Best Forex Brokers Canada 2021

If you are based in Canada and wish to begin trading the forex market, you must choose a safe and reputable broker to trade with. These days there are so many brokers to choose from, so it’s understandable a daunting prospect trying to decide which option is best for you and your investment situation.

Not to worry – in this guide, we discuss the Best Forex Brokers Canada, highlighting the best options for FX traders this year and showing you how to get started with a top broker in under ten minutes.

Best Forex Brokers Canada 2021 List

The list below showcases the top ten brokers for forex traders in Canada, helping you make an effective broker choice. The section that follows explores a selection of these brokers in detail, providing insight into their fees, platform, and features.

- Avatrade – Overall Best Forex Broker Canada

- OANDA – Best Forex Broker Canada for User-Friendly Platform

- Interactive Brokers – Best Forex Broker Canada with Stellar Reputation

- Forex.com – Best Forex Broker Canada for Low Fees

- FXCM – Best Forex Broker Canada for Educational Content

- CMC Markets – Best Forex Broker Canada with Great Track Record

- TD Direct Investing – Best Forex Broker Canada for Advanced Traders

- Easymarkets – Best Forex Broker Canada for Straightforward Trading

- FP Markets – Best Canada Forex Broker for Tight Spreads

- Questrade – Best Forex Broker Canada for Regulation

Top Canadian Forex Brokers Reviewed

As you can see from the list above, there are numerous forex brokers to choose from, each having its own unique selling point and fee structure. Selecting a trustworthy and low-cost broker to trade with can be crucial to your trading success, as it safeguards you from unauthorised access to your capital and allows you to save money on fees and commissions.

With that in mind, this section reviews five of the best forex brokers in Canada, breaking down their services and helping you make the best decision for your unique situation.

1. Avatrade – Overall Best Forex Broker Canada

Topping our list of forex broker reviews for Canadian brokers is Avatrade. Avatrade is well known in the forex trading scene thanks to its stellar reputation and excellent fee structure. Avatrade has partnered with Friedberg Direct in Canada, meaning that all accounts are held with the investment firm. Friedberg Direct is licensed and regulated by the IIROC and the CIPF – two of the leading regulatory bodies in Canada. Furthermore, accounts are also protected by the Canadian Investor Protection Fund.

