Best Forex Brokers Thailand 2021

If you are interested in getting involved in the trillion-dollar a day foreign exchange market, then choosing a top forex broker is extremely important. Finding the best forex brokers in Thailand with the best commissions, fees, platforms and customer support can be difficult as well as time-consuming. This is why we have done the work for you!

In this Best Forex Brokers Thailand 2021 guide, we review some of the best forex brokers in Thailand so you can find the right one for yourself and get started with them today.

Best Forex Brokers Thailand 2021 List

Below is a list of the best forex brokers in Thailand. Further down, is a comprehensive review of all the features and services provided by each one of these brokers and the pros and cons of trading with them.

- eToro – Overall Best Forex Broker in Thailand with Largest Copy Trading Service

- VantageFX – Best Thai Forex Broker for ECN Trading Accounts

- Capital.com – Best Forex Broker with Low Minimum Deposit ($20)

- Libertex – Best Forex Broker in Thailand with Tight Spreads

- AvaTrade – Best Broker for Account Types (CFD, Copy, Options)

- Pepperstone – Best Broker for Trading Platforms Offered

- Forex.com – Top-Rated Forex Broker for Range of Instruments

- XM – Best Forex Broker for Trading Tools & Research

- FXTM – Best Forex Broker for Advanced Trading App

- IC Markets – Best Forex Broker for Raw Spreads

Best Forex Brokers in Thailand

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

-

Leverage max

50

Currency Pairs

52

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

2.5

EUR/USD

1

EUR/JPY

2

EUR/CHF

5

GBP/USD

2

GBP/JPY

3

GBP/CHF

4

USD/JPY

1

USD/CHF

1.5

CHF/JPY

2.7

Additional Fee

Continuous rate

-

Conversión

-

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$20

Spread min.

0.0 pips

Leverage max

20

Currency Pairs

100

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.4

EUR/USD

0.6

EUR/JPY

1.5

EUR/CHF

2.2

GBP/USD

0.8

GBP/JPY

1.9

GBP/CHF

2.4

USD/JPY

1.3

USD/CHF

1.3

CHF/JPY

2.6

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$0

Spread min.

-

Leverage max

2

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSEC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

from 0,0003%

EUR/USD

from 0,0003%

EUR/JPY

from 0,0003%

EUR/CHF

from 0,0003%

GBP/USD

from 0,0003%

GBP/JPY

from 0,0003%

GBP/CHF

from 0,0003%

USD/JPY

from 0,0003%

USD/CHF

from 0,0003%

CHF/JPY

from 0,0003%

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

70.8% of retail investor accounts lose money when trading CFDs

Find the Best Forex Brokers Thailand – Comparison

In the forex brokers list shown above, many of these entities are considered to be in the top 10 forex brokers in the world. This will become evident as we go through some of the core features and benefits of the services each broker provides.

Top Thailand Forex Brokers Reviewed

Since the pandemic, the interest in trading the foreign exchange market has surged. This has led to an increase in how many forex brokers there are in the world. Unfortunately, not every forex trading broker will be good.

How do you find the best forex broker in Thailand? Which Thai forex broker offers the best commissions and fees? Are they regulated to ensure your capital is safe?

Find the best Thai forex broker isn’t as easy as it seems. It requires detailed research, testing and analysis which can take some time. Fortunately, we have done this for you! Below we review the 5 best forex brokers in Thailand.

