in the world of forex trading, it might be a good idea to start with a Copy Trading tool – such as the one offered by eToro.

This is because you will not be required to have any knowledge of what makes the forex market tick – nor do you need to learn the ins and outs of technical and fundamental analysis. On the contrary, all you need to do is select a successful trader with a verifiable track record.

Past performance is not an indication of future results

Then, any buy or sell orders that the trader places will be mirrored in your own eToro portfolio on a proportionate basis.

For example:

- Let’s say that you select an experienced forex swing trader and decide to invest $1,000

- A few hours later, the trade risks 2% of their capital on a EUR/TRY sell order

- The trader applies leverage of 1:10 on this trade

- You also risk 2% on this trade – which is $20

- The trader closes their position on EUR/TRY a few days later – making a profit of 6%

- On your stake of $20 – you made a profit of $1.20 – which is boosted to $12 when you factor in the leverage of 1:10 that was applied to the trade

As you can see from the example above, the eToro Copy Trading tool allows you to actively trade forex without needing to do anything. On the contrary, you will be trading in a passive manner.

Not only is eToro the go-to platform for Copy Trading because it is home to thousands of verified investors, but it doesn’t charge any additional fees for this service.

67% of retail investors lose money trading CFDs at this site

Forex Signals

In a similar nature to Copy Trading, signals are a great way to making money with forex trading as a beginner. Once again, this is because you will not be required to scan the currency markets looking for trends and trading opportunities.

Instead, your chosen signal provider will send you trading suggestions based on its own in-depth research. For example, Learn2Trade – which is a popular forex signals provider that has more than 20,000 members in its Telegram group, will send you something like the below:

- GBP/CAD

- Buy Order

- Limit Order @ 1.7185

- Take-Profit Order @ 1.7295

- Stop-Loss Order @ 1.7101

As you can see from the above, the best forex signals Telegram groups will give you all of the information you need to go and place the respective orders in a risk-averse way.

For example, not only are you told to go long on GBP/CAD with an entry price of 1.7185, but you are also provided with a suggested stop-loss and take-profit order. As such, all you need to do is log into your forex brokerage account and place the orders that have been sent to you.

If you do opt for a provider like Learn 2 Trade, you will receive three forex signals every day – Monday to Friday.

There is no guarantee that you will make money using signals with this provider.

Forex EAs

Another way to make money with forex trading without needing to do any research yourself is to utilize the service of an expert advisor (EA). Otherwise referred to as a forex robot, EAs are software files that have pre-set trading conditions built into them.

As the underlying code is based on artificial intelligence, the forex EA will scan the forex markets 24 hours per day – constantly looking for trading opportunities. When it finds one, it will place a series of orders on your behalf.

The vast majority of forex EAs are built for MT4, but MT5 is ofter supported too. Either way, you will need to purchase your chosen forex EA and then install it into either MT4 or MT5. Once activated, the robot will begin trading for you around the clock.

Fundamental Research

If you do not want to rely on a third-party trader or robot, you will need to learn the ropes of technical analysis. This means being able to read and interpret charts and pricing trends. The way around this is to instead focus on fundamental research – which is much easier to grasp as a beginner.

In its most basic form, fundamental research will see you trade on the back of a relevant new story. After all, the strength or weakness of a currency is directly tied to how the economy is performing and what actions the central bank decides to take – especially in the case of interest rates.

- For example, if the Bank of England decides to increase interest rates, then the value of the pound sterling is all but certain to rise.

- If the Federal Reserve decides to cut interest rates, then the likelihood is that the US dollar will decline in value.

Similarly, if there are tensions in a particular country then the value of the nation’s currency will likely drop. Or, if a country releases better-than-expected GDP results, then the currency will likely appreciate.

Irrespective of the economic event or financial news story – knowing which orders to place at your forex brokerage site is relatively easy. For example, if you believe that the pound sterling will rise, you could place a buy order on GBP/USD.

