- The Delta boosted the Greenback’s demand, and the Fed’s tapering plummeted the pair.

- Investors will look for the Jackson Hole Symposium for further clues about the tapering.

- From a technical standpoint, the EUR/USD is bearish and might hit 1.1500 next week.

The weekly forecast for the EUR/USD is bearish as the Greenback rises ahead of the key events of the Jackson Hole Symposium.

The EUR/USD pair is trading at its lowest level since November 2020. As a result, USD bulls will likely dip the pair further below.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

EUR/USD fundamental forecast

As fears boosted demand for the Greenback, the EUR/USD pair is trading at its lowest level since November 2020, at 1.1660. The combination is supported by the increased likelihood of US tapering and the proliferation of the coronavirus Delta variant.

Feds tapering talks

The Federal Reserve’s most recent FOMC meeting minutes were released, revealing that policymakers are prepared to debate the timing of tapering at the next meeting. This time, though, clues hinted that obtaining financial assistance would be easier than previously thought.

Delta COVID concerns in the Eurozone

Concerns about the Covid-19 Delta version, on the other hand, eroded investor trust.

According to the WHO, the Delta form is also prevalent in Europe. Although the spread has not yet reached significantly as the area intensifies its immunization efforts.

Still, the pandemic’s future developments are unknown, increasing the financial markets’ uncertainty.

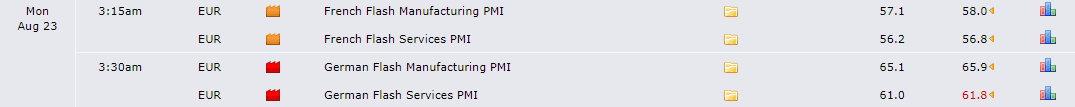

Key Data Releases from EUR during Aug 23-27

The following week will begin with preliminary August Market PMI numbers for the EU, expected to mirror the overall negative attitude.

In addition, Germany will issue its Q2 GDP forecast, which is expected to be 1.5 % and the IFO Business Climate and GFK Consumer Confidence reports.

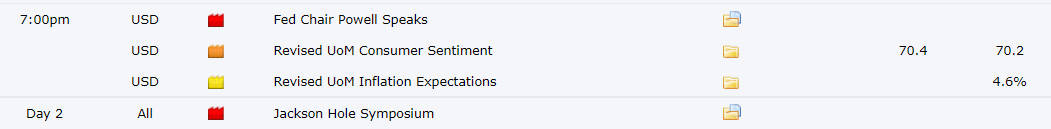

Key Data Releases in the US during Aug 23-27

The Jackson Hole Symposium, which begins on Thursday, will be the highlight of the week.

The annual conference, which is intended to address significant economic issues that impact economies across the world, generally attracts many central bank leaders and market players to watch the proceedings to learning new information about the future of economic policies.

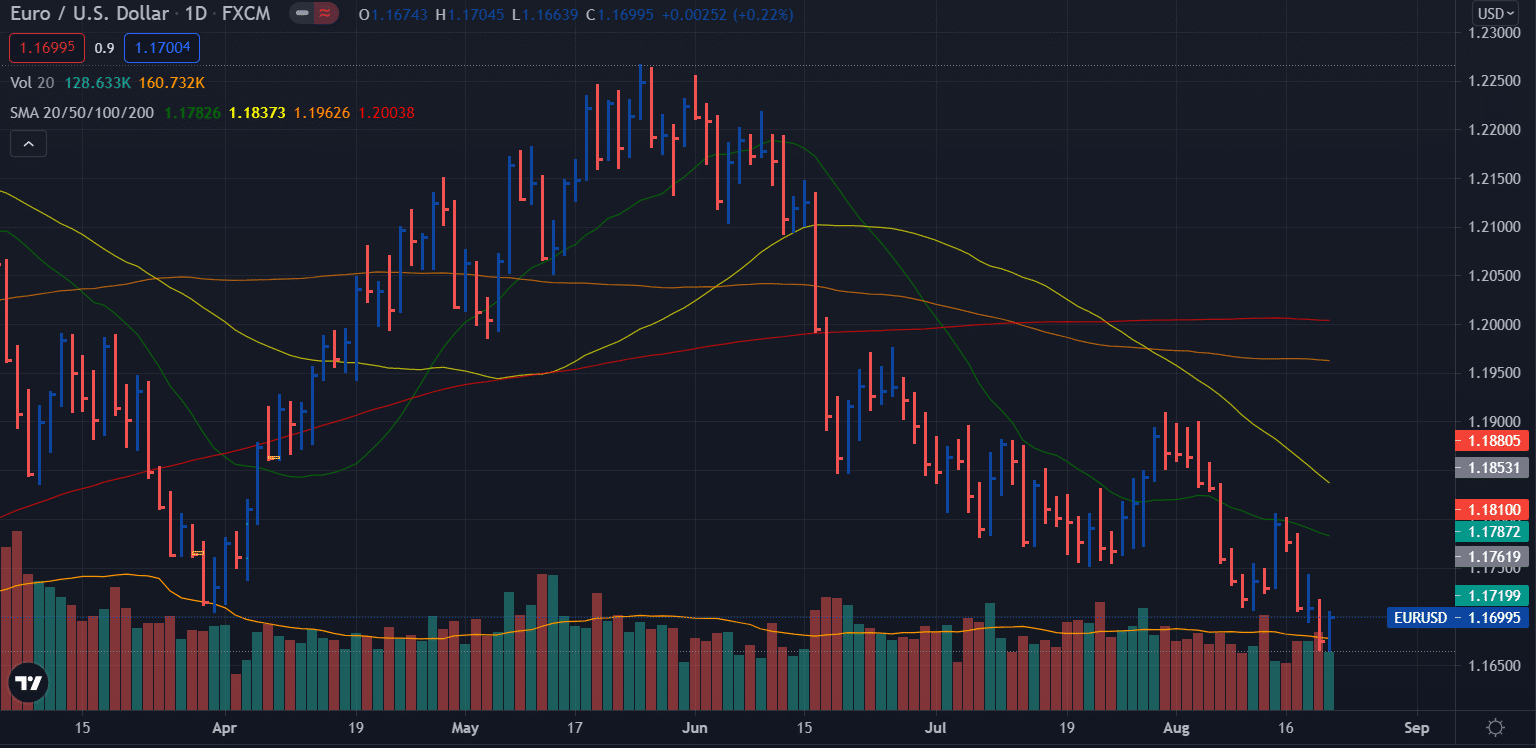

EUR/USD technical analysis: key levels in action

The EUR/USD pair continues to lose ground, ending the week a few ticks above its yearly low. The long-term technical picture is negative, with a bearish objective of 1.1602, the November 2020 low, as an urgent bearish target.

–Are you interested to learn more about forex signals? Check our detailed guide-

The pair might touch the 1.1500 level in the following days, especially if it closes a day below the stated 1.1560 price zone. Resistance levels on the upswing are 1.1735 and 1.1790, close to 1.790 will likely generate selling attention.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.