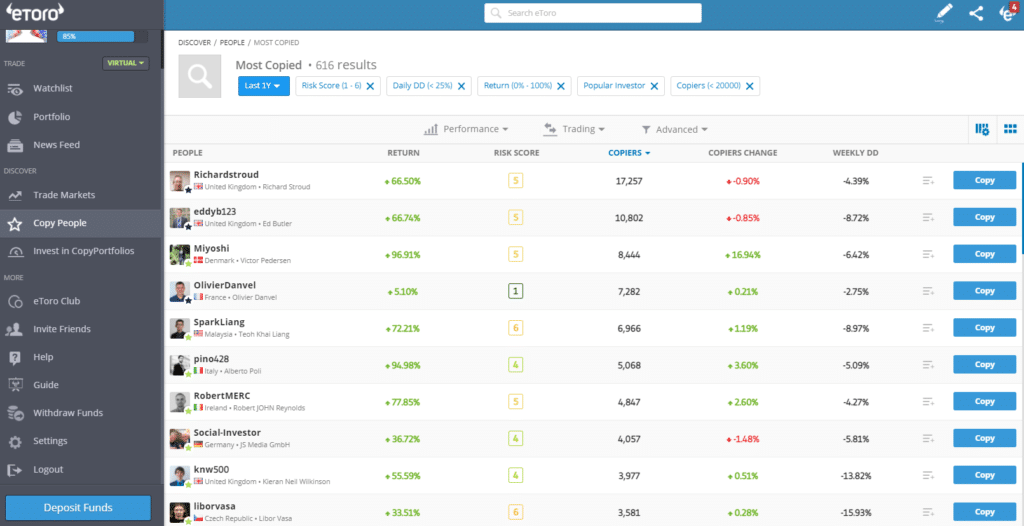

1. eToro – Overall Best Forex Broker in Thailand with Largest Copy Trading Service

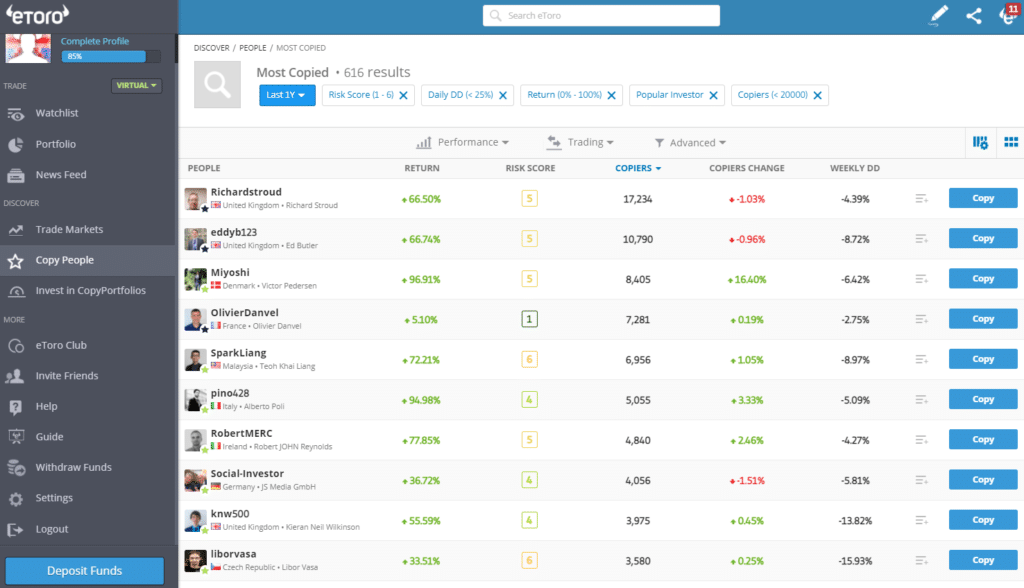

If you’re not familiar with social or copy trading, it basically means that you can view the performance of other traders and have their trades copied onto your own account. It’s the fastest-growing trend in the forex industry and one you seriously want to think about – take a look at some of the results below.

By clicking on the Copy People tab you can see the performance of all the different traders on the platform. You can also use the search feature to find traders with a specific return, risk metric, markets traded and more!

eToro is also considered one of the best forex brokers in Thailand because it is heavily regulated, providing a high level of safety and security of your funds and a negative balance protection policy. The broker is authorised and regulated by the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

Furthermore, you can trade 100% commission-free from the eToro trading platform – making it one of the top Thai forex brokers around. You can also trade on more than 2,400+ instruments covering global markets such as foreign exchange, cryptocurrency, stocks, indices and commodities.

The eToro trading platform is also very simple to use. No download is required and it works on any web browser. You can view charts, perform technical analysis, discuss trades with others through the social trading news feed and access live trading tickets. You only need $200 to open an account and benefit from all of these features and more! Depositing funds is also fee-free and can be done through bank transfer, debit/credit and even PayPal.