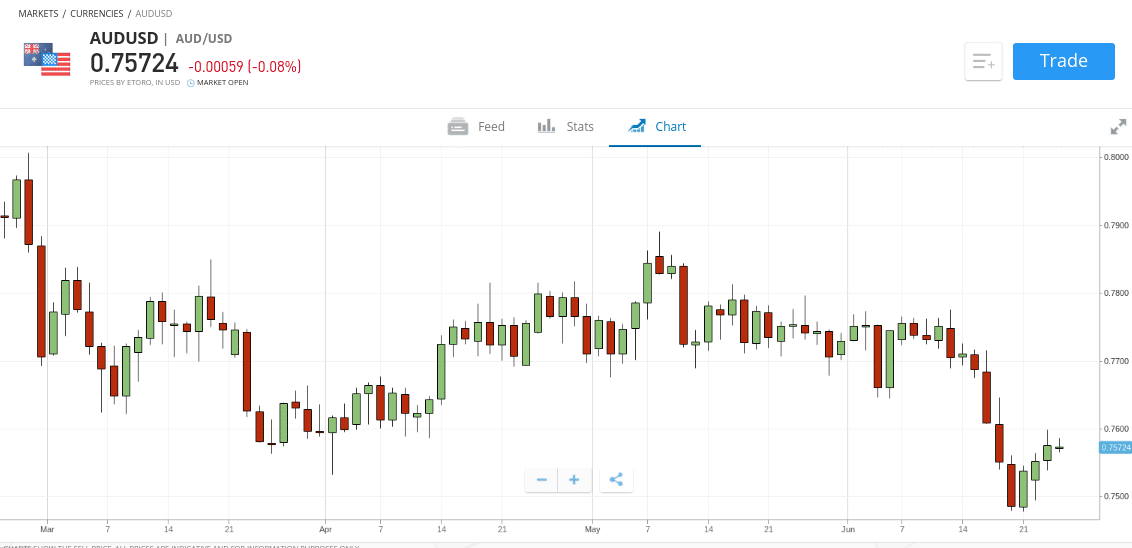

Swing Trading

There are many ways to approach the fx trading space – with several strategies focused on specific durations. For example, scalping involves opening and closing multiple positions throughout the day with the view of making small but frequent gains.

You then have day trading, which will see your positions open for several minutes or hours, but never more than a single day. With that said, the best way to make forex trading profit is to adopt a swing trading strategy. This gives you much more time to make trading decisions – as positions can remain open for weeks at a time.

In particular, swing traders will place more of a focus on fundamental research in comparison to day traders or scalpers. As a result, this makes it ideal for newbies – as you can trade purely on the fundamentals as opposed to performing more complex technical analysis,.

What Forex Pairs are Most Profitable?

With dozens of currency pairs available to trade, you might be wondering which one is likely to be the most profitable. The short answer is that no specific pair will give you more of a chance of making money. On the contrary, you can make money on any pair of your choosing – as long as you speculate correctly.

With that said, we would suggest initially focusing on major pairs if you are just starting out in the world of forex trading. This is because major pairs allow you to make money using forex but in a more risk-averse manner.

For example, stable currencies like the Canadian dollar or Japanese yen will rarely move by more than a few percentage points each week. At the other end of the scale, exotic currencies like the Turkish Lira and Mexican peso are a lot more volatile and thus – not suited for inexperienced traders.

Another good idea is to focus on one or two forex pairs, as opposed to trying to trade lots of different markets. This will allow you to become an expert in your chosen currencies and subsequently – will give you a much better chance of correctly predicting whether the exchange rate is likely to rise or fall in the near future.

Choosing the Right Forex Broker

When learning how to make money on foreign exchange, it’s absolutely crucial that you choose the right broker. This is because the broker is responsible for connecting you to the forex markets and thus – will execute your trading positions on your behalf.

When choosing the right broker for you, important metrics to look for are as follows:

- Regulation: The best forex brokers are heavily regulated – so make sure you choose a platform that holds at least one license with a reputable financial body.

- Fees: Check how much you will need to pay in commission to trade forex at the broker. Many platforms in this industry allow you to trade commission-free, meaning you only need to cover the spread.

- Markets: The number of pairs offered by online forex brokers can and will vary by some distance, so check what markets are supported before opening an account.

- User Experience: If you are a forex trading newbie, you’ll want to choose a broker that is easy to use.

Taking the above factors into account, below you will find a selection of top-rated forex brokers – all of which are ideal for beginners.

1. eToro – Overall Best Forex Broker 2021

With more than 20 million people using the platform to trade – eToro is now one of the largest and most popular brokers in the online space. In particular, the broker offers around 50 forex markets – covering a wide selection of major, minor, and exotic pairs.

When it comes to fees, you can trade forex on a spread-only basis. This means that there isn’t a commission per-say, as the only fee applicable is the difference between the buy and sell price of your chosen forex market. On top of forex, the eToro platform is also home to a number of alternative asset classes.

