- A new lower low activates more declines.

- The Canadian inflation and the US data could be decisive tomorrow.

- Escaping from this pattern could bring us new opportunities.

The EUR/USD price continues to stay higher as the FED delivered only a 50-bps rate hike after the US CPI and Core CPI reported lower inflation in November.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Fundamentally, the Euro received a helping hand from the German Ifo Business Climate yesterday. The economic indicator came in at 88.6 points versus 87.6 expected and compared to 86.4 in the previous reporting period.

Today, the German PPI reported a 3.9% drop versus a 1.7% drop, while the Eurozone Current Account was reported at -0.4B versus -10.3B expected. Later, the Eurozone Consumer Confidence is expected to be at -22 points versus -24 points in the previous reporting period.

Also, the US is to release important data. Housing Starts are expected to drop from 1.43M to 1.40 M. In contrast, Building Permits may drop from 1.51M to 1.48 M. Tomorrow, the Canadian inflation data and the US CB Consumer Confidence are seen as high-impact events and could shake the markets.

In addition, the German Gfk Consumer Climate could also have an impact. Canada is expected to report lower inflation and move the EUR/USD pair.

EUR/USD price technical analysis: Broadly ranging

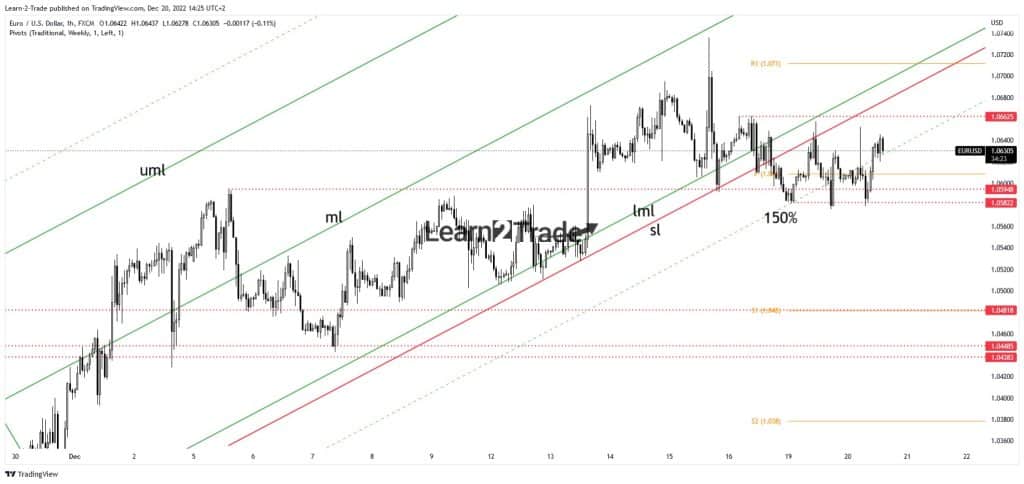

The EUR/USD pair found support around 1.0582 and rebounded. The 1.0662 and the 150% Fibonacci line represent upside obstacles. Failing to stay above the 150% Fibonacci line signals exhausted buyers. It’s trapped between the 1.0662 and the 1.0582 levels. Escaping from this pattern could bring new opportunities.

–Are you interested to learn more about forex options trading? Check our detailed guide-

A new lower low, dropping and stabilizing below 1.0582, can activate more declines. Failing to approach the 1.0662 signals that the upside movement could be over and that the sellers could take the lead. After escaping from the ascending pitchfork’s body, the price action signaled a potential larger correction. Still, a new leg down needs strong confirmation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.