- Heavily regulated – FCA, CySEC, ASIC

- Trade on 2,400+ global markets

- Access Copy Trading FREE

- Trade forex 24/5 and digital currencies 24/7

- Access premium events and tools with eToro Club

- Trade from feature-rich, web trading platform

- 100% commission-free!

Cons

- Limited technical analysis tools

67% of retail investors lose money trading CFDs at this site

2. VantageFX – Best Forex Broker for ECN Trading Accounts

For example, the VantageFX Raw account provides you with spreads from 0 pips with a very small commission of just $1 per lot, per side. You can also trade a 100% commission-free trading account with slightly higher spreads which are still highly competitive.

Through the VantageFX ECN account, you can trade on more than 44 currency pairs, as well as other markets such as indices, commodities or stocks. You can also trade from the globally recognised MetaTrader 4 and MetaTrader 5 forex trading platforms for desktop, web and mobile.

- ASIC and VFSC regulated

- Access raw spreads from the interbank market

- Competitive commissions for ECN trading

- 100% commission-free trading accounts available

- Trade from MetaTrader 4 and MetaTrader 5

- Premium trading tools and plugins provided

- Trade forex, stocks, indices, commodities

Cons

- VantageFX Mobile App has limited features

Your capital is at risk when trading financial instruments at this provider

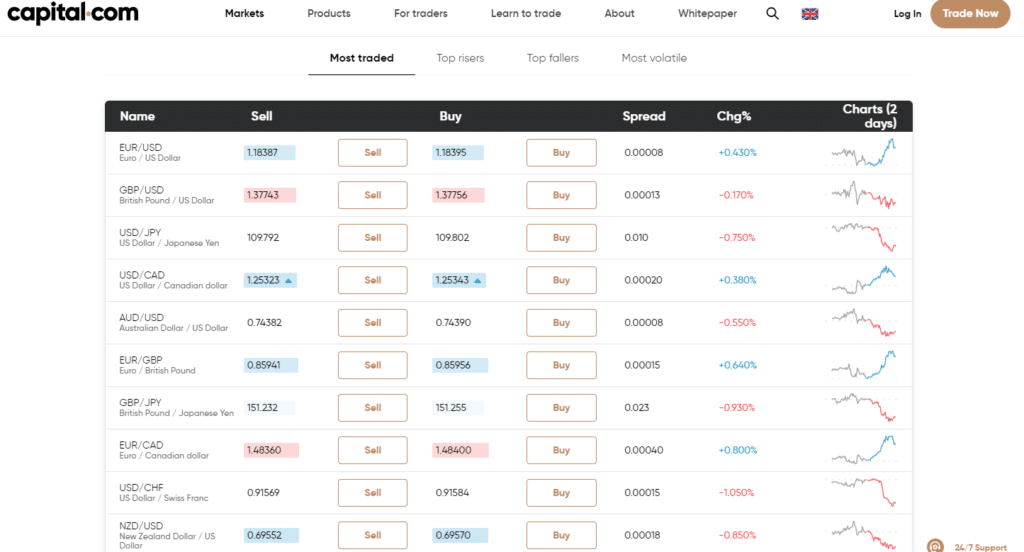

3. Capital.com – Best Forex Broker in Thailand with Low Minimum Deposit ($20)

One of the best features of Capital.com is the fact you can trade 100% commission with very low spreads using CFDs, or contracts for difference. This product allows you to trade currencies long and short to profit from rising and falling markets, making Capital.com a quality CFD broker.

The Capital.com online trading platform is simple to use and no download is required. You can also trade from the mobile trading app which is feature-rich and easy to navigate.

This Thai forex broker also offers 100% commission free deposit and withdrawal options as well as great customer service 24/7.

- Regulated by CySEC and FCA

- 100% commission-free trading

- 100% commission free deposit and withdrawal

- Access low spreads

- Trade 3,000+ global markets

- Simple to use web trading platform

- Only $20 minimum deposit

Cons

- Only CFD trading accounts available

72.6% of retail investors lose money trading CFDs at this site.

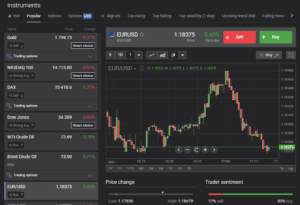

4. Libertex – Best Forex Broker in Thailand with Tight Spreads

So how does Libertex make their money? Through a small commission when you buy and sell. For example, the commission to currency pairs like EUR/USD and AUD/USD is just 0.014%.