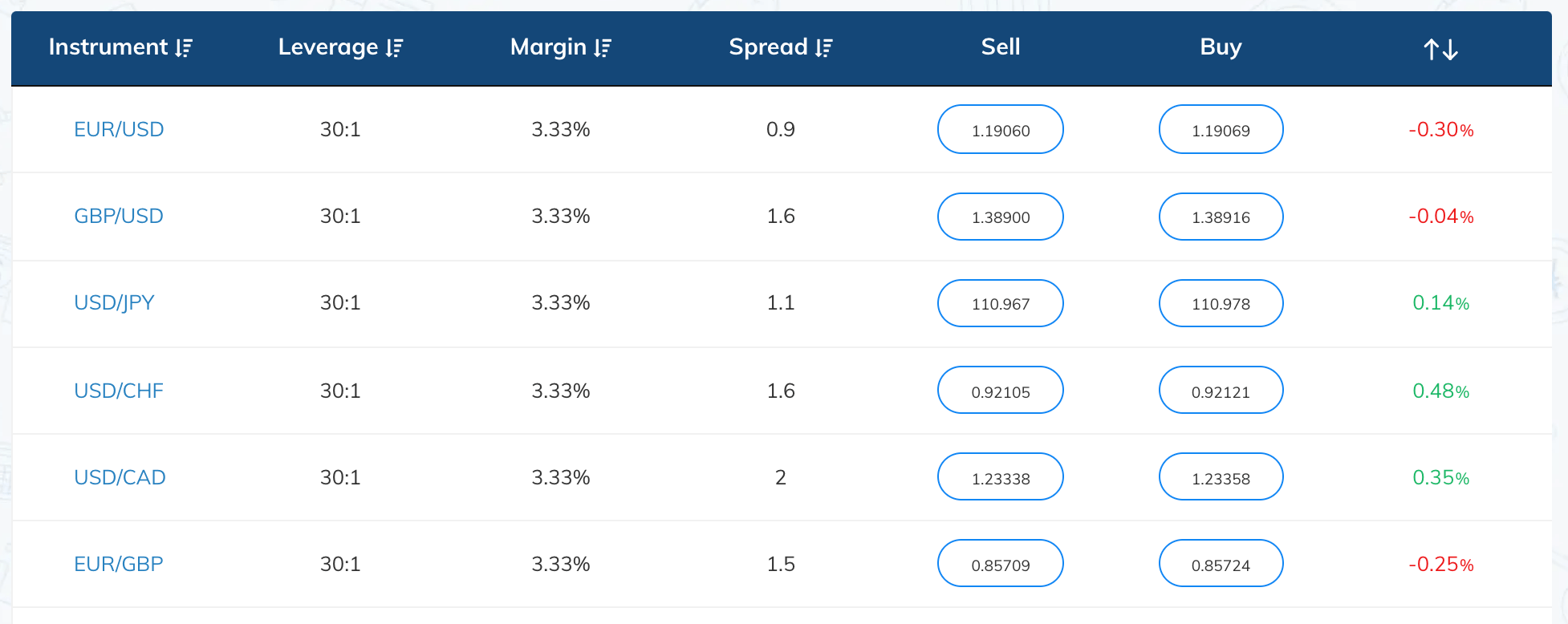

In terms of fees, Avatrade utilises a 0% commission structure, which means that you don’t have to pay any transaction fees when you place a trade. Instead, Avatrade’s fee is incorporated into the spread. As a result, this spread is typically very tight, especially for high-liquidity pairs. For example, EUR/USD’s spread is usually around 0.9 pips, and USD/JPY’s spread is usually about 1.1 pips.

Avatrade also offers a wide range of trading options for users. Full support for MT4 and MT5 is provided, alongside Avatrade’s proprietary online trading platform. This ensures forex traders have an option that suits them and their needs. In terms of deposits, Avatrade allows a minimum deposit of only $100 (123 CAD), which users can complete via credit card or wire transfer. Notably, these deposits are totally free to make – and no withdrawal fees are charged either.

- Regulated in multiple jurisdictions

- Supports CFD markets on forex, stocks, cryptocurrencies, and more

- 0% commission and tight spreads

- Compatible with MT4 and MT5

- Minimum deposit of just $100

- Leverage offered on all markets

Cons

- Stock CFD department is limited

71% of retail investor accounts lose money when trading CFDs with this provider

2. OANDA – Best Forex Broker Canada for User-Friendly Platform

If you are interested in forex brokers accepting Canadian clients, with a particular emphasis on user-friendliness, then OANDA certainly fits the bill. OANDA is one of the IIROC regulated forex brokers on our list – ensuring Canadian traders are afforded the highest levels of protection possible. OANDA is also regulated by top-tier entities in many other countries, highlighting just how safe this broker is.

The great thing about OANDA is that they do not employ a minimum initial deposit. This means they are accessible to beginner traders who may wish to start small before using more significant amounts. Deposits can be made for free via credit/debit card, PayPal, wire transfer and electronic transfer. In terms of fees, OANDA incorporates their commission into the spread – although this spread varies, it can be as low as 0.6 pips for EUR/USD.

OANDA’s platform is where the broker really shines, as it offers forex traders a multitude of charting options and indicators to use. You are also able to create watch lists, view news feeds, and utilise advanced order types. Moreover, as you can trade directly from the chart, you’ll be able to place orders instantly – thereby getting the best prices you possibly can!

- Regulated by the IIROC

- No minimum deposit

- Very low spreads

- Multitude of charting options

- Instant trading from the chart

Cons

- Customer support could be better

Your capital is at risk when trading financial instruments with this provider

3. Interactive Brokers – Best Forex Broker Canada with Stellar Reputation

Interactive Brokers are another excellent option for Canadian traders as they have a solid reputation worldwide and offer various account types depending on your experience level. Notably, Interactive Brokers has been around since 1978 and is regulated in Canada by the IIROC and the CIPF. Furthermore, the broker has won many awards over the years for its services and is even regulated in the US by the SEC.

Interactive Brokers is one of the best ECN brokers as they offer accounts with direct access to interbank rates. This means that spreads can be extremely low – as low as 0.1 pips for specific pairs. However, it’s worth noting that Interactive Brokers does charge a commission. This commission works under a tiered structure, whereby commissions get lower depending on how active you are in the market. Notably, if you use the IBKR Lite account, you’ll get larger spreads but commission-free trading!

Aside from fees, Interactive Brokers also offer a good selection of trading platforms that will appeal to advanced traders. Their forex trading platform provides an extraordinary level of customisation and data that ensures traders can operate optimally. Finally, Interactive Brokers have no minimum deposit requirements – meaning that users can begin trading with as little capital as they wish.

