- In a surprise move, ECB President Christine Lagarde appears to be more hawkish than expected.

- Despite market expectations, the US managed to add 467,000 new jobs in January.

- The EUR/USD is unlikely to continue its recent rally if it loses 1.1400.

The weekly forecast for the EUR/USD pair remains negative as the pair is in hot waters after the greenback started a strong recovery amid upbeat NFP figures.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

With a weekly gain of around 350 pips, the EUR/USD posted its biggest weekly gain since March 2020, rising to a new 2022 high of 1.1483 and closing the week at 1.1450. A hawkish tone from European Central Bank president Christine Lagarde surprised market participants after issuing a soft dove statement. It was noted by Lagarde & Co that inflation reached a record in January. Eurostat reported that consumer prices rose 5.1% year over year in the euro area versus a forecast of 4.4%, exceeding the 5% recorded in December. Germany’s preliminary inflation estimate for the same period was 4.9%, also above expectations.

Strong US NFP dominates the ECB.

In February, the central bank reiterated December’s announcement of stable interest rates and a halt to PEPP purchases. The ECB confirmed that it plans to expand purchases under the APP program. The APP program will be reduced in October next year. Note that policymakers removed the word “both ways” from the paragraph about adjusting monetary policy as needed.

President Lagarde, however, made one of her most radical statements to date. In addition to expressing concern about rising inflation pressures, she also avoided saying that the rate hikes this year is unbelievable, noting that “compared to our December predictions, the inflation outlook is skewed to the upside, especially in the short term.” As a result, participants in the market were quick to expect a rate hike by the end of 2022.

The yields on government bonds skyrocketed. In the past week, German 2-year bond yields have risen more than 30 basis points, the biggest gain in more than a decade, while US 2-year Treasury yields have risen more than 1.20%. Long-term bond yields also rose, but this was not enough to boost demand for US dollars.

Meanwhile, US employment data will continue to exert pressure on the dollar later next week. The ADP survey of private-sector job creation showed a loss of 301,000 jobs, significantly more than the expected gain of 207,000. However, nonfarm labor productivity increased 6.6% over the same period, exceeding forecasts, despite a modest rise in unit labor costs.

Following the January nonfarm payroll report release, the dollar recovered on Friday. Investors were angry because they expected a tepid result, but the US managed to add 467,000 jobs, three times the predicted 150,000. In addition, the Bureau of Labor Statistics reported that the unemployment rate rose to 4%, and the labor force participation rate increased to 62.2%, suggesting a healthy recovery in the economy.

Market participants were reminded of the Fed’s aggressive stance by the Nonfarm Payrolls report, which eclipsed Lagarde’s words.

In addition, macroeconomic data released this week indicated that major economies are still struggling to return to pre-pandemic growth rates. EU gross domestic product for Q4 was estimated at 0.3% q/q, well below the final 2.3% estimate for Q3. Moreover, Markit reduced its PMI estimate for January, as Union retail sales unexpectedly fell below 3.0% m/m. German numbers suffered the same fate despite a 2.8% m/m rise in domestic manufacturing orders in December.