If you’re interested in trading exotic currency pairs, then Libertex may be for you. Capital.com has a huge list of major, minor and exotic currency pairs and other markets such as stocks, indices, commodities and cryptocurrencies. These can all be traded with ZERO spreads.

The web trading platform provided by Libertex is simple to use and comes packed with different features. This includes a news portal, sentiment indicators, a forex app and more. The broker’s also regulated by CySEC providing a high level of safety and security of your funds.

- Trade with tight spreads!

- Regulated by CySEC

- Trade more than 213+ global markets

- Simple to use web trading platform

- Live news in the platform

- Advanced trading tools provided

Cons

- Can only trade CFDs

83% of retail investors lose money trading CFDs at this site.

5. AvaTrade – Best Broker for Account Types (CFD, Copy, Options)

You can also access AvaSocial which is the broker’s mobile copy trading app developed with FCA regulated firm Pelican Trading. This enables you to find and copy some of the best traders around and effectively operate your own human forex robot!

You can trade more than 1,250+ markets with AvaTrade 100% commission free and with low spreads. The spread for EUR/USD starts at just 0.9 pips! You can also trade forex options and other asset classes such as stocks, indices and cryptos.

This forex broker in Thailand also provides a high level of safety and security of your funds as they are regulated in six different jurisdictions around the world. If you’re interested in accessing advanced trading tools then AvaTrade may be for you as they provide access to correlation and sentiment indicators from Trading Central.

- Trade more than 1,250+ global markets

- Regulated in six different jurisdictions

- 100% commission free trading accounts

- Trade from MT4/MT5 desktop, web and mobile

- Copy trading via AvaSocial

- Trade forex options

Cons

- Inactivity fees

71% of retail investor accounts lose money when trading CFDs with this provider

Best Forex Brokers in Thailand Comparison

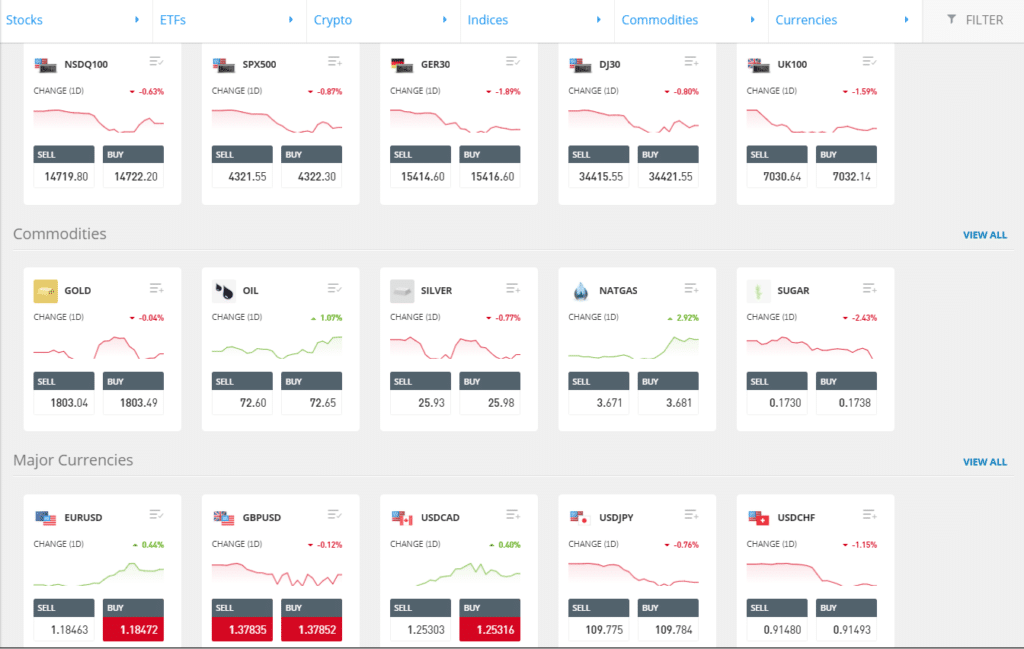

Now you know about the features and benefits of the best forex brokers in Thailand, how do they compare with each other? The table below summarises the differences between the commission, typical spread, maximum leverage and fees for deposits and withdrawals.

