- The pair will continue its downtrend in the long term while keeping levels below a bearish 20 SMA.

- The EUR/USD failed to surpass the 1.1900 level even after the disappointing unemployment report.

- The European Central Bank will reduce emergency bonds purchases in the next quarter while keeping its rates at the same level.

At the beginning of the week, traders’ expectations started to deteriorate without any major event behind this sentiment. The spread of the delta variant of the Covid-19 may be the main reason behind the movement. In the middle of the week, the EUR/USD stopped its downtrend and closed over the 1.18100 level. EUR/USD weekly forecast remains bearish however, the focus will remain on the fundamental events from the Eurozone.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

This is after the ECB decision of leaving rates at the same level, as expected. However, after the meeting, Christine Legarde maintained her opinion about inflation being due to temporal factors, which didn’t help the pair to rise.

On the other hand, The expectations about the FED beginning the tapering were fueled by the comments made on Thursday by Fed Governor Michelle Bowmans. Also, various FED officials supported the plan to reduce bond purchasing by $120 billion.

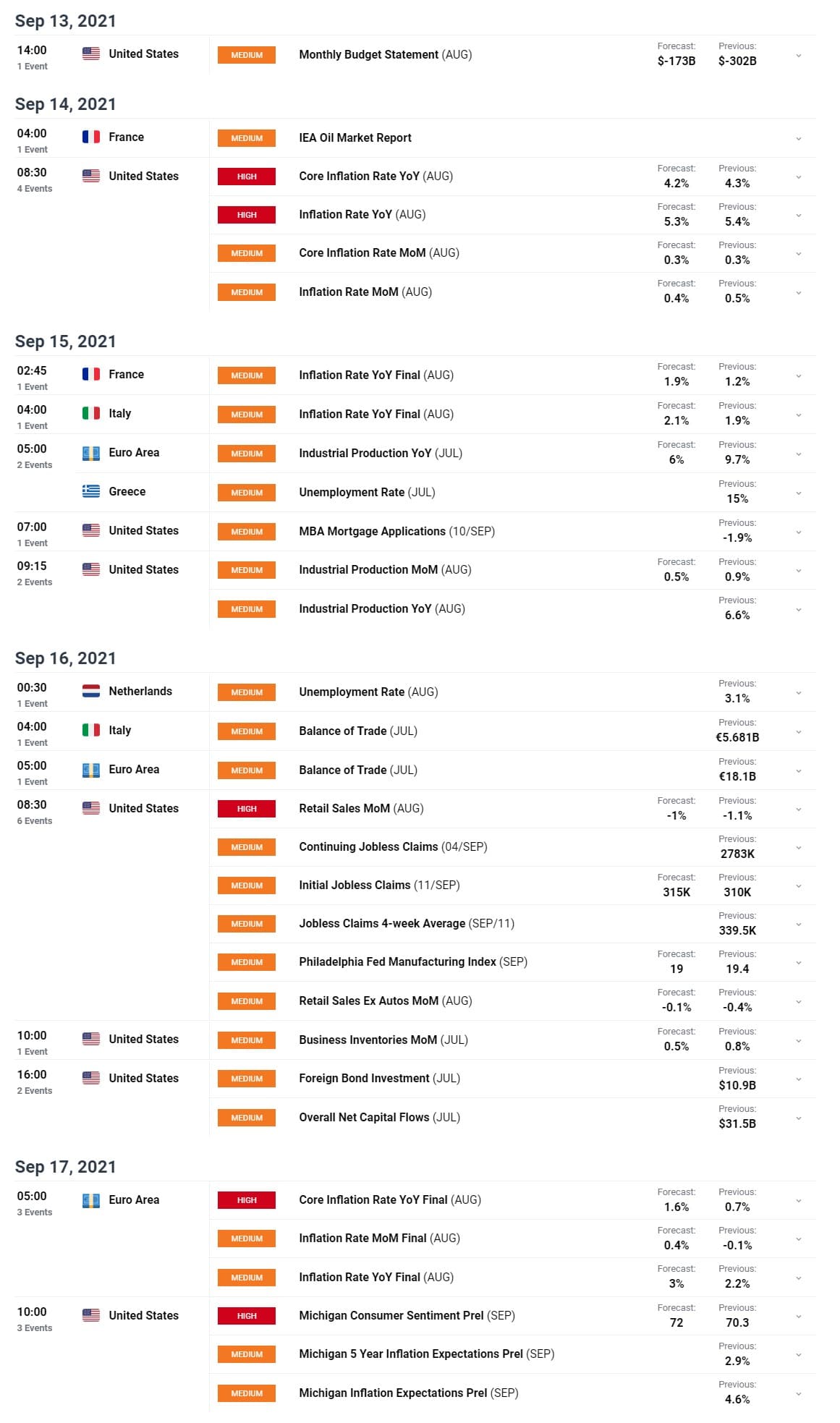

Upcoming Events

For the next week, it is expected to be released in the United States the indexes on inflation and core inflation rates will be released in August. For the Core inflation, the forecast is 4,2%, below 4,3% of the previous month. The inflation rate prediction is 5.3%. On the European side, the inflation rate will also be released by the end of the week.

–Are you interested to learn more about forex signals? Check our detailed guide-

EUR/USD Weekly Forecast: Technical indicators signal a downtrend in the long term

From a technical perspective, we can expect a downtrend. While the pair is below the 100 and 200-days SMA, it is still above the 20-days SMA on the daily chart. We can see the low interest in purchasing the pair evidenced in some technical indicators. All this indicates that the price will keep falling in the long run. However, in case it uptrends, it will face a resistance level at 1.1908 which was the highest level reached in July, and beyond that, there is the psychological level of 1.2000.

EUR/USD Next week Forecast

For the next week, we expect the bearish side to win the pulse and force the price to fall in the long term. However, since there will be no major events on the European calendar, the direction of the movement will depend mostly on the US side

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.