- Great reputation worldwide

- Regulated by the IIROC and CIPF

- ECN account offered

- Multiple trading platforms to use

- No minimum deposits

Cons

- More suited for experienced traders

Your capital is at risk when trading financial instruments with this provider

4. Forex.com – Best Forex Broker Canada for Low Fees

Another of the best Canadian forex brokers is Forex.com. Established in 2001, Forex.com has a solid track record as a reliable and low-cost broker. The broker’s parent company, StoneX Group, is listed on the NASDAQ – highlighting how reputable Forex.com is. Furthermore, Forex.com is regulated in Canada by the IIROC.

Similar to other brokers, Forex.com incorporate their fee into the spread. As a result, these spreads tend to be extremely tight on the Standard account – as low as 1 pip on EUR/USD. Forex.com does not charge any commissions on this account; however, you will have to pay a transaction fee if you open a commission or an STP pro account. These accounts do offer some valuable features though, as the STP system ensures Forex.com are up there with the best STP brokers on the market.

The minimum deposit at Forex.com is only $100 (123 CAD) and can be made via credit/debit card, bank transfer, or various e-wallets. Deposits and withdrawals are entirely free to make, regardless of which method you choose. Forex.com also do not charge a monthly account fee – although they do charge a small inactivity fee after one year of no trading.

- Great forex broker for Canadian traders

- Leverage facilities available on many pairs

- Multiple account types available

- Trade online or via MT4/MT5

- More than 80+ pairs supported

- Permits automated trading

Cons

- Small inactivity fee charged

Your capital is at risk when trading financial instruments with this provider

5. FXCM – Best Forex Broker Canada for Educational Content

Rounding off our list of the best forex brokers in Canada is FXCM. Like Avatrade, FXCM operates under the Friedberg Direct umbrella in Canada, which manages over $2 billion in assets. This backing provides a solid level of credibility to FXCM’s services and ensures traders are safe when operating in the markets.

FXCM employs a variable spread structure, meaning that spreads will fluctuate depending on liquidity levels and market conditions. According to their website, the average spread for EUR/USD is 1.3 pips – slightly higher than some other options on our list but still relatively inexpensive. Notably, FXCM offers a selection of 39 pairs to trade, including the majors, minors, and some exotics.

One excellent feature FXCM offer is their Active Trader discount. If you are active in the market, FXCM will allow you to claim back some of the money you spend on spreads. The amount you are entitled to depends on how active you are and how large your position sizes are – the more active you are, the more money you can claim back. Finally, FXCM offers a fantastic selection of educational materials, including daily market coverage through in-depth videos and guides for forex trading beginners.

- Full MT4 support

- Spreads are competitive

- Zero or low commissions depending on account

- Active trader discount

- Huge selection of educational materials

- Heavily regulated

- Low minimum deposit

Cons

- Fees slightly higher than other brokers

73.05% of retail investors lose money when trading CFDs at this site

Best Forex Brokers in Canada Comparison

The section above highlights a selection of the best Canadian forex brokers this year. To help streamline your decision making, the table below presents a breakdown of the critical factors relating to each broker – providing a handy way to compare and contrast fees, spreads, and leverage.

| Pricing (Spreads/Commissions) | Average GBP/USD Spread | Deposit Fee | Withdrawal Fee | Max Leverage | |

| Avatrade | 0% commission + variable spreads | 1.6pips | None | None | 30:1 |

| OANDA | 0% commission + variable spreads | 1.7pips | None | None if card; 20 CAD if bank transfer | 50:1 |

| Interactive Brokers | Commission based on activity level + variable spreads | As low as 0.1pips | None | One free withdrawal per month | Depends on the account type |

| Forex.com | 0% commissions + variable spreads | 2pips | None | None | 50:1 |

| FXCM | 0% commissions (on standard account) + variable spreads | 1.7pips | None | None | 30:1 |

How to Choose the Right Forex Broker for You

To make money with forex, it’s crucial that you choose a broker that offers a low-cost trading environment and that provides the necessary features for you to trade optimally. With that in mind, this section presents some of the key things to research when choosing between the best forex brokers in Canada.

Safety

Understandably, safety is one of the top priorities when choosing a forex broker. Ensuring your preferred broker is regulated by top tier entities is crucial to your trading success, as it means your personal information and capital are afforded the highest levels of protection.

When forex trading in Canada, look out for brokers regulated by the IIROC or the CSA. These two entities provide excellent protection for forex traders – so if your chosen broker is covered by one (or both) of them, then you’re onto a winner.

