Last week was all about US dollar weakness and a not-so-serious jawboning from the ECB. EUR/USD took advantage of the US dollar weakness. It then extended its gains as Draghi’s words about the exchange rate weren’t strong. In addition, he offered absolutely no news about the next steps of the ECB beyond the current QE program that lasts through September 2018.

That bit seems to have changed now. A fresh report suggests that Draghi will announce further bond-buying until the end of the year. The ECB started off the program at 60 billion euros per month, enlarged it to 80 billion, reduced it to 60 billion and from this month, the rate is half the previous rate: 30 billion.

So, we may expect perhaps a rate of 15 billion euros per month during the last three months of the year. This is an addition of a total of 45 billion to a pile that has already exceeded 2 billion. Does this really make a difference?

The answer isn’t in the additional money printing but rather in the timing.

Any delay the end of QE implies extending the horizon for an initial rate hike in the euro-zone. The Federal Reserve made its first move in December 2015 and lately, we had hikes from both the BOE and the BOC. Draghi ends his 8-year term in November 2019 and at this snail’s pace, he may oversee only one hike before he retires.

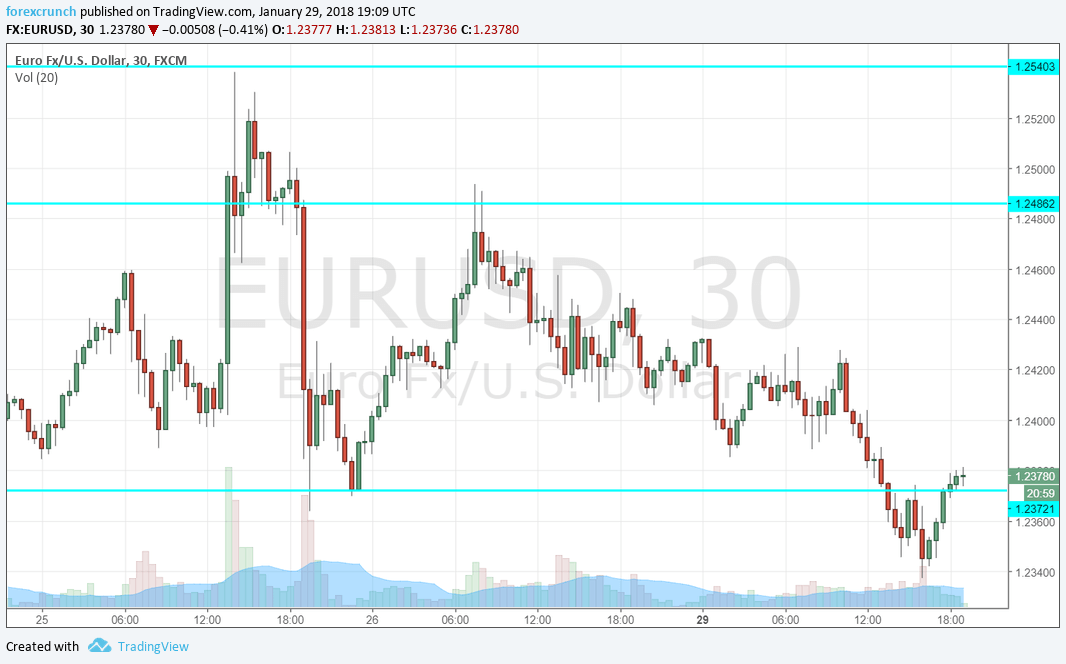

Dovish report comes on top of a USD correction

Given the recent optimism from the ECB, the growing calls to end the program by the hawks, and the meeting minutes that suggested an early announcement, this 3-month delay weighs on the euro.

In addition, EUR/USD was already on the back foot due to the recovery of the US dollar. A comeback of the greenback was to be desired after the big downfall that seemed somewhat overstretched.

Is the dollar ready to rally? Probably not. Later in the week, the dollar could resume its sell-off. However, the euro lost some of its punch due to this report. Needless to say, other data points such as euro-zone GDP and inflation, will later play a role.

More: Is EUR/USD heading to 1.27? Two models point that way