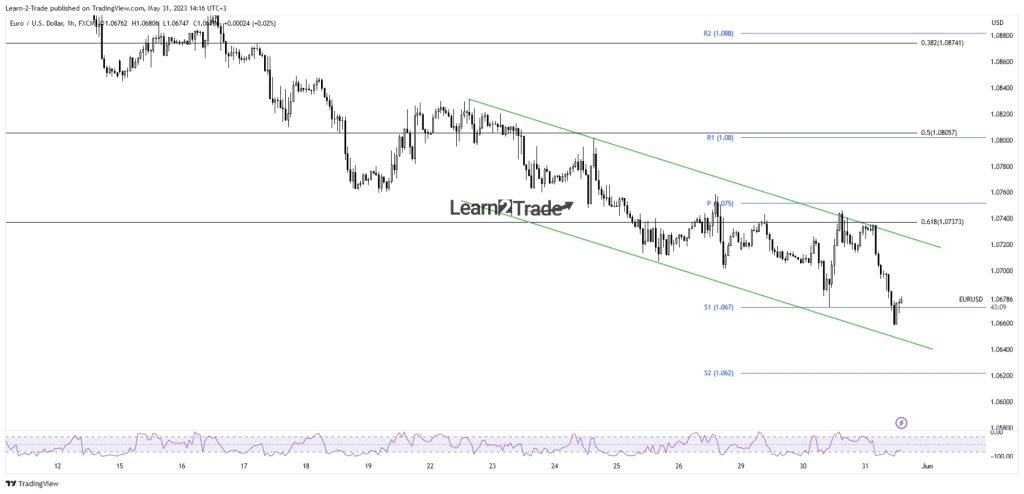

- The bias remains bearish despite temporary rebounds.

- Coming back below the S1 should announce more declines.

- The US data should bring high action later today.

The EUR/USD price extended its sell-off as the US dollar resumed its upside. Today, the pair has dropped as low as 1.0658, registering a new lower low.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

The pair is trading at 1.0680 at the time of writing. It’s located far below today’s high of 1.0735. The bias is bearish, so a deeper drop could be expected. However, the probability of a corrective upside cannot be ruled out.

Fundamentally, a downside continuation was favored after the US CB Consumer Confidence came in better than expected yesterday. Today, the German Import Prices, French Prelim CPI, and French Consumer Spending came in worse than expected.

Furthermore, German Unemployment Claims and Italian Prelim CPI indicators reported better than expected data. The EUR/USD pair rebounded in the last hours despite mixed data. The German Prelim CPI is also expected to be released today and could bring more action.

Though, the US data could be decisive in the US trading session. The JOLTS Job Openings may drop from 9.59M to 9.41M, which could be bad for the US Dollar. In addition, the Chicago PMI may drop from 48.6 points to 47.1 points.

EUR/USD price technical analysis: Sellers’ dominance

From the technical point of view, the EUR/USD price slipped today after retesting the downtrend line and after failing to retest the 61.8% retracement level.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The pair has extended its downside movement within a down channel. It has dropped below the weekly S1 (1.0670) but failed to hit the channel’s downside line.

It seems that the price is oversold, that’s why a rebound could be expected. Coming back and stabilizing below the S1 may trigger a downside continuation.

The downside line and the weekly S2 (1.0620) could represent downside targets if the rate continues to drop. The current rebound may bring new short opportunities.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.