Key data released for EUR/USD next week

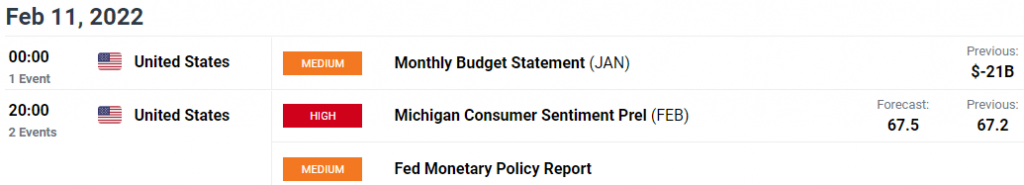

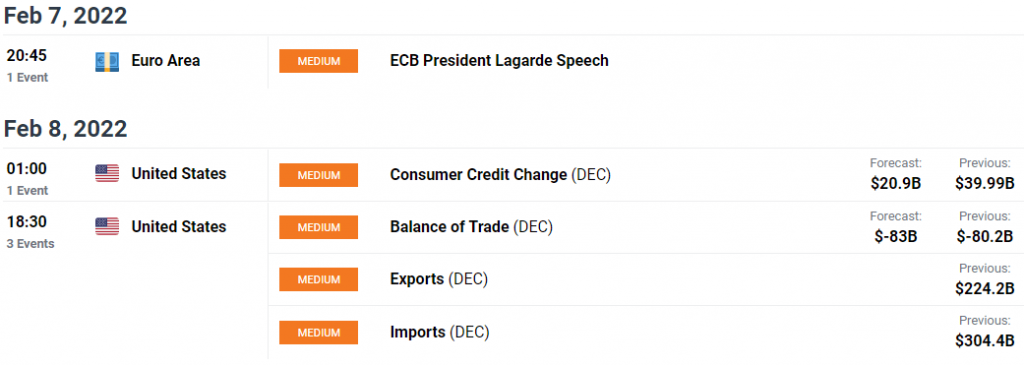

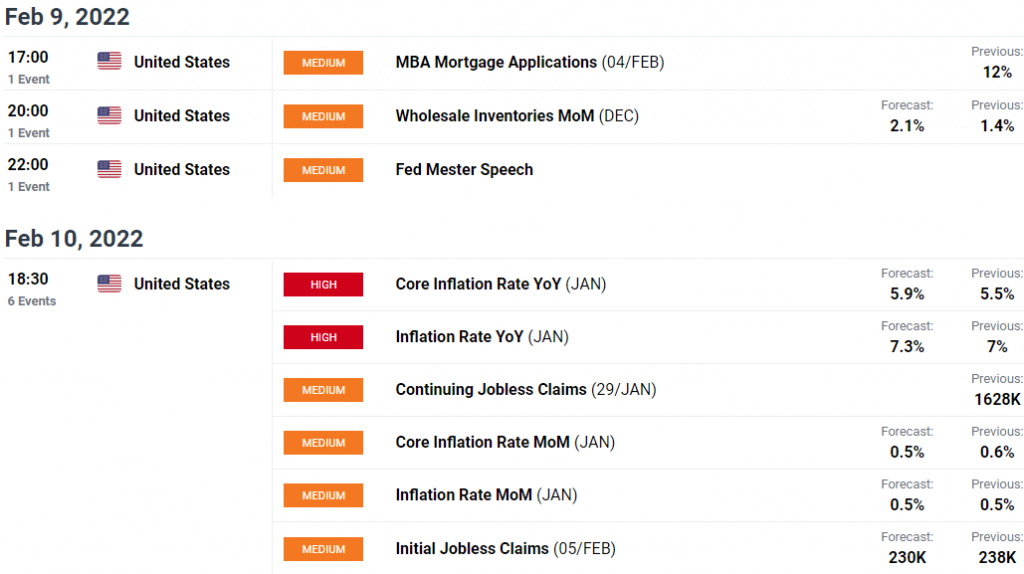

Macroeconomic data will be light next week, but the US will release its final CPI estimate for January, and Michigan will release its preliminary CPI estimate for February. In addition, a final reading of Germany’s consumer price index will also be released.

EUR/USD weekly technical forecast: Downside looking eminent

The EUR/USD price remains positive on the daily chart. The pair lies above the key SMAs. However, Friday’s daily bar closed in the middle, indicating a probability of downside correction next week. The 1.1400 mark will be an important support. If broken, the bearish reversal will be confirmed, and the next support emerges at 1.1330. However, the long-term sellers still aim for a 1.1000 target.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

Alternatively, the move above 1.1480 may urge the buyers to look for targets at 1.1550 ahead of 1.1600. However, the upside path is full of technical resistance levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.