- The Fed Vice President’s comments generated positive expectations for the US economy.

- US employment data beat expectations, lending strong support to the Greenback.

- The price could break the 1.1700 barrier next week.

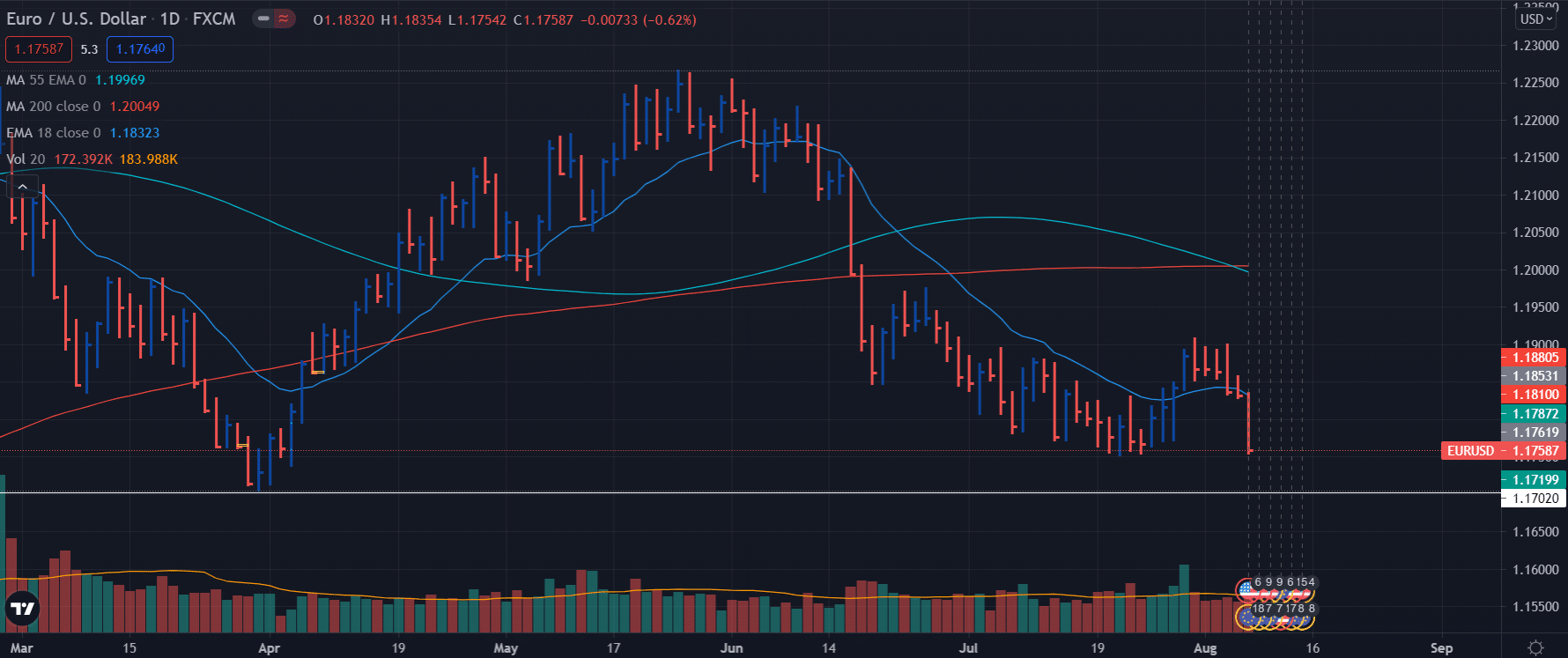

The EUR/USD weekly forecast has had a bearish end reaching new lows every day. At the moment, it is well below the 1.1800 level. Since the beginning of the week, all attempts to advance towards the level of 1.19 failed.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

This week the US Dollar has managed to recover some ground after the statements of the previous week by the Fed Chair, Jerome Powell, who for the moment ruled out a change in the country’s monetary policy.

However, this week the statements of the Fed Vice Chairman Richard Clarida encouraged investors by assuring that the central bank is preparing the way to regularity and even saying that by the end of the year or early 2022, it could announce the rise in interest rates for 2023.

The statements of the Fed representatives are accompanied by the good economic results of July. As announced in the middle of the week, 943,000 new jobs were created in the previous month, much more than the 870,000 expected. Furthermore, the unemployment rate fell to 5.4%, and underemployment fell to 9.2%.

On the European side, although retail sales increased 4.2% m/m in Germany, June factory orders increased 26.2% measured from June 2020 to June this year, far from the 54.9% previously. Industrial production also registered a slight advance, only 5.1% y/y, a low percentage compared to 16.6% in the previous period.

Upcoming Events

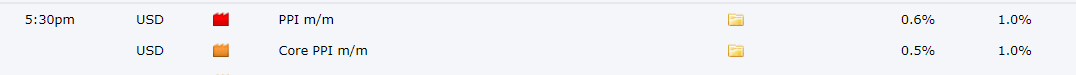

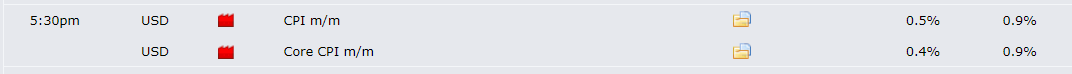

The main relevant economic events for the EUR/USD pair will take place on the North American side starting Wednesday. For next week, the consumer price and product price indices will be published. The relevance of this data is due to high inflation in the United States and in the Fed’s decision to update its monetary policy.

–Are you interested to learn more about forex signals? Check our detailed guide-

As for the CPI, an increase of 0.5% is expected compared to the 0.9% of the previous period. For the PPI, the increase should be 0.6% compared to 1.0%. If the forecasts are fulfilled, a slowdown in inflation would be confirmed, strengthening the US Dollar.

EUR/USD weekly technical analysis: MAs pointing at more losses

The pair closed the week near the July lows and is preparing to test new lows next week. It could even break the 1.1700 barrier. The immediate support level is 1.1751. The 20-day SMA maintains a slightly bearish slope but is well above the current level. On the other hand, the moving averages converge around 1.1500.

EUR/USD next week forecast

The pair’s price will depend on the inflation results published for next week. However, it is expected to test the support levels at 1.1751 and 1.1703.

Below those levels, the price may move towards 1.1600. Resistance levels will be at 1.1840 followed by 1.1920.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.