Fees

Another thing to look out for is the broker’s fee structure. Typically there are two fee types when forex trading – commissions and spreads. It’s common for forex brokers to offer zero commissions and instead incorporate their fee into the spread. This approach ensures traders are always aware of the ‘fee’ they are paying, as it is clearly stated on the quote screen.

Low spread forex brokers are an excellent way to ensure you aren’t paying hefty amounts in fees. Brokers such as this will either offer a fixed spread (which doesn’t fluctuate during trading hours) or a variable spread. Using a broker with a low spread will save you lots of money in the long run – especially if you are an active trader. Finally, spreads will tend to be tighter for pairs with higher liquidity (such as EUR/USD and GBP/USD), so be aware of this if you are interested in trading minors or exotics.

Range of Assets

Choosing one of the best forex brokers in Canada with a solid range of assets is another way to optimise your forex trading. There are hundreds of forex pairs in the worldwide FX market – so ensuring the broker you choose offers a variety of them to trade will mean that you’ll always have access to market opportunities.

If you are an advanced trader, you might even want to keep an eye out for brokers that offer minors and exotics to trade. These pairs have much less liquidity and higher spreads – but can often provide excellent opportunities for profits. Again, due to the volatile nature of these pairs, beginners should probably steer clear until they have more experience in the market.

Trading Tools

A broker that offers a range of forex tools is another vital thing to look out for. Technical analysis is a crucial part of trading the forex markets optimally – so choosing a broker that offers a selection of indicators and charting options will mean that you can complete your analysis in the same place that you place your trades.

This is important as, depending on your strategy, some opportunities will require instant action to be taken. Another thing to look for is a broker that offers MT4 and MT5 support – this opens up the possibility of automated trading too.

Platforms

Trading the forex market from your laptop or smartphone requires access to trading software that can facilitate the opening of your positions. Most brokers will offer their own trading platform for traders to use, which usually allows positions to be opened online with the click of a button. Depending on the broker, some of these platforms may be more advanced than others, with features such as complex order types and innovative indicators not being uncommon.

Many of the best forex brokers in Canada will also offer full support for MT4 and MT5. These platforms are popular with FX traders worldwide thanks to the ability to build custom indicators and even use forex robots. MT4 and MT5 will easily link with your broker account, allowing you to trade through these platforms seamlessly.

Account Types

Many of the top forex brokers will offer various account types, each one appealing to a specific subset of traders. For example, ECN brokers are great for advanced traders who need instant order execution and lower spreads. However, these brokers will often require larger position sizes and higher balances to sign up – so perhaps not the best option for first-time traders.

Some brokers will offer a ‘Standard’ account which will appeal to traders of all experience levels. Typically, these accounts will be commission-free and incorporate a variable spread structure. Therefore, it’s vital to explore all of the account types offered by your chosen broker and find one that has a fee structure and feature set that suits you and your goals.

Payments

Finally, it’s crucial to analyse the deposit methods that your chosen forex broker accepts. These days, forex brokers ensure they accept a wide range of payment methods from traders, and it’s not uncommon for some brokers to accept e-wallets such as PayPal and Skrill.

Aside from the actual methods that are accepted, it’s important to double-check whether your broker charges a deposit (or withdrawal) fee. Certain deposit types may come with a cost attached – for example, some brokers will charge a fee for using your credit card to make a deposit. Withdrawals may also come with a fee; however, some brokers may allow your first withdrawal of the month for free before charging for any subsequent ones.

How to Get Started with a Forex Broker

So now that you have a comprehensive overview of the best forex brokers in Canada, it’s time to take a look at the sign-up process. Our recommendation for one of the best Canadian forex brokers is Avatrade, thanks to their 0% commission structure and full MT4/MT5 support. So, by following the steps below, you’ll be able to be set up and ready to go with Avatrade in under ten minutes.