This included thousands of shares from 17 international stock exchanges, as well as commodities, indices, cryptocurrencies, and ETFs. If you are interested in the previously discussed Copy Trading tool – which allows you to access the forex arena passively, eToro is the best broker for the job. The platform is home to thousands of verified forex investors and you can use the Copy Trading tool fee-free.

There are also a number of CopyPortfolios that are professionally managed by eToro, albeit, these are more suited to long-term investments. Nevertheless, eToro requires a minimum deposit of just $200 to get started. Your capital is safe at all times, not least because eToro is regulated by the FCA, ASIC, and CySEC. Supported payment methods include debit/credit cards, Paypal, Neteller, and a bank wire.

- Heavily regulated trading platform used by over 20 million people

- 0% commission on stocks and ETFs

- Spread-only pricing structure on crypto, indices, forex, and commodities

- Very easy to use – ideal for beginners

- The minimum stake starts at $25 per trade

- Supports debit/credit cards, bank transfers, and e-wallets

- Copy Trading features promote passive investing

Cons

- Charting analysis tools are a bit basic

67% of retail investors lose money trading CFDs at this site

2. AvaTrade – Best Forex Broker for Swing Trading

Regarding the latter, this includes everything from market insights and financial analysis to an economic calendar and intelligence reports. In the technical department, AvaTrade offers plenty of chart reading tools and technical indicators. You can access these trading tools via the AvaTrade web platform or through MT4 OR MT5.

We found the spreads at AvaTrade to be very competitive, with EUR/USD starting at 0.9 pips and USD/JPY at 1.1 pips. Opening an account at AvaTrade should take you no more than a few minutes and you can instantly deposit funds with a debit or credit card. The minimum deposit is just $100, albeit, you can also use the free forex demo account as soon as you register.

- Regulated in 6 different jurisdictions

- Supports CFD markets on forex, stocks, cryptocurrencies, and more

- 0% commission and low spreads

- Compatible with MT4 and MT5

- Minimum deposit of just $100

- Leverage offered on all markets

Cons

- Stock CFD department is limited in comparison to other platforms

71% of retail investor accounts lose money when trading CFDs with this provider

3. Capital.com – Best Forex Broker for Beginners ($20 Minimum Deposit)

If you are looking for a forex broker that is tailored to beginners, then Capital.com might be of interest. This broker is regulated by the FCA and CySEC – so you can trade currencies in a safe and secure environment. Capital.com requires a minimum deposit of just $20 too – which is ideal for newbies.

The trading platform itself – which can be accessed online or via the Capital.com trading app, is very easy on the eye. As such, finding a suitable market and placing your trading orders could not be simpler. This top-rated forex broker also offers a free paper trading platform. This allows you to test out your chosen forex trading strategies in a risk-free nature.

- 0% commission and tight spreads

- Thousands of markets on offer

- CFD asset classes include crypto, stocks, forex, and commodities

- Minimum deposit of just $20

- Supports debit/credit cards and e-wallets

- Great for beginners

- Metatrader 4 supported

- Leverage available – limits depend on your location

Cons

- You can’t invest in the underlying asset – CFD instruments only

67.7% of retail investor accounts lose money when trading CFDs with this provider

How to Make Money Trading Forex – Tutorial

If you want to attempt to make money using forex right now – in the tutorial below we show you how to get started with eToro.

