- Lagarde warned of financial instability amid a slowing Eurozone economy.

- Higher inflation in the US will mean higher interest rates for longer.

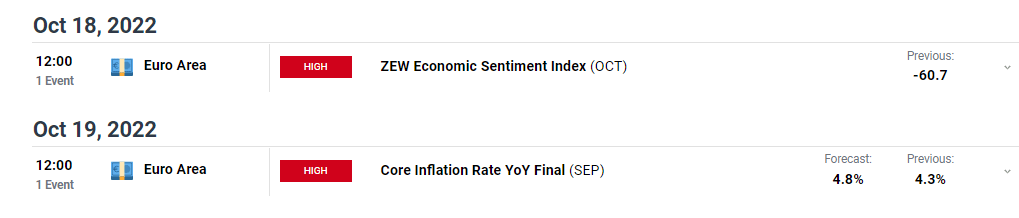

- Investors are awaiting Eurozone inflation data after last month’s new high of 10%.

The EUR/USD weekly forecast is bearish as the Eurozone economy heads for recession amid rising interest rates.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Ups and downs of EUR/USD

ECB president Christine Lagarde spoke on Wednesday. She stated that the euro area’s financial stability was in jeopardy due to a slowing economy and inflation spreading to more sectors. The pair barely reacted to this statement.

According to the minutes from the Federal Reserve’s September meeting, officials expressed astonishment at the pace of inflation. They said they expected higher interest rates to be in place until prices declined.

Last month, US consumer prices increased more than anticipated, showing that the struggle against inflation in the biggest economy in the world is far from complete. In the twelve months ending in September, inflation, which measures how quickly prices rise, was 8.2%, down from 8.3% in August. Despite the decline, the number still exceeded expectations. This saw the pair ending Friday lower as investors expect the Fed to respond aggressively.

Next week’s key events for EUR/USD

In the coming week, investors will see the state of eurozone inflation. To lower prices and curb demand, the ECB has raised interest rates alongside central banks worldwide, raising the possibility of an economic slowdown. In September, the 19-nation eurozone’s inflation rate reached a new high of 10%.

This new high has markets expecting a 75bps rate hike at the next meeting. However, this might change with next week’s inflation reading.

EUR/USD weekly technical forecast: Bears eyeing 0.9584

Looking at the daily chart, we see the price trading below the 22-SMA and RSI below 50, showing bears are in charge. The 22-SMA has offered resistance on many occasions, showing a strong downtrend.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Buyers made a good attempt at taking over at the 0.9584 support level. They could take the price to parity, offering too strong a resistance. At this point, bears returned, pushing the price back below the 22-SMA. In the coming week, the price might retest the SMA as resistance before retesting and possibly making a new low below 0.9584.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.