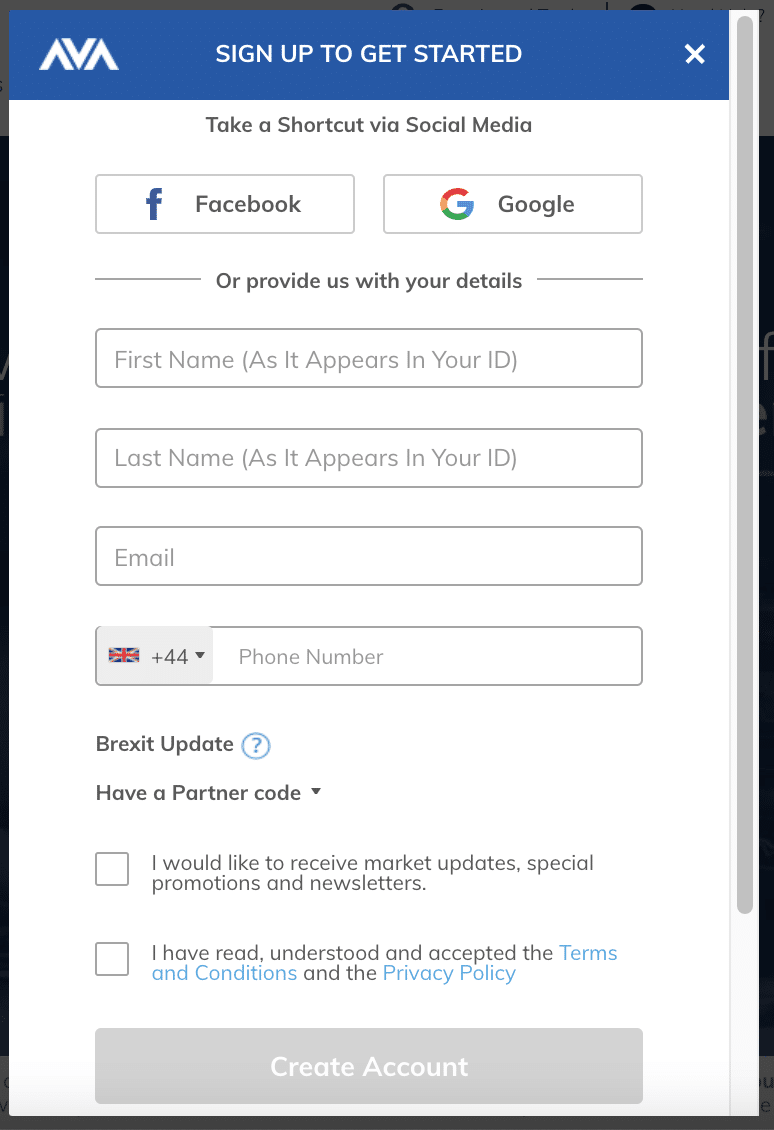

Step 1: Open an Avatrade Account

Head over to Avatrade’s website and click the ‘Register Now’ button in the top right. You’ll then be prompted to enter some personal details, including your name, contact number, and email address.

Step 2: Complete KYC and Verify Account

Due to Avatrade’s strict regulation, new customers must perform some KYC checks and verify themselves. Luckily, this is super easy to do – it’s simply a case of providing the personal details that Avatrade require and uploading some verification documents. Avatrade will require proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill).

Step 3: Fund Your Account

Now you are able to deposit funds into your account. The minimum deposit for Avatrade users is $100 (around 123 CAD). In terms of deposit methods, Avatrade accepts the following:

- Credit card

- Wire transfer

- Skrill

- WebMoney

- Neteller

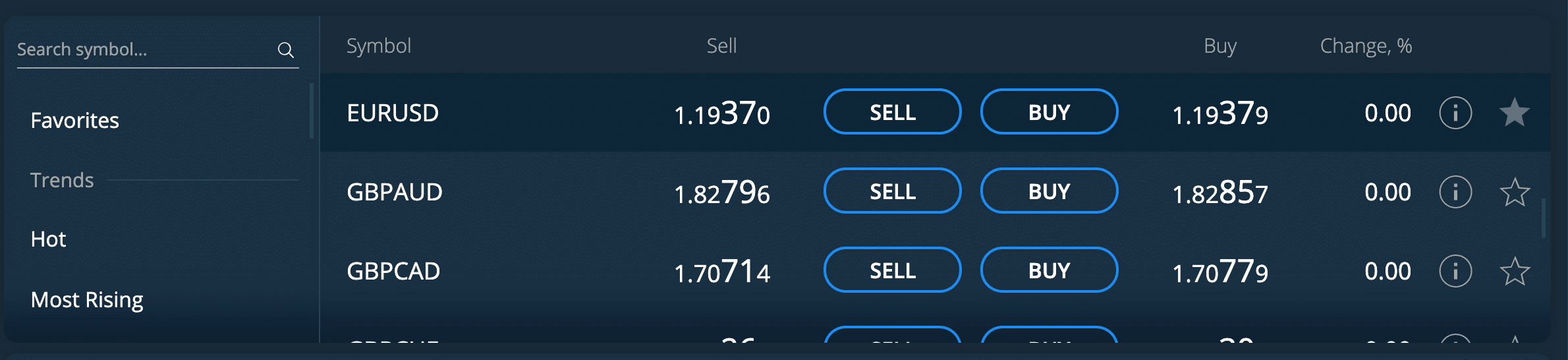

Step 4: Search for Currency to Trade

Head to Avatrade’s trading platform and type in the ticker symbol of the pair you’d like to trade. For the purposes of this guide, we’d like to trade EUR/USD. Once you see the pair in the search results, click either ‘Buy’ or ‘Sell’, depending on which position you’d like to open.