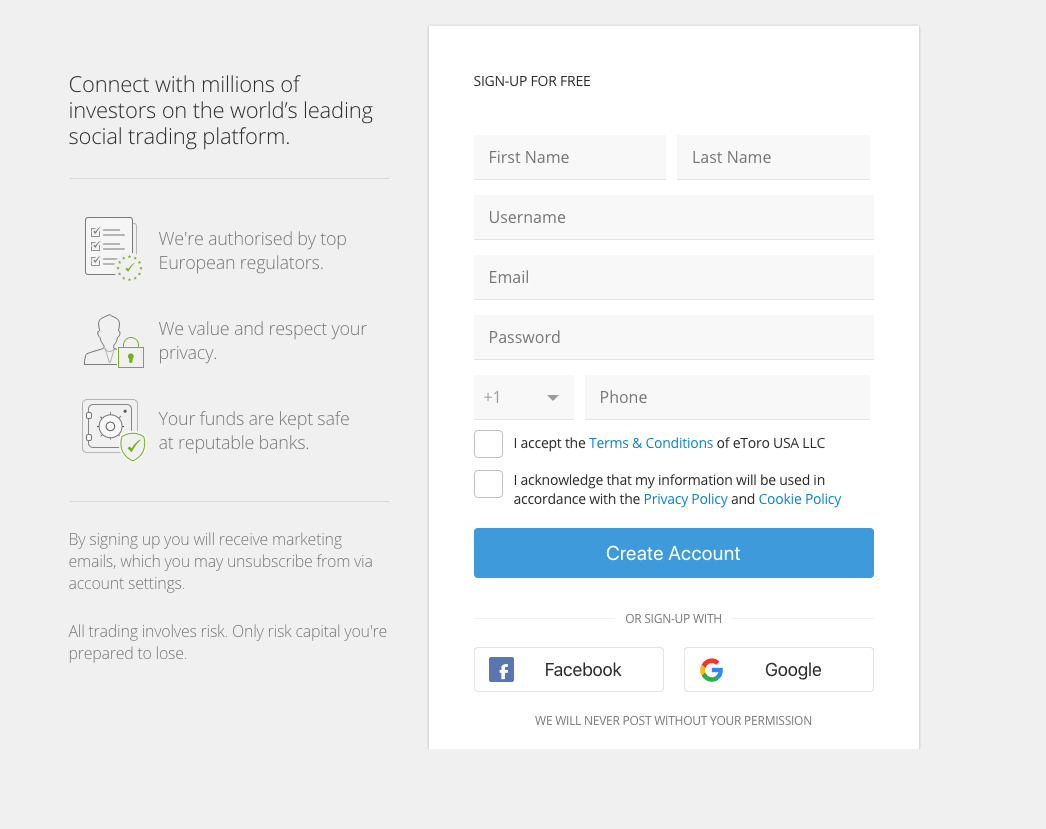

Step 1: Open an eToro Account

Visit the eToro homepage and open an account. You will be asked to enter your first and last name, as well as your email address and mobile number. You will also need to choose a username and create a strong password.

67% of retail investors lose money trading CFDs at this site

Once you have completed the account opening process, eToro will need you to upload a copy of your passport, driver’s license, or national ID card. This is to ensure the platform complies with the regulations set by its licensing bodies.

Step 2: Deposit Trading Funds

You can now add some money to your eToro account – ensuring you meet the minimum of $200. The broker supports several deposit methods – such as Paypal, Visa, MasterCard, and bank transfers.