| Forex Broker | Commission | Min. Spread (GBP/USD) | Deposit Fee | Withdrawal Fee | Max. Leverage (Retail) |

| eToro | Zero | 2 pips | Free | $5 | 1:30 |

| VantageFX | Zero (STP) or $1 per lot (ECN) | 0.1 pip | Free | Free or 20 units of base currency | 1:500 |

| Capital.com | Zero | 1.3 pips | Free | Free | 1:30 |

| Libertex | From 0.006% | Zero | Free | Free or from €1 | 1:30 |

| AvaTrade | Zero | 1.6 pips | Free | Free | 1:30 |

For online brokers such as eToro, Capital.com, Libertex and AvaTrade you can access higher leverage as a professionally categorised client.

How to Choose the Right Forex Broker for You

In this Best Forex Broker in Thailand guide, we have so far looked at the top five brokers. But how did we compile the list and what should you look for when trying to find the best forex broker in the world?

Below is a list of the key metrics to look out for when choosing a forex brokerage.

Safety

As more and more forex brokers in Thailand are popping up to satisfy the surge in demand for online retail trading, it’s very important to do your own due diligence on them. Unfortunately, there are many brokers who are offering services that are not authorised or regulated to do so.

Trading with a regulated broker is essential. After all, they are holding the capital you trade with and are executing trades on your behalf – you want to make sure they are held to a high standard in doing these properly.

All of the brokers in our top five forex brokers list above are regulated by all or some of the most well-known regulators in the world. This includes the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) from Australia, Federal Financial Supervisory Authority (BAFIN) International Finances Services Commission (IFSC), Dubai Financial Services Authority (DFSA), Financial Sector Conduct Authority (FSCA), and FSA (Financial Services Authority).

Fees

The next key metric to focus on when choosing a broker are the fees as these will eat into your profits. Many brokers offer a range of account types with have different fees. Some might offer commission-free trading with a higher spread and some might offer commission-based trading with lower spreads.

Here are the fees to watch out for:

- Trade commission. These are the fees for placing a trade (buy or sell).

- Spreads. This is the difference between the buy and sell price and is often marked up by the broker.

- Swaps. These are the fees for any overnight trades if you are trading on margin products such as CFDs.

- Inactivity fees. These are the fees for when no trading activity takes place on your account over a certain period of time.

- Currency conversion fees. If you fund your account in US dollars but trade a European index priced in euros, there will be a currency conversion done by the broker.

Range of Assets

Having access to global markets is essential to navigating a more globalised world. Make sure you have the best range of asset classes for you to find enough trading opportunities.

For example, all forex brokers will offer major and minor currency pairs to trade on. The selection of exotic currency pairs will differ. Some will offer more and some will offer less.

Most forex traders usually have other asset classes they like to speculate on as well. This could be cryptocurrencies, stocks, indices or commodities.

With eToro, you can trade on more than 2,400+ financial instruments covering forex, stocks, indices, commodities, ETFs and cryptocurrencies.

Furthermore, you can trade all of these asset classes 100% commission free with low spreads!

Trading Tools

When making trading decisions in the market it is essential to have the right trading tools to help you. Markets are now moving faster than ever before, so having additional tools beyond the standard trading platform can make a big difference.

For example, some brokers may provide access to sentiment indicators, or extra plugins and indicators you can download into the trading platforms they use. The best trading tool that we have seen is the eToro CopyTrading tool.

Performance is not an indication of future results

With the eToro CopyTrading tool, you can see the performance of other traders, choose the best one for you and then have their trades copied directly onto your account. It’s a great way to earn passive income if you can find the right trader to follow.

Platforms

Your trading platform is your gateway to the world’s financial markets. It needs to be fast, secure and easy to use. Nowadays, most brokers will offer a variety of different platforms and may even offer a proprietary, custom-built solution.

Some of the most popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. Not only can you place your own trades through these platforms, but they also offer algorithmic trading capabilities.

Brokers such as VantageFX, Capital.com, Libertex and AvaTrade offer the MetaTrader suite of trading platforms. eToro offers its own custom-built, web trading platform that is simple to use and feature-rich.