Step 5: Trade Forex

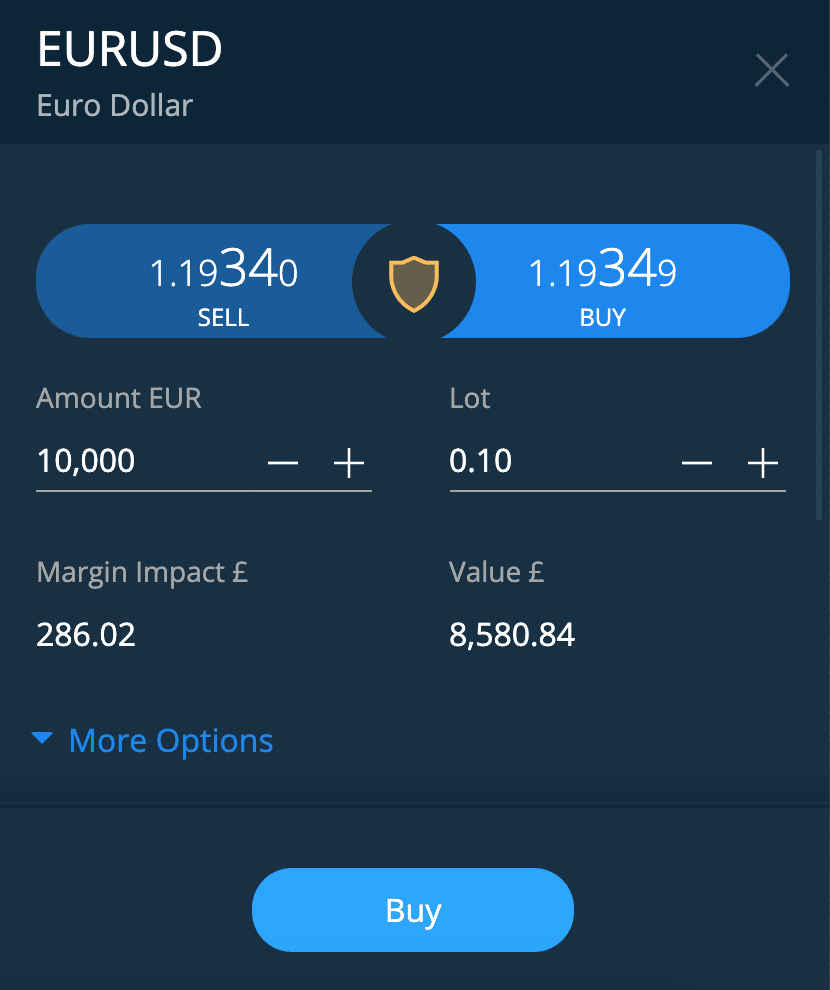

An order box will now appear, similar to the one in the image below. You can now enter your lot size/how much you’d like to trade, choose a take profit level, and set your stop loss. Once you are happy with everything, click the ‘Buy’ or ‘Sell’ button to finalise the position.

And that’s it! You’ve just completed your first trade with the best Canadian forex broker – all without paying any commissions!

Best Forex Brokers Canada – Conclusion

As this guide has highlighted, there are many brokers to choose from for Canada-based traders – many of which offer a trustworthy and cost-effective trading environment. By using this guide, you’ll be able to narrow down the options and choose a suitable broker that will allow you to trade the forex market safely and optimally.

However, if you’re looking to start trading right away, we’d recommend opening an account with Avatrade. By signing up with Avatrade, you’ll be able to get up and running in under ten minutes, with minimum deposits of only $100. Aside from that, Avatrade allow you to trade the forex market with 0% commissions – ensuring you’re able to save substantial amounts of money in the long run.

71% of retail investors lose money trading CFDs at this site

FAQs

What is a forex broker?

How do forex brokers make money?

What is the best forex broker?

Which forex brokers accept Canadian clients?

What is spread in a forex broker?