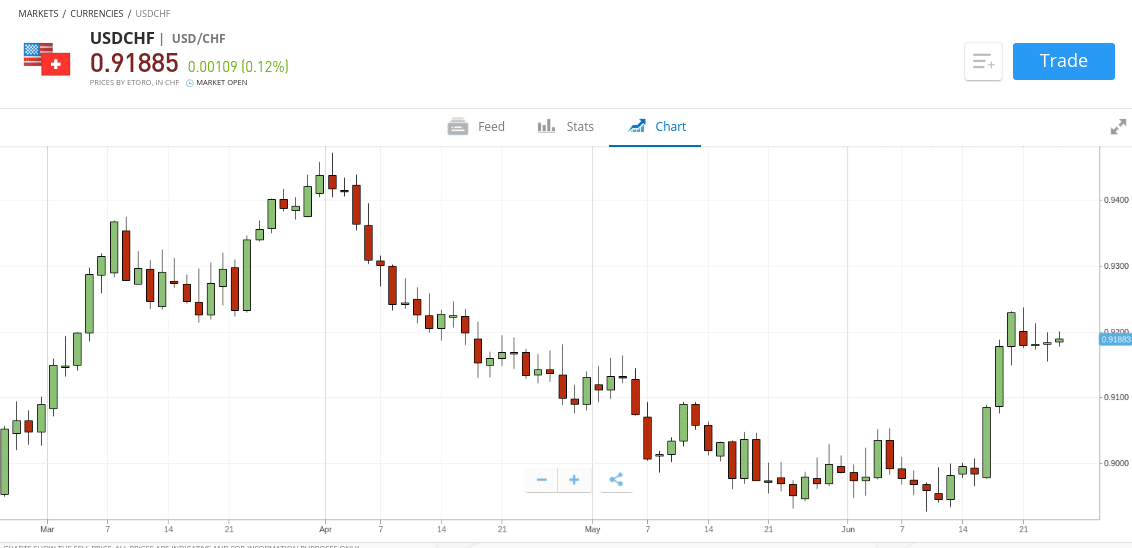

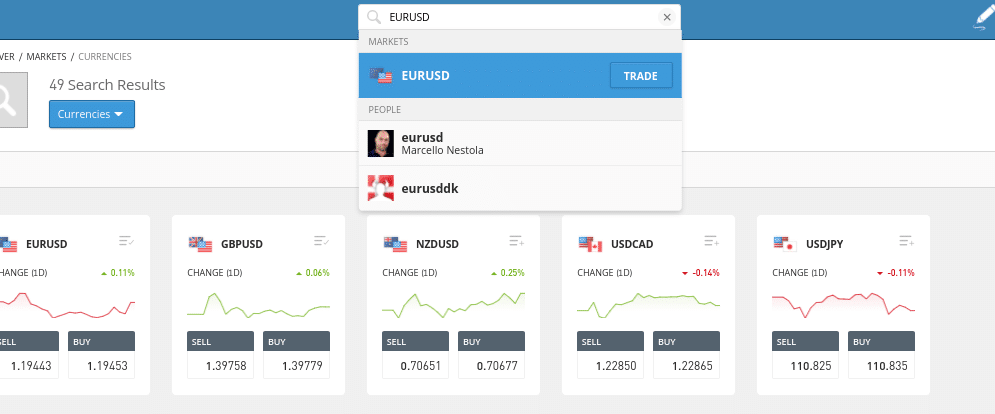

Step 3: Search for Forex Pair

Now that you have a funded eToro account, you can proceed to search for the forex pair that you want to trade. The easiest way to do this is to use the search box at the top of the page.

As we covered earlier, it’s best to stick with major pairs when you are first starting out. With this in mind, the image above shows us searching for EUR/USD.

Step 4: Place Forex Order

We discussed the importance of placing orders when you learn how to trade forex. To recap, you need to enter the market with a buy order if you think the exchange rate of the pair will rise. A sell order should be placed if you think the opposite.

Then, you need to set up a stop-loss and take-profit order. You will also need to enter your stake and leverage multiple – if applicable. Finally, click on the ‘Open Trade’ button to place your forex order.

Assuming you have set up a stop-loss and take-profit, your forex position will close automatically when one of your stated price points is triggered.

Tips to Avoid Losing Money Trading Forex

Before we conclude this guide, we will discuss five trading tips that can help you avoid losing money when trading forex.

Tip 1: Start With a Demo Account

We briefly mentioned the benefit of using a demo account in our three forex broker reviews. To elaborate – demo accounts give you access to live forex trading conditions, but in a risk-free way.

That is to say, you will be able to trade currencies without needing to risk any of your capital by trading real money. This is an invaluable way to get to grips with how to make money trading forex.

Tip 2: Learn Technical Analysis

If you are serious about becoming a better all-round forex trader – then you must learn how to perform technical analysis. This means that you will be using chart drawing tools and technical indicators to find trading opportunities. The best way to learn how to do this effectively is to practice via a demo account.

Tip 3: Use a 1:3 Risk Ratio

Seasoned traders will often have a risk/reward ratio that they stick to religiously. This illustrates how much the trader can risk on each trade and how much profit they should target. A good starting point is to opt for a ratio of 1:3. This means that you will risk 1% of your account balance per trade, and looking to make 3% in gains.

Tip 4: Avoid Exotic Pairs

We have mentioned the importance of sticking to major forex pairs throughout this guide. To reiterate – if you are a complete beginner, then you should avoid exotic pairs. The reason for this is that exotic currencies can be very volatile – which is something you will want to avoid as a newbie.

Tip 5: Consider Your Emotions

Forex trading can be an overly emotional marketplace for beginners. After all, even the most seasoned of traders will lose money at some point – as this is just part and parcel of speculating on forex prices.

However, many newbie traders fail to deal with the emotional side effects of losing money. As such, they will often resort to irrational decisions – such as trading with more than their bankroll management plan permits.

Conclusion

All in all, whether or not you are able to make money trading forex will ultimately depend on the strategy that you decide to take. For example, if you want to actively day trade currencies, you will need to spend many months mastering the skill of technical analysis.

On the other hand, you can actively trade forex without needing to do any of the legwork by using an automated strategy. This might include the Copy Trading tool offered by eToro or by using the forex signals provided by Learn2Trade.

Either way, if you want to trade currencies online – you will need a good forex broker on your side. eToro stands out for us, as the broker is heavily regulated, offers nearly 50 FX pairs, and charges some of the lowest fees in this industry.

67% of retail investors lose money trading CFDs at this site