- The EUR/USD pair failed to confirm a potential further growth, so the current sell-off is natural.

- Better than expected US data may boost the USD.

- A larger downwards movement will be confirmed by a valid breakdown below the former lower low.

The EUR/USD price drops like a rock at the time of writing as the Dollar Index edges higher. We have a strong negative correlation between the DXY and EUR/USD. The currency pair maintained a bearish bias.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

In the short term, the price moves sideways, extending its range pattern. The price action also developed a triangle formation. Escaping from this pattern could bring really good trading opportunities.

The USD drags the price down after receiving a helping hand from the US HPI and the Richmond Manufacturing Index yesterday. Earlier, the Euro-zone Private loans reported a 4.2% growth matching expectations, while the M3 Money Supply registered only a 7.3% growth versus 7.6% expected.

Later, the US will release the Pending Home Sales, which may report a 0.6% growth. The Prelim Wholesale Inventories are expected to rise by 1.5%, while the Goods Trade Balance could drop to -89.0B. Tomorrow, the US unemployment claims and the Chicago PMI could bring more action.

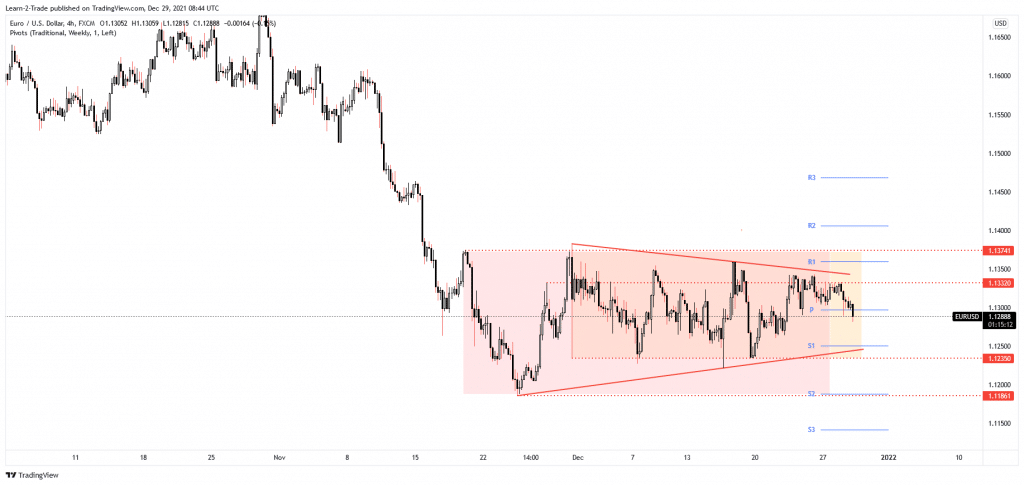

EUR/USD price technical analysis: Triangle pattern

As you can see on the 4-hour chart, the currency pair failed to reach and retest the triangle’s resistance, and now it has dropped way below the 1.1297 weekly pivot point. The upside movement was stopped by the 1.1332 static resistance. The EUR/USD pair continues to move sideways between 1.1235 and 1.1374 levels. A valid breakout from the current triangle and escaping from this range could bring us a clear direction.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

As you already know, the downtrend remains intact as long as the price is traded below 1.1374. The current narrow range could represent a distribution. Still, it remains to see how it will react around the uptrend line and after reaching the 1.1235. A downside continuation, a broader drop, could be confirmed by a valid breakdown below the 1.1186 lower low. Staying above the immediate downside obstacles and jumping above the 1.1374 may announce an upside reversal. This scenario is less likely to happen.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.