Account Types

Most brokers will now offer you a variety of different account types, helping you to find the right one for your own needs. All of the brokers featured above offer CFD trading accounts where you do not own the underlying asset but merely speculate on its price direction. This is an account that allows you to trade long and short using leverage.

Leveraged trading is very popular as it allows you to control a large position with a small deposit. For example, a broker that offers 1:30 leverage allows you to open a $100,000 position size with just $3,333 in your own account. While beginners like to trade with high leverage brokers it’s worthwhile remembering leverage amplifies your profits AND your losses.

Brokers such as AvaTrade also provide an Options Trading Account. eToro also allows you to operate an Investing account alongside your CFD trading account. This allows you to buy real stocks, ETFs and cryptocurrencies where you own the underlying asset.

Payments

A broker’s deposit and withdrawal fee is one of the most important metrics to know. After all, you don’t want to make a decent profit and then be stung with a very high withdrawal fee.

Most brokers now offer a variety of payment methods. For example, with eToro, you can deposit funds fee-free and withdraw funds using bank transfer, debit/credit card or via e-wallets such as PayPal.

How to Get Started with a Thai Forex Broker

If you’re eager to get started with the Overall Best Forex Broker in Thailand, eToro, then simply follow the step by step process outlined below.

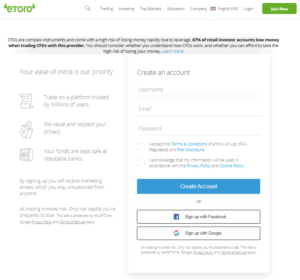

Step 1: Open an Account

Opening an account with eToro is a very simple process. Simply click on the Join Now button on the broker’s website and fill in some personal details which includes a username, email and password.

You will also need to accept the Terms and Conditions before moving on. Once you have done this, you will be automatically redirected to the eToro trading platform so you can check out all of the features such as CopyTrading.

As eToro is regulated, they will need to follow Anti-Money Laundering regulations and Know Your Client policies. This means you will need to fill in a short questionnaire so they know more about you and your trading experience.

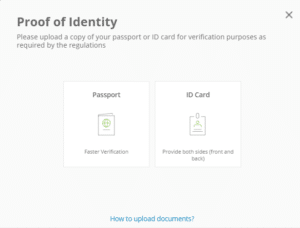

Step 2: Upload your ID

Regulated brokers will also need to verify your ID to comply with AML and KYC regulations. To get verified with eToro, you only need to provide two documents to verify your identity and your address.

These can be uploaded directly from the trading platform and could be:

- A valid passport or driver’s licence for ID verification

- A bank account statement or utility bill, issued in the last six months, for address verification

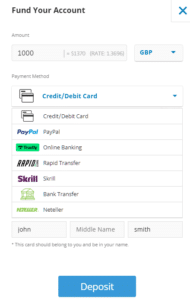

Step 3: Fund your account

You can fund your eToro account using the following fee-free methods:

- Bank wire transfer

- Debit/credit card

- Neteller

- Skrill

- PayPal

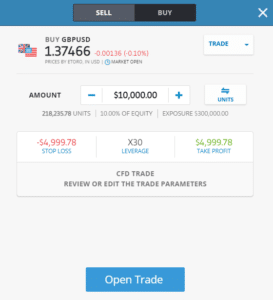

Step 4: Choose your market and trade!

Once you’ve deposited funds you can start trading on any of the 2,400+ financial instruments offered by eToro. This covers major, minor and exotic forex pairs, stocks, indices, commodities and cryptocurrencies.

The eToro trading ticket allows you to customise your trade size and also set a stop loss and take profit price level. The ticket also details any fees for holding the position overnight and your total leveraged exposure.

eToro – Best Forex Broker in Thailand

If you want to trade the forex market successfully, the broker you choose will play a key role in doing so. In this guide, we have reviewed some of the best brokers to trade with.

From our research, eToro is by far the best forex broker in Thailand. You can trade 100% commission free on more than 2,400+ global markets while accessing the CopyTrading feature used by more than 20 million people around the world.

67% of retail investor accounts lose money when trading CFDs with this provider.