- Chairman Powell of the Federal Reserve stepped up his monetary policy.

- Russian-Ukrainian tensions continue to escalate and are detrimental to global economic development.

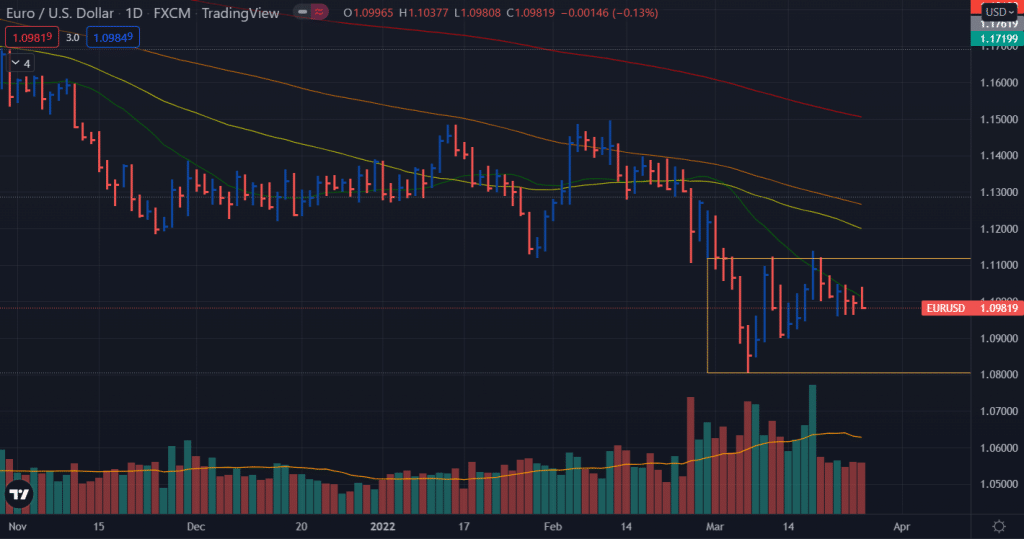

- EUR/USD fluctuates in the 1.1000 area, with risk-shifting increasingly to the downside.

The EUR/USD weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 1.1000 area after several attempts.

The EUR/USD pair may not attract much speculative interest as it hovers around the 1.1000 level. As war-related uncertainty grew, volatility was limited due to a lean macroeconomic calendar. However, as a diplomatic solution grows farther from reach, Russia has intensified its attacks on Ukraine.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Global reaction to Russia

US President Joe Biden met with European leaders, G-7 partners, and NATO allies before a White House press briefing. Among other things, Biden said he would support the expulsion of Russia from the G-20, noting that sanctions could not deter Russia but might eventually force it to end the invasion. In addition, he said that the US does not confirm that it will send troops to Ukraine if the Kremlin decides to use weapons of mass destruction.

Global growth prospects and inflation are already affected by the Eastern European conflict. Therefore, central banks are not worried about monetary tightening in this new global scenario too soon. On the contrary, they believe that it may be too late.

Fed’s monetary tightening

Despite Jerome Powell’s more aggressive stance as Fed chair, the US dollar strengthened on Monday. During the annual economic policy conference of the National Business Economics Association, he said that “inflation is too high” and that the central bank will act accordingly. As early as May, several Fed members reported that they would support a decision to scale back the Fed’s policy. Powell joined the bullish club with this announcement.

Upon Powell’s announcement, Treasuries were sold off, pushing yields to their highest level since May 2019. While yields declined over the days, the week yielded a higher yield.

ECB’s potential hawkishness

European Central Bank’s patience is slowly ebbing away. As a result of Christine Lagarde’s unexpected aggressive comments at the last meeting, several members of the ECB have hinted at a rate hike by the end of the year. This is now planned for the third quarter of the year, earlier than previously planned by the central bank.

The Fed aims to achieve maximum employment and price stability, while the ECB is only concerned with price stability. The US and EU are experiencing the highest inflation in decades as economies slowly recover from the massive lockdowns imposed at the pandemic.

Coronaviruses are spreading rapidly in Europe right now. There has been a spike in Omicron BA.2 infections in Germany in recent months, but the strain is also spreading to the UK, France, Italy, Austria, and other countries. So far, governments have refrained from enacting further restrictions, but chances of that happening are growing. The healthcare systems of most countries are unlikely to collapse unless lockdowns return.

Key data for the EUR/USD weekly forecast

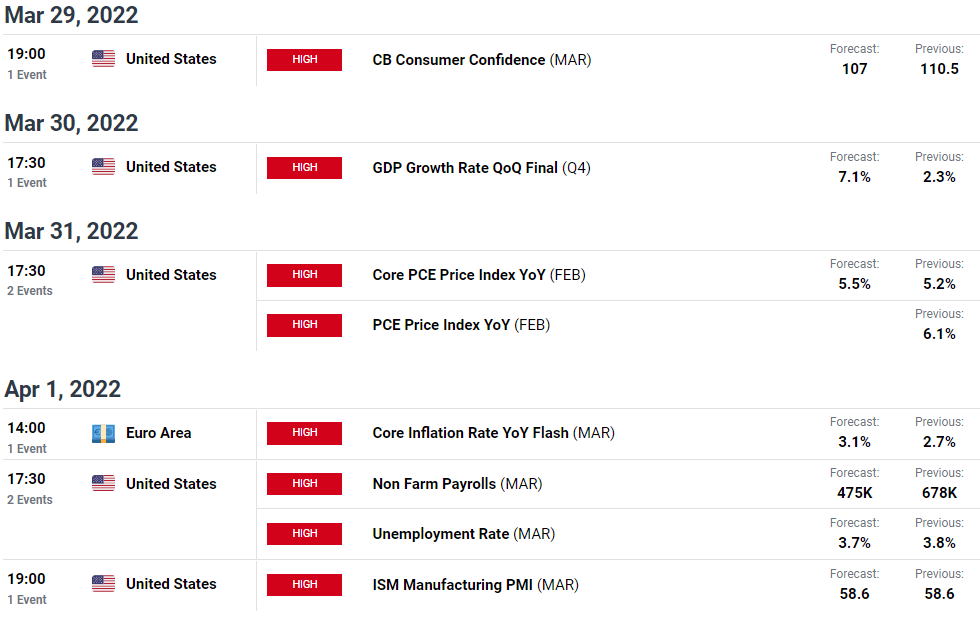

Next week, we will have a busy week since we will have the final CPI and GDP data for Germany and the EU for March and the final American Gross Domestic Product for the fourth quarter. We will also receive monthly employment data from the US on Friday. As part of the Nonfarm Payroll report, the country is expected to have created 450,000 new jobs in March, and the unemployment rate is expected to be 3.7%. March will also see the release of the ISM index of manufacturing activity.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

EUR/USD weekly technical forecast: Triple bottom to watch

The EUR/USD daily chart shows that the price is hovering around the 20-day MA. As a result, the pair could not find acceptance above the 1.1000 mark. However, the volume remains low for downside correction that started from the 1.1135 area. Therefore, the pair remains in a broad range, and traders should wait for a clear directional bias. Moreover, the traders should watch the triple bottom at 1.0965. If broken, the pair will lead to 1.0900 ahead of